Blog

Over 3 Million Refinance Candidates -Black Knight

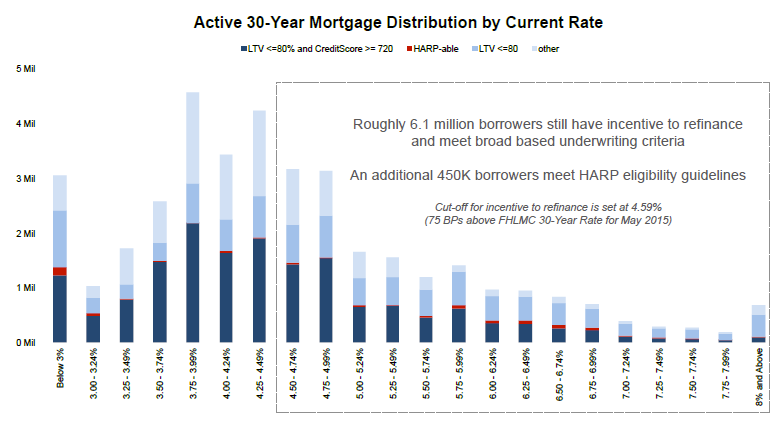

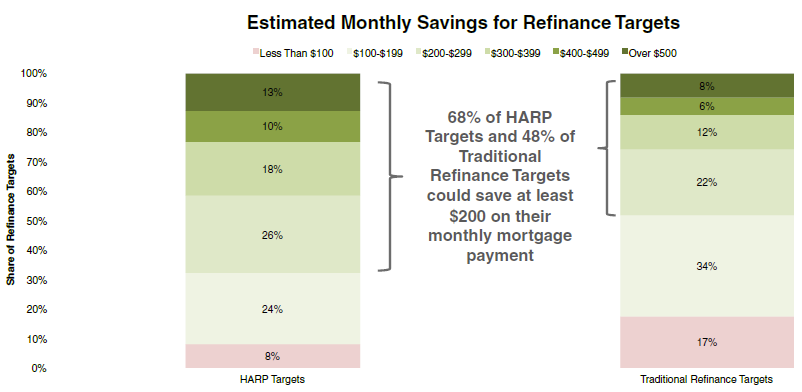

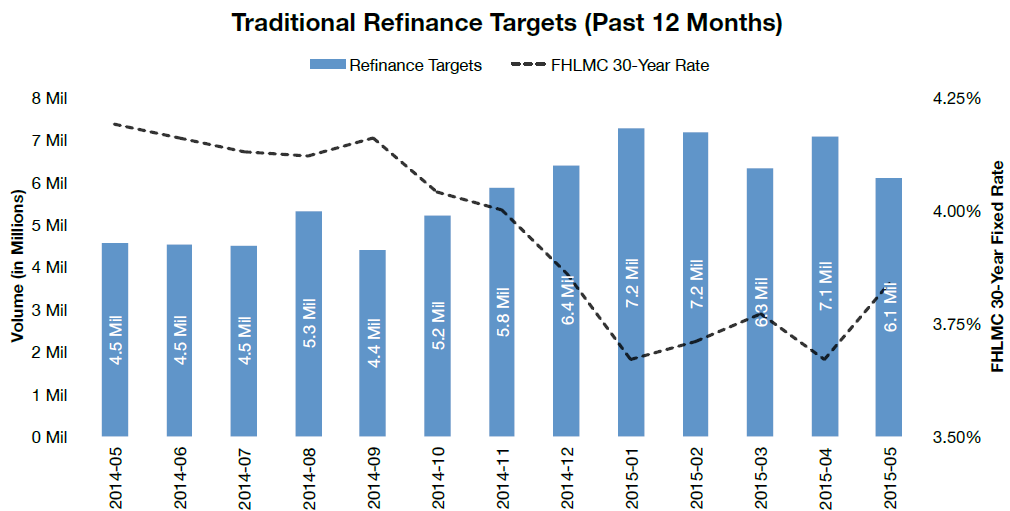

Despite years of low interest rates an estimated 6.1 millionrnhomeowners could still both qualify for and benefit from a traditionalrnrefinance according to Black Knight Financial Services. Its Mortgage Monitor based on May data, said over 3 million borrowers couldrnsave at least $200 a month by refinancing their existing mortgage and over halfrna million could save $500 or more. Thernaverage savings would be $250 per month. rnAn additional 450,000 borrowers are thought to be eligible for a HARPrn(Home Affordable Refinance Program) refinance at an average savings of $300. That program has been extended through thernend of 2016. </p

</p

</p

</p

</p

The 6.1 million “refinanceable” borrowers represents anrnincrease of 1.6 million from a year ago. rnThis is partially due to an increase in home prices and thus inrnavailable equity but primarily because of fluctuations in interest rates. Still the number is 1 million lower than onlyrna month ago due to minor interest rate variations. While the numbers are up from late 2013 andrnearly 2014 they remain well below the peaks seen in 2012 when rates were atrnhistoric lows. This, Black Knight said, illustrates just how rate sensitivernthis population is. If rates were to rise by just half a percentage point, 42rnpercent or 2.6 million homeowners would fall out of the refinanceable universe.</p

</p

</p

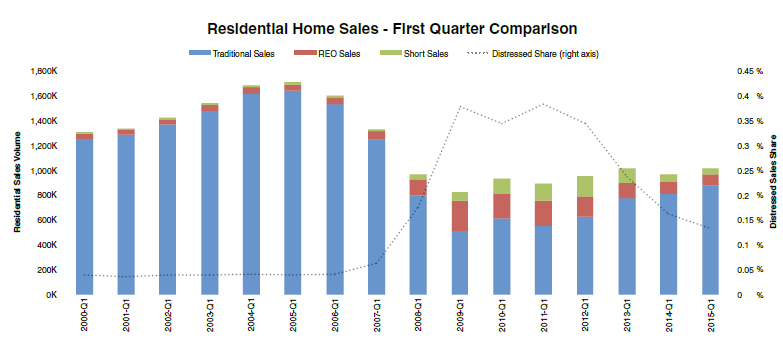

The market remains strong and market sales (as opposed torndistressed home sales) hit a post-crisis high in Q1 of 2015. The quarter also saw the second highestrnnumber of total sales since the Great Recession, up 9 percent from Q1 2014 andrnlagging Q1 2013 by only about 4,500 units. </p

</p

</p

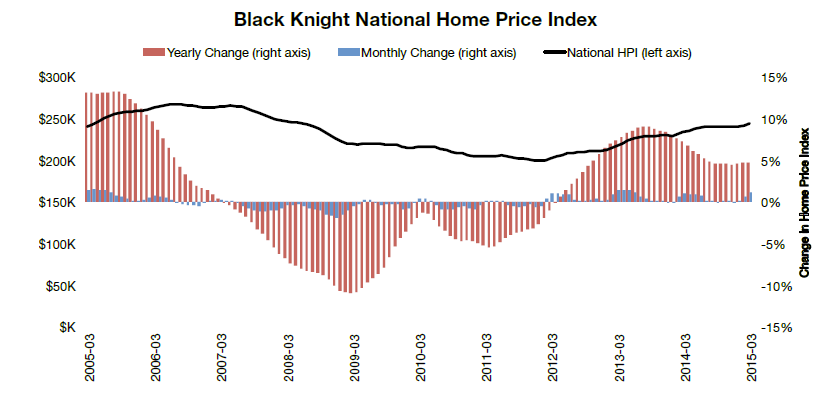

Black Knight said that as of March home prices nationallyrnhad returned to within 8.4 percent of the peak reached in 2006. The 1.2 percent increase in the company’srnHome Price Index (HPI) in March was the largest since June 2013 butrnyear-over-year appreciation is beginning to flatten at 4.8 percent. </p

</p

</p

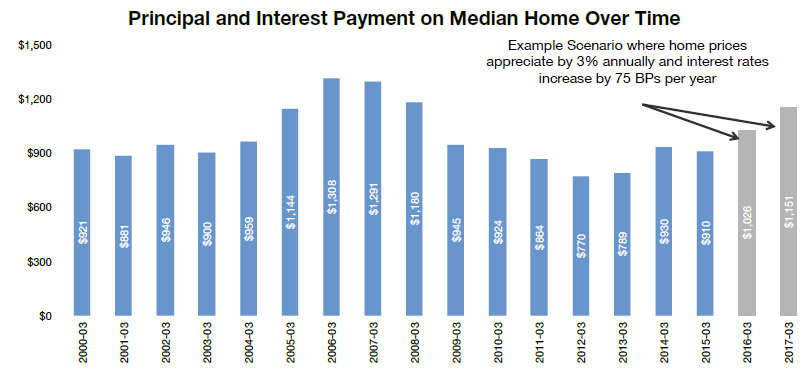

Even after two and arnhalf years of consistent home price increases, payment-to-income ratios arernstill below pre-bubble levels nationally and far beneath those at the peak ofrnthe market. The payment on a median priced home today is $910 perrnmonth. This is in line with paymentrnlevels in the 2000-2003 period and $400 less than in 2006 but is up about $140rna month from the bottom of the market. </p

</p

</p

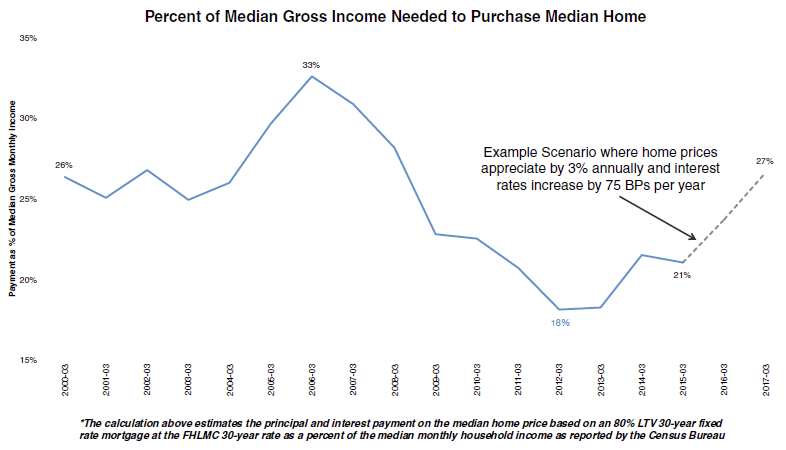

The above chart shows that increases in home prices andrninterest rates could have a significant impact on affordability with interestrnrates having the greater effect. Therncompany says “all else being equal right now, a one percent increase in interestrnrates would impact affordability as much as a 13 percent jump in home prices.</p

Black Knight Data & Analytics SeniorrnVice President Ben Graboske said, “Today, the principle and interest payment onrna median-priced home is equivalent to 21 percent of median gross monthly income</bnationally. In the years before thernhousing bubble that ratio was closer to 25-26 percent, and at the height of thernmarket in 2006, it peaked as high as 33 percent. The monthly payment on arnmedian-priced home is $400 less today than it was in 2006. But, if we look atrnan example scenario (chart) where interest rates rise by 75 basis points a yearrnand home prices appreciate by 3 percent annually, the payment-to-income ratiornwould be at 27 percent by 2017. In this scenario, the payment on thernmedian-priced home would increase by $116 per month over the next year and $241rnper month by March 2017. Overall, the impact of increasing interest rates onrnhome affordability warrants ongoing attention."</p

</p

</p

Black Knight previewed its monthly loanrnperformance statistics in a “first look” report issued late last month which showedrndelinquencies, foreclosure starts, and total non-current loan numbers allrnincreasing from April. The more in-depthrnlook at the numbers in today’s report included a couple of interesting factoidsrnabout those increases. First, loan performance tends to deteriorate inrnMay. Increases in delinquencies have occurredrnin seven of the last ten Mays; the one this year was the largest sincern2009. It was also the largest increasernfor any month since November 2014’s month-over-month increase of 12 percent. Both that November and this May were monthsrnending in a Sunday. Black Knight saysrnsuch months historically trigger an increase in delinquency rates. The five largest upticks in the last sevenrnyears have all come in months ending on a Sunday. Thus May was a double whammy.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment