Blog

Path of Economy Critical to Big Picture for Mortgages

Bank of America/Merrill Lynch says its official outlookrnfor the economy is neither that of a Bull forecasting a cyclical surge or arnBear’s view of secular stagnation. rnRather, the company says it is looking for a low growth recovery.</p

Chris Flanagan, head of the company’s U.S. Mortgage andrnStructured Finance Research has written a paper titled Mortgages: the big picture</iin which he lays out a lot of theories and a lot of projections. </p

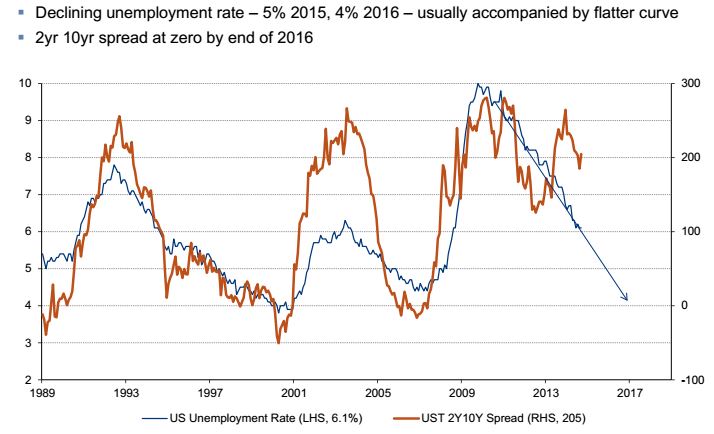

Looking ahead tornthe end of 2015 Flanagan first sees only minimal growth in Real GDP. From its 3.1 percent level in the fourthrnquarter of 2013 he sees it dipping to 2.1 percent this year and ending 2015 at 3.2rnpercent. From the end of 2012 to the endrnof 2015 the Core PCE (personalrnconsumption expenditures price index excluding food and energy) will have risenrnonly a net 0.1 percent, from 1.6 to 1.7 percent. The Federal Funds rate may as much asrnquadruple in the next year but still will not cross above 1 percent and hernprojects that the 10 Year Treasury Note rate, currently at 3.10 percent we risernto 3.75 percent. The only realrnindication of an improving economy will be unemployment which, from 8.1 percentrnat the end of 2012 he forecasts at 5.5 percent by the end of next year, fallingrneven further after that.</p

What happens to the economy of course isrncritical to what will happen to interest rates and thus to the mortgagernindustry. Flanagan points to somerncurrent indicators and what they might mean for the industry looking ahead.</p

A declining unemployment rate, is usuallyrnaccompanied by a flatting yield curve and he sees the spread between 2 year andrn10 year at zero by the time unemployment hits 4 percent at the end of 2016. Both credit and volatility tend to be, asrnFlanagan puts it, “well behaved in flatteners.”</p

</p

</p

The demand for non-mortgage types of credit,rncommercial, corporate, and consumer, has returned more closely to normal in thernwake of the recession. But both thernsupply of and demand for mortgage credit remain very weak and for severalrnreasons. </p

Homeownership peaked in the fourth quarter ofrn2004 at 69.2 percent then began a gradual decline that brought it down to itsrncurrent 64.7 percent. Even after thatrndecline began credit continued to expand and did not peak until the secondrnquarter of 2006. At that point thernMortgage Bankers Association says its recently introduced Mortgage CreditrnAvailability Index would have been at 868.71 percent. It has been coasting along in thernneighborhood of 100 since late 2007 or early 2008.</p

Flanagan blames this tight credit on the lastrnfive years of regulation, litigation, and government intervention. </p

The lack of a normal mortgage market, especiallyrntight credit, is having a major impact on most aspects of residential realrnestate – some negative and some positive. rnWhile new home sales have suffered, prices have risen, yet affordabilityrnhas remained high.</p

Flanagan sees the lack of supply and demand asrnindicating a need for further monetary accommodation as Quantitative Easing (QE)rnwinds down although a zero interest policy is expected to continue through thernsecond quarter of next year.</p

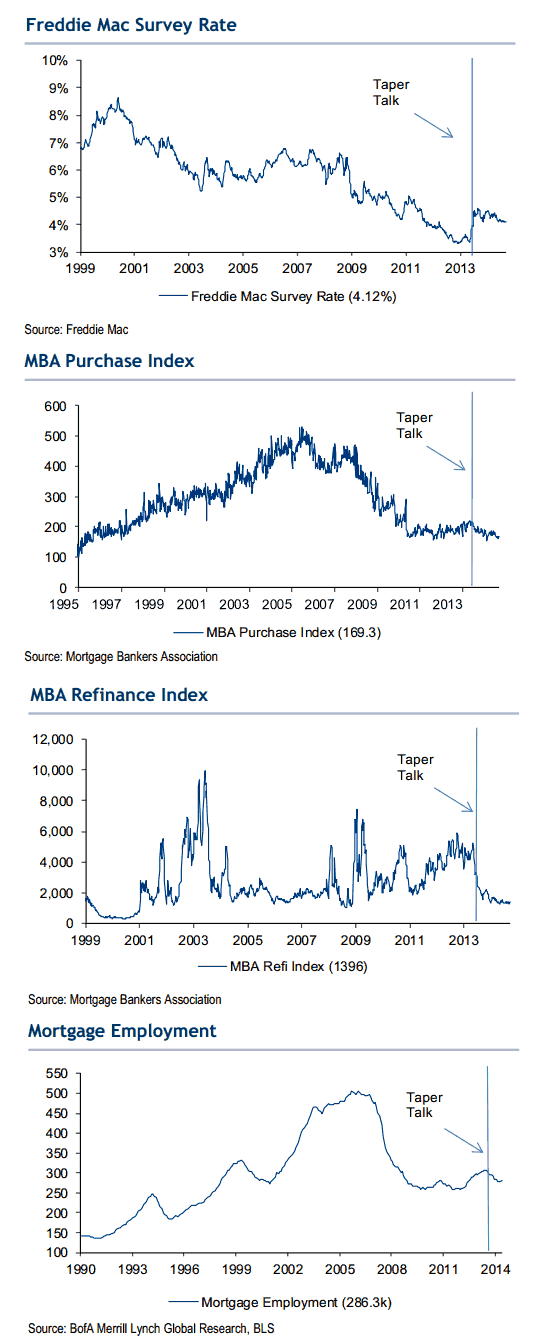

Like loose lips sinking ships Flanagan showsrnthat even talk about the Federal Reserves’ intention to taper QE had an impactrnon interest rates, mortgage origination and employment in the industry.</p

</p

</p

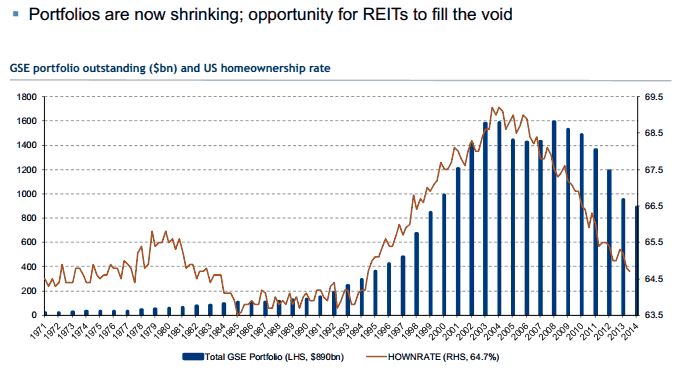

Homeownership grew quickly in the 1990s, thernmost precipitous increase can be dated to a call from President Clinton for arnnational homeownership effort in 1994, and as might be expected the volume ofrnpurchase mortgage applications increased right along with it. The 2004 peak in the former closelyrnapproximated the peak in the latter and both have proceeded down in nearrnlockstep.</p

The relationship isn’t quite as close betweenrnthe decline in homeownership and the growth and retraction in GSE portfolios. Portfoliorngrowth tracked closely from the mid 1980 through the peak and during the firstrnfew years of homeownership decline. Butrnthe portfolios did not begin to decline in earnest until the GSEs were mandatedrnto liquidate them as a condition of their federal conservatorship. With those portfolios down to slightly morernthan half their size in 2008 Flanagan says this could be an opportunity forrnreal estate investment trusts (REITs) to fill the void.</p

</p

</p

Declining homeownership equals declining homernpurchase mortgages and that, together with the declining GSE portfolios, meansrna much smaller investment in MBS, especially Agency MBS. The paper points out that of the 5.47rntrillion in U.S. fixed income gross issuance in 2008, 20.8 percent was AgencyrnMBS and 16.7 percent was Treasury notes. With a substantially smaller issuern($4.38 trillion) in 2014 the Agency MBS share has dropped to 13.1 percent whilernTreasury has 31.6 percent. </p

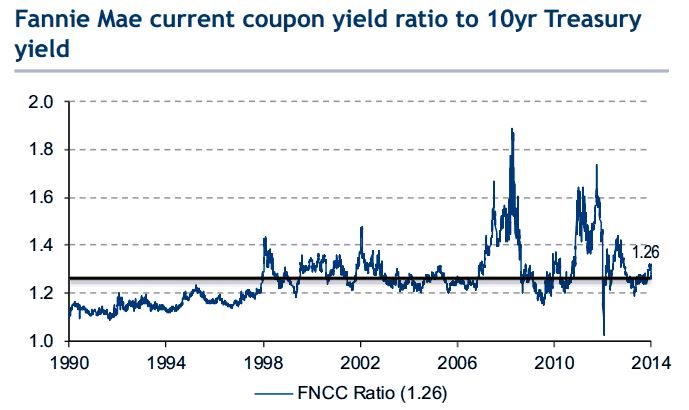

Flanagan says the stable and low MBS spreadsrnalong with low volatility seem to be the new normal in the mortgage world andrnagain he points to the current environment as providing opportunity for REITSrnas the Federal Reserve and the GSEs no longer continue to grow theirrnportfolios.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment