Blog

Obama Budget Focuses on Jobs. MBA Reacts to Reduction in Mortgage Writeoffs

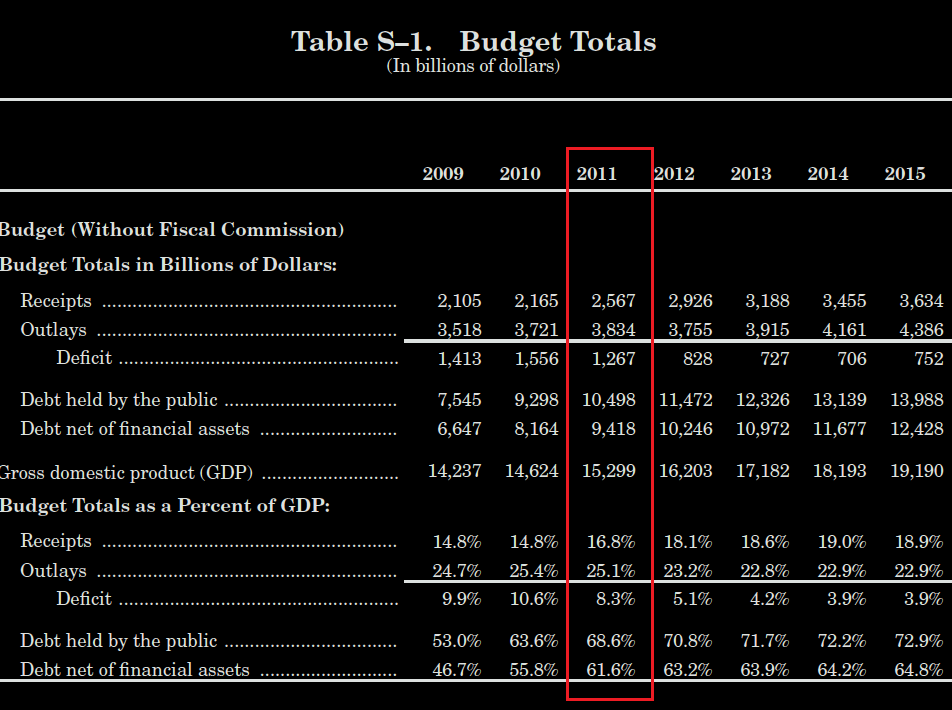

The Obama Administration released the Fiscal Year 2011 Budget. To put the size of this document in perspective: the SUMMARY TABLES alone required 36 pages.

I have spent the last few days using the control-f function to locate anything mentioning housing or the mortgage industry. I searched the document for terms like mortgage, mortgage-backed security, housing, community, GSE, government sponsored enterprise, Fannie Mae, Freddie Mac, etc, etc. Needless to say, I found a healthy portion of content to discuss. Yesterday I realized that I had 2,500 words written…that isrnWAY TOO MUCH content for one post. With that in mind, this is the firstrnof several budget related commentaries.

The main focus of the budget: CREATING JOBS

TOTAL 2011 BUDGET TO ACCOMPLISH THIS GOAL: $3.834 trillion

THE WHITE HOUSE SAYS:“Having steered the economy back fromrnthe brink of a depression, the Administration is committed to movingrnthe Nation from recession to recovery by sparking job creation to getrnmillions of Americans back to work and building a new foundation forrnthe long-term prosperity for all American families. To do this, thern2011 Budget makes critical investments in the key areas that willrnhelp to reverse the decline in economic security that American familiesrnhave experienced over the past decade with investments in education,rnclean energy, infrastructure, and innovation.”

HEREis the message from the President. Its five pages long and basicallyrnre-iterates the above statement. This is how he ends his message:rn”These have been tough times, and there will be difficult months ahead.rnBut the storms of the past are receding; the skies are brightening; andrnthe horizon is beckoning once more”

HUD SAYS: “HUD’s budget proposal seeks to make targeted investments in people and places – instead of policies and programs –to effectively support HUD’s mission while being accountable to the American taxpayer. $6.9 billion in projected FHA and Ginnie Mae receipts contribute to the FY 2011 proposed $48.5 billion budget total and to the administration’s deficit reduction plans. Net of the $6.9 billion in projected FHA and Ginnie Mae receipts the Budget proposes overall funding of $41.6 billion, 5% below fiscal year 2010, and makes difficult decisions to cut funding for a number of programs.”

The carefully targeted investments in the Budget will enable HUD programs to:

- House over 2.3 million families in public and assisted housing (over 58% elderly or disabled);

- Provide voucher assistance to 78,000 additional families (over 47% elderly or disabled);

- Assist nearly 5.5 million households, over 200,000 more than at the end of fiscal year 2009.

- More than double the annual rate at which HUD assistance creates new permanent supportive housing for the homeless;

- Create and retain over 112,000 jobs through the Department’s housing and economic development investments in communities across the country.

THE MORTGAGE BANKERS ASSOCIATION SAYS:

The Mortgage Bankers Association (MBA) issued the following reactions and analysis to the fiscal year 2011 federal budget, as proposed today by the Obama Administration.

“Reducing the federal deficit is vital to the long-term health of the US economy and our industry. However, we believe it can and should be done without negatively impacting the already-fragile housing market,” said Robert E. Story, Jr., CMB, MBA's Chairman. “Limiting the mortgage interest deduction and imposing additional taxes on lenders will only make economic recovery more difficult.”

MBA opposes the proposal to reduce itemized deductions, including the deduction of mortgage interest, for taxpayers reporting income above $250,000 (joint) $200,000 (single). This would have a negative impact on the housing market, particularly in high cost states like California and New York, as it would increase the cost of mortgages for many potential homeowners, especially those in high-cost states. MBA also opposes the proposal to tax carried interest at ordinary tax rates (as opposed to the capital gains rate, as it is taxed now), as it would discourage capital formation for lending.

MBA believes the Financial Crisis Responsibility Fee will reduce the availability and increase the costs of real estate loans to consumers and small businesses by discouraging large financial institutions from entering into new, private label commercial mortgage backed securities (CMBS) and residential mortgage backed securities (RMBS) transactions and significantly reducing the profitability of non-agency servicing.

Story also noted that the budget did not offer any indications of the Administration's plans for the future of Fannie Mae and Freddie Mac.

“MBA has been at the forefront of the debate over the future of the government's role in the secondary mortgage market,” said Story. “We rolled out our proposal in September and have been meeting with all stakeholders on Capitol Hill, within the administration, and across the industry to share our perspectives. Our proposal would provide a new foundation for supporting the core of the mortgage market. We look forward to continuing our discussions as the administration readies its suggestions.”

MBA has supported the administration's efforts to improve risk management of the Federal Housing Administration's (FHA), and thus strongly supports the additional $18 million budgeted to allow FHA to implement its improved risk management systems. MBA also supports the $20 million budgeted to combat predatory lending and mortgage fraud at HUD, as well as additional funding for housing counseling and foreclosure avoidance.

“We are pleased to see increased funding for several critical programs at FHA,” added Story. “We support both the efforts to help FHA better manage its risk. We also support additional funding at HUD and the Department of Justice to combat mortgage fraud. I also want to add how pleased I am to see that FHA's multifamily programs are continuing to show strong performance in the face of the current challenges in the housing market.”

MBA also found troublesome the following additional provisions in the budget proposal:

- Termination of program authority to allow expensing (for tax purposes) of real estate environmental remediation, or “brownfields” clean up costs.

- Reduced federal support for terrorism risk insurance programs (TRIA).

———————————————————————————————————

NEXT POST: WHERE ARE THE GSEs IN THE BUDGET?

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment