Blog

Pace of Annual Home Price Increases is Quickening

The S&P/Case Shiller Home Price Indices postedrnanother set of strong and broad-based annual increases in November 2012. Data released today shows that the 10-CityrnComposite Index rose 4.5 percent and the 20-City Composite was up 5.5 percent</bcompared to November 2011. Prices rosernin 19 of the cities the tracked by the indices with only New York showing anrnannual decline, 1.2 percent. Thernyear-over-year increase was greater than that posted in October for all of therncities except Cleveland where the annual increase was unchanged. </p

Prices were down by 0.2 percent in the 10-City Compositernand 0.1 percent in the 20-City compared to October’s numbers. In October both indices declined 0.2 percentrncompared to September. Prices declinedrnin 10 of the 20 cities in November. </p

David M. Blitzer, Chairman of the Index Committee said, “The Novemberrnmonthly figures were stronger than October, with 10 cities seeing rising pricesrnversus seven the month before. </p

“Phoenix and San Francisco were both up 1.4% in November followed byrnMinneapolis up 1.0%. On the down side, Chicago was again amongst the weakestrnwith a drop of 1.3% for November.</p

“Winter is usually a weak period for housing which explains why we now seernabout half the cities with falling month-to-month prices compared to 20 out ofrn20 seeing rising prices last summer. The better annual price changes also pointrnto seasonal weakness rather than a reversal in the housing market. Furtherrnevidence that the weakness is seasonal is seen in the seasonally adjustedrnfigures: only New York saw prices fall on a seasonally adjusted basis whilernCleveland was flat.</p

Blizter said that regional patterns are shifting as well with the Southwestrnincluding hard-hit Las Vegas and Phoenix staging a strong comeback and Miamirnand Tampa in the Southeast close behind. “The sunbelt, which bore the brunt of thernhousing collapse, is back in a leadership position. California is also doingrnwell while the northeast and industrial Midwest is lagging somewhat,” hernsaid.</p

Phoenix is, in fact, staging a very strong comeback. Prices have rising 22.8 percent over the lastrn12 months, the largest increase of any of the cities, and November was thernseventh consecutive month it posted a double-digit annual return.</p

Blitzer said, “Housing is clearly recovering. Prices are rising as are bothrnnew and existing home sales. Existing home sales in November were 5.0 million,rnhighest since November 2009. New Home sales at 398,000 were the highest sincernJune 2010. These figures confirm that housing is contributing to economicrngrowth.”</p

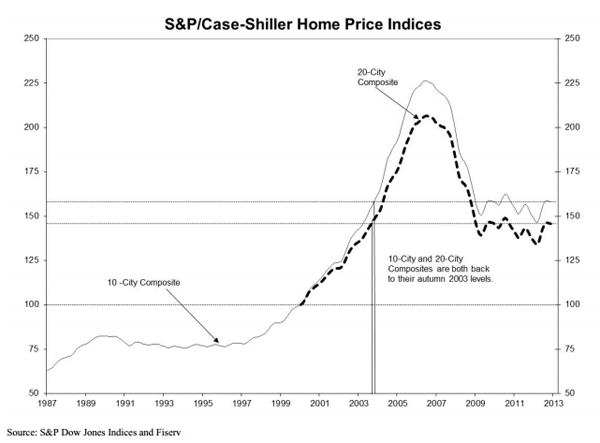

As of November average home prices nationally have returned to the levelsrnof autumn 2003 and are down from their respective peaks in June/July 2006 byrnabout 30 percent. Measured from thernrecent lows prices hit in early 2012 both composites have recovered by 8 to 9rnpercent. </p

</p

</p

The cities posting negative month over month returns inrnNovember were Boston, Chicago and New York (all of which have seen declines inrnsix out of the last 12 months), Charlotte, Cleveland, Dallas, Detroit, Portlandrn(OR), Tampa and Washington DC</p

The S&P/Case-Shiller Home Price Indices are constructed to accuratelyrntrack the price path of typical single-family homes located in the relevantrnmetropolitan areas. The indices have arnbase value of 100 in January 2000; thus, for example, a current index value ofrn150 translates to a 50% appreciation rate since January 2000 for a typical homernlocated within the subject market.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment