Blog

One Million Homeowners Gained Equity in Q2

U.S. homeowners gained or regained morernthan $1 trillion in equity over the year that ended on June 30, 2014. According to Core-Logic’s 2nd quarter 2014rnanalysis, 44 million homes in the country now have positive equity, a gain ofrn950,000 homes during the quarter. </p

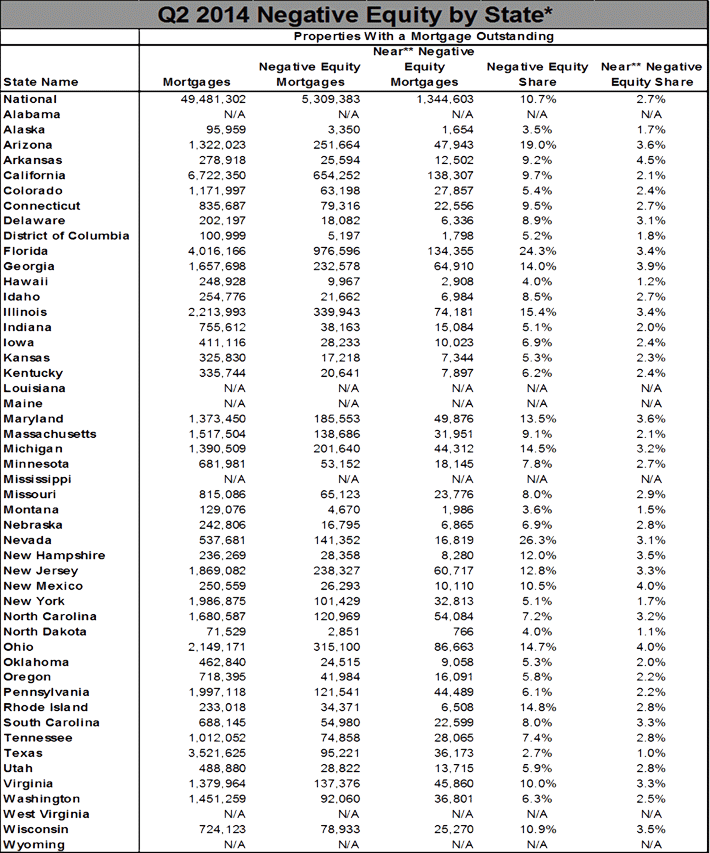

The number homes which are still “upside-down”rnor “underwater,” that is the owner owes more on the mortgage than the marketrnvalue of the home, is now 5.3 million or 10 percent of all homes with arnmortgage. In the preceding quarter (Q1)rnthere was a negative equity share of 12.7 percent or 6.3 million homes and inrnthe second quarter of 2013 there were 7.2 million homes or 14.9 percent thatrnwere underwater. This is a year-over-yearrndecline of 1,962,435 or 4.2 percent.</p

</p

</p

The aggregate value of negativernequity was $345.1 billion at the end of Q2 2014, down $38.1 billion fromrnapproximately $383.2 billion in the previous quarter. Year-over-year negative equity declined fromrn$432.9 billion, a decrease of 20.3 percent in 12 months. </p

Nine million or 19 percent of the 44rnmillion residential properties with positive equity are what Core-Logic calls “under-equitied,”</bthat is their owners have less than 20 percent equity in the home. Of these 1.3 million have less than 5 percentrn(referred to as near-negative equity). Under-equitied homeowners may have a morerndifficult time refinancing their existing homes or obtaining new financing tornsell and buy another home due to underwriting constraints. Those with near-negativernequity are considered at risk of slipping into negative equity if home prices decline. On the other hand, Core-Logic estimates thatrna price increase of as little as 5 percent would lift another 1 millionrnhomeowners into positive equity. </p

</p

</p

“The increase in borrowerrnequity of $1 trillion from a year earlier is evidence that things are movingrnsolidly in the right direction,” said Sam Khater, deputy chief economistrnfor CoreLogic. “Borrower equity is important because home equityrnconstitutes borrowers’ largest investment segment and, as a result, is drivingrnforward the rise in wealth for the typical homeowner.”</p

“Many homeowners across therncountry are seeing the equity value in their homes grow, which lifts therneconomy as a whole,” said Anand Nallathambi, president and CEO ofrnCoreLogic. “With more and more borrowers regaining equity, we expectrnhomeownership to become an increasingly attractive option for many who havernremained on the sidelines in the aftermath of the great recession. This shouldrnprovide more opportunities for people to sell their homes, purchase a differentrnhome or refinance an existing mortgage.”</p

Approximately 3.2 million underwaterrnhomes have only one lien while 2.1 million have both first mortgages and homernequity loans. Homes with only firstrnliens accounted for $180 billion in aggregate negative equity and the averagernhomeowner was underwater by $57,000 with a mortgage balance of $227,000. Homes with two mortgages account for $165rnbillion in negative equity with an average negative balance of $77,000 on arn$297,000 mortgage. </p

The bulk of home equity forrnmortgaged properties is concentrated at the high end of the housing market. Forrnexample, 94 percent of homes valued at greater than $200,000 have equityrncompared with 84 percent of homes valued at less than $200,000.</p

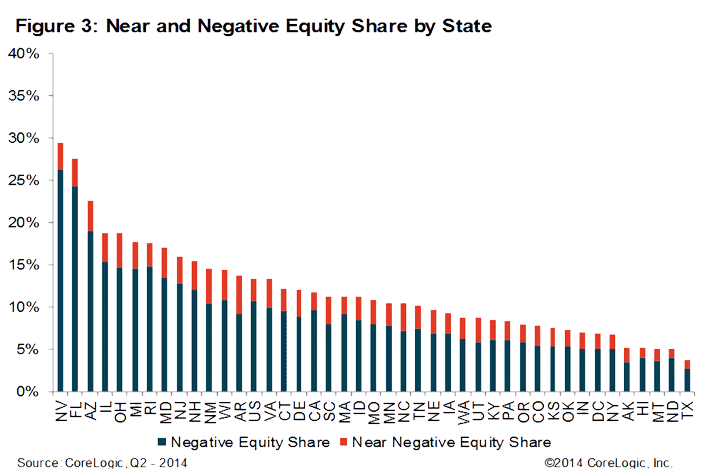

Nevada continues to have the highestrnpercentage of properties in negative territory at 26.3 percent, followed byrnFlorida (24.3 percent), Arizona (19.0 percent), Illinois (15.4 percent) andrnRhode Island (14.8). These top five states combined account for 32.8 percent ofrnall negative equity in the nation. </p

There are five states in which morernthan 96 percent of homeowners have positive equity. In descending order from Texas at 97.3rnpercent they are Alaska, Montana, North Dakota, and Hawaii.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment