Blog

Pending Home Sales Confirm Increase in Buyer Demand Ahead of Tax Credit Expiration

The National Association of Realtors released Pending Home Sales data today.

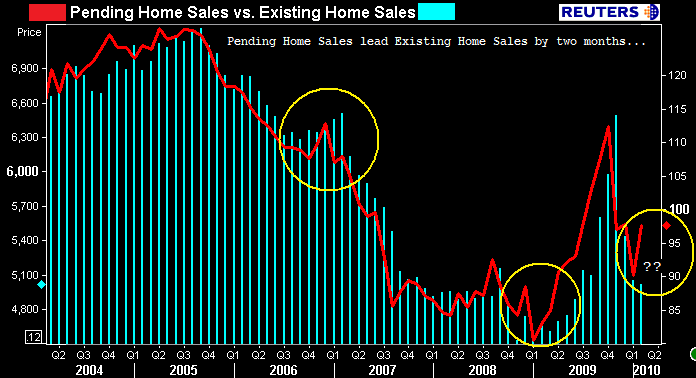

A sale is listed as “pending” when a contract to purchase an existing home has been signed but the transaction has not closed. The index is based on a large national sample, typically representing about 20 percent of transactions for existing-home sales. In developing the model for the index, it was demonstrated that the level of monthly pending home sales parallels the level of closed existing-home sales in the following two months.

From the release:

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in February, rose 8.2 percent to 97.6 from a downwardly revised 90.2 in January, and remains 17.3 percent above February 2009 when it was 83.2. The data reflects contracts signed, not closings, which usually occur with a lag time of one or two months after the home sales contract is signed.

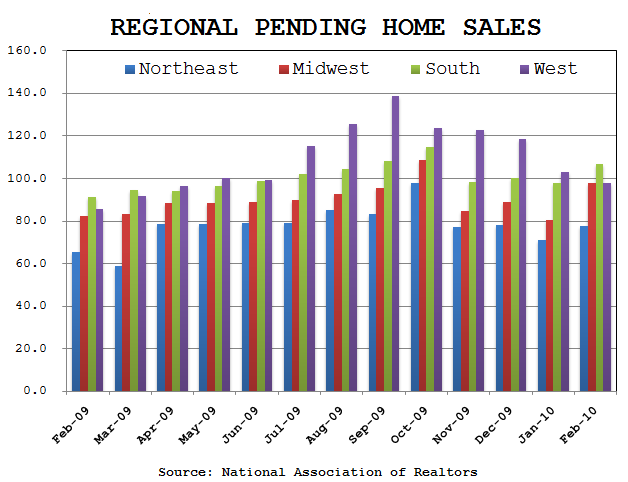

Regionally, the Midwest saw the biggest month over month uptick while the West extended its losing streak to five months.

- The Northeast rose 9.0 percent to 77.7 and is18.9 percent higher than February 2009

- In the Midwest the index jumped21.8 percent to 97.9 and is 18.7 percent above a year ago

- In the South increased 9.2 percent to an index of 107.0 and is 17.5 percent higher than February 2009.

- The West fell 4.8 percent to 98.0 but is 14.6 percent above a year ago.

Lawrence Yun, NAR chief economist says:

“Anecdotally, we’re hearing about a rise of activity in recent weekswith ongoing reports of multiple offers in more markets, so the Marchdata could demonstrate additional improvement from buyers responding tothe tax credit,”

I am hearing the sameanecdotal evidence the NAR is receiving. READrn MORE

The chart below illustrates how Pending Home Sales (contracts signed)are a forward looking indicator of Existing Home Sales. The 8.2 percentrise in contracts signed implies we should see a modest increase inExisting Home Sales in the months to come, as long as there are no “hiccups” in the loan qualifying process that is…

I should point out that the modest rise in mortgage rates which has occured over the past two weeks will push a portion of March's Existing Home Sales into April.

Yun adds:

“The rise in buyer contact activity may signal the early stages of asecond surge of home sales this spring. The healthy gain hints homeprices are continuing to flatten….We need a second surge tomeaningfully draw down inventory and definitively stabilize homevalues.”

Plain and Simple: this is a key point in time for housing and the macroeconomic outlook. If housing is unable to gain recovery momentum before the tax credit expires, where will demand come from afterward?

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment