Blog

Pending Home Sales Basically Flat in January. Rent or Own?

The National Association of Realtors today released the Pending Home Sales Index for January.

The Pending Home Sales index measures housing contract activity. It is based on signed real estate contracts for existing single-family homes, condos and co-ops. A signed contract is not counted as a sale until the transaction closes. Instead, when a seller accepts a sales contract on a property, it is recorded into a Multiple Listing Service (MLS) as a “pending home sale.” Once that transaction settles it becomes an Existing Home Sale. The majority of pending home sales become Existing Home Sales transactions, typically one to two-months later.

Since pending home sales measure actual existing-home sales, the PHSI provides an accurate and reliable indicator of future home sales activity. Samples show that about 80% of all pending home sales go to settlement within a 2-month time-period (and a significant share of the rest close in month 3 and month 4). Not all pending home sales go to closing though. A certain percentage of properties that go under contract are cancelled (or fallout) before ever going to settlement. This percentage has been on the rise since early 2009. An index of 100 is equal to the average level of contract activity during 2001, the first year to be analyzed.</p

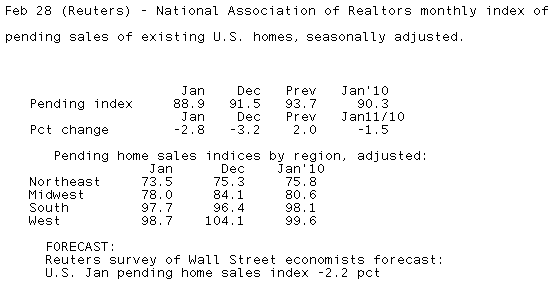

Here is the Reuter’s Quick Recap…</p

28Feb11 RTRS-U.S. JAN PENDING HOME SALES INDEX -2.8 PCT (CONSENSUS -2.2 PCT) TO 88.9 – REALTORS

28Feb11 RTRS-U.S. JAN PENDING HOME SALES -1.5 PCT FROM JAN 2010

28Feb11 RTRS-TABLE-U.S. Jan pending home sales fall 2.8 pct</p

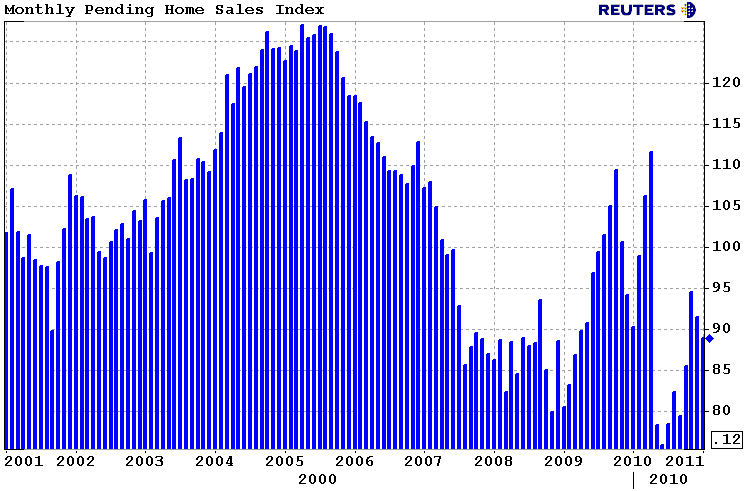

Plain and Simple: -2.8%. Basically flat just above record lows on a year over year basis. Remember: the purchase market slowed considerably last winter.</p

</p

</p

Excerpts from the Release…</p

Pending home sales eased moderately in January for the second straight month, but remain 20.6 percent above the cyclical low last June, according to the National Association of Realtors®.

The Pending Home Sales Index,* a forward-looking indicator, declined 2.8 percent to 88.9 based on contracts signed in January from a downwardly revised 91.5 in December. The index is 1.5 percent below the 90.3 level in January 2010 when a tax credit stimulus was in place. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.</p

The PHSI in the Northeast declined 2.4 percent to 73.5 in January and is 3.0 percent below January 2010. In the Midwest the index fell 7.3rn percent in January to 78.0 and is 3.2 percent below a year ago. Pendingrn home sales in the South rose 1.4 percent to an index of 97.7 but are 0.4 percent below January 2010. In the West the index fell 5.2 percent to 98.7 and is 0.9 percent below a year ago.</p

Lawrence Yun, NAR chief economist, points to the broader trend. “The housing market is healing with sales fluctuating at times, depending on the flow of distressed properties coming on the market,” he said.

“While home buyers over the past two years have been exceptionally successful with historically low default rates, there is still an elevated level of shadow inventory of distressed homes from past lending mistakes that need to go through the system,” Yun said. “We should not expect the recovery to be in a straight upward path – it will zig-zag at times.”</p

The pace of January existing-home sales, 5.36 million, is slightly higher than NAR’s annual forecast for 2011. If contract activity stays on its present course, there should be an 8 percent increase in total existing-home sales this year.

“The broad fundamentals for a housing recovery are developing,” Yun said. “Job growth, high housing affordability and rising apartment rent are conducive to bringing more buyers into the market. Some buyers may be looking to real estate as a hedge against potential future inflation.”</p

————————————————-</p

(WHY POINT THE FINGER NAR? REALTORS PLAYED NO PART IN THE HOUSING CRISIS?)</p

Fannie Mae’s latest National Housing Survey shows thatrnAmericans have markedly changed their perception of homeownership. </p

The most recent survey,rnconducted between October and December 2010, revealed that 64 percent ofrnrespondents felt buying a home was a safe investment. This is 6 points below the responses given inrna January 2010 survey and 19 points below the answers to an initial surveyrnconducted in 2003. But at the same time, 84 percent of consumers believe thatrnowning a home makes more sense than renting, a number that has remained relativelyrnstable since the January 2010 survey.</p

Respondents gave, as positive reasons for homeownershiprnthe quality of local schools (79 percent) and safety (also 79 percent.) These ranked far ahead of any financialrnconsiderations such as tax benefits or a belief that paying rent makes lessrnsense. Amongrnrenters 28 percent thought renting made more sense. </p

Americans have grown more confident about the stability ofrnhome prices than they were one year ago although this is not matched by theirrnattitudes regarding strength in the economy. rnA majority (78 percent) feel that home prices will either stay the samernor go up (73 percent held this position in January) versus 19 percent whornexpect further declines. Expectationsrnamong the 26 percent expecting an increase were modest; the average projectedrnincrease was 0.4 percent. </p

A larger sharernof respondents – 39 percent – expect rents to increase over the next year withrnthe average estimate of increase at 2.8 percent.</p

SO. WITH THAT WE ASK….</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment