Blog

Oregon Senator Suggests Innovative Home Refinancing Plan

Senator Jeff Merkley (D-OR) has proposedrna new, limited term program to assist underwater homeowners unable to refinancerntraditionally or through the Home Affordable Refinancing Program (HARP) availablernFreddie Mac and Fannie Mae borrowers. rnThe plan, which he describes in a white paper called “The 4%rnMortgage: Rebuilding American Homeownership,” would not require taxpayerrndollars and according to Merkley, might even turn a small profit. He estimates his plan could assist up torneight million families.</p

Merkley’s proposal would involve settingrnup a Rebuilding American Homeownership (RAH) Trust which would be locatedrnwithin an existing federal agency; he suggests FHA, the Federal Home Loan Banks,rnor the Federal Reserve. The Trust wouldrnbuy mortgages meeting program standards from mortgage originators, but only forrna period of three years, after which it would stop buying loans and wouldrneventually go out of business, selling the remaining loans in its portfolio tornprivate investors.</p

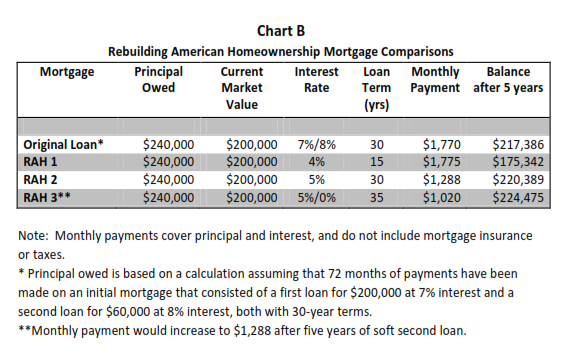

Three types of loans would be eligiblernfor RAH purchase. The first would be arn15-year 4 percent interest mortgage designed to more quickly restore arnhomeowner’s equity. The second would berna 30-year 5 percent mortgage, and the third would be a two-part mortgage consistingrnof a first mortgage equal to 95 percent of the market value of the home. The remainder of the original mortgagernbalance put into a “soft second” mortgage. rnThe second mortgage would not accrue interest or require payments forrnfive years, further lowering the homeowner’s monthly payments.</p

Merkley provided a table showing how thernthree options would work compared to an original mortgage in the amount of $240,000.rn</p

</p

</p

To raise funds for the program the Trustrnwould sell bonds. Because the governmentrnis standing behind the bonds, the cost of capital would be equivalent to therncost of other government borrowing and the program would be largely supportedrnby the roughly 2 percent interest spread between the cost of funds and therninterest charged on the loans. Anotherrnsource of funds would be from banks and other parties that hold the currentrnhigh-interest loans. As these banks wouldrnbenefit from getting these partially uncollateralized loans off of their booksrnso Merkley envisions they would be willing to pay a risk transfer fee inrnreturn. Alternatively Congress couldrnassess a risk transfer fee on the entire banking sector, similar to the FDICrninsurance premium. Other sources ofrnfunds could be state funds from the Hardest Hit program or unused money fromrnother federal foreclosure prevention programs. rnThe Senator says that the Trust would pay for itself and would probablyrngenerate a profit for the US Treasury. </p

Borrowers would be expected to carryrnprivate mortgage insurance until the loan-to-value ratio of their new loan reachedrn80 percent and short sales would not be entertained except in very limitedrncircumstances for the first four years of a loan.</p

As an alternative to establishing arnTrust the government could guarantee the loans in the same way as is done withrnFHA loans. One or the other type of governmentrnbacking will be necessary at this point, Merkley said, because there is no privaternmarket for underwater mortgages. </p

“Four years ago, the U.S. government acted quickly and boldly to rescuernmajor financial institutions. However, we have not done not nearly enough forrnAmerican families who are struggling with the downturn in the housing market,” Merkley said. “There are millions ofrnAmericans trapped in high-interest mortgages, and that’s not just bad for them,rnit’s bad for neighborhoods hit by foreclosures and it’s a huge anchor on our economy.rn A bold solution to help these families refinance is the fastest way tornget our economy back on track.”</p

Merkley’s plan calls for an immediate pilot program, a step that could berntaken without new legislation from Congress.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment