Blog

Purchase Apps Extend Tax Credit Trend. Low Downpayment Loans Fuel Buyer Demand

The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending April 23, 2010.

Michael Fratantoni, MBA's VicePresident of Research and Economics says:

“Purchase activity continues to increase as we approach the end of thehomebuyer tax credit program….Purchase applications were upalmost 9 percent from a month ago, with a disproportionate share of theincrease due to government purchase applications. Governmentapplications for purchasing a home accounted for almost 49 percent ofall purchase applications last week.”

From the release…

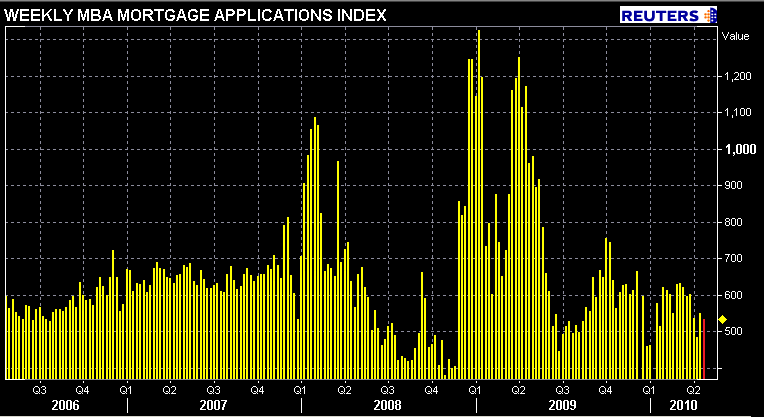

The Market Composite Index, a measure of mortgage loan application volume decreased 2.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 1.9 percent compared with the previous week. The four week moving average for the seasonally adjusted Market Index isrn down 3.1 percent.

The Refinance Index decreased 8.8 percent from the previous weeK. The Refinance Index four week moving average is up 1.6 percent. The refinance share of mortgage activity decreased to 55.7 percent oftotal applications from 60.0 percent the previous week. The refinanceshare is at its lowest since August 2009.

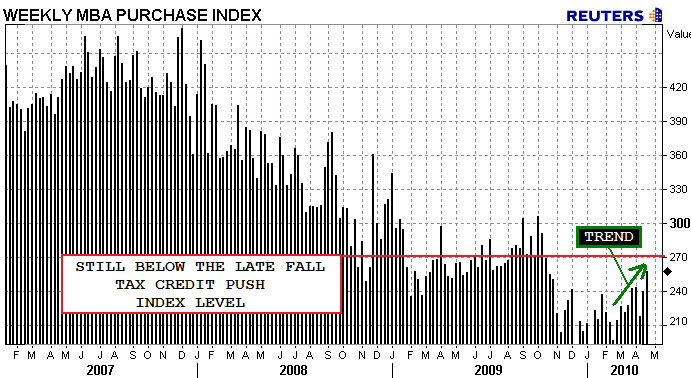

The seasonally adjusted Purchase Index increased 7.4 percent from one week earlier and reached its highest level since October 2009. The unadjusted Purchase Index increased 8.5 percent compared with theprevious week and was 2.4 percent higher than the same week one yearago. The four week moving average is up 1.6 percent for the seasonallyadjusted Purchase Index.

The increase in the purchase index was driven largely by the government purchase index, which increased 11.9 percent from last week on a seasonally adjusted basis, while the conventional purchase index increased 3.5 percent from last week.

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.08 percent from 5.04 percent, with points decreasing to 0.91 from 0.98 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

The average contract interest rate for 15-year fixed-rate mortgages increased to 4.38 percent from 4.34 percent, with points decreasing to 0.93 from 0.98 (including the origination fee) for 80 percent LTV loans.

The average contract interest rate for one-year ARMs increased to 7.03 percent from 6.95 percent, with points increasing to 0.3 from 0.28 (including the origination fee) for 80 percent LTV loans. The adjustable-rate mortgage (ARM) share of activity remained unchangedrn at 6.0 percent of total applications from the previous week.

No surprises in this data. Purchase apps continue to trend higher as the April 30th tax credit deadline fast approaches. Slowly falling refinance demand reflects the fact that most eligible fence-sitters already pulled the trigger.

It might be of interest to some that so many borrowers are applying for low downpayment FHA insured loans. This implies prospective borrowers are looking to put as little down as possible to keep their personal balance sheet as liquid as possible. Either that or they simply just don't have the reserves on hand to qualify for a conventional 30 year fixed loan. These folks better keep a close watch on local home values…the last thing we need is a double-dip in housing and growth in the number of underwater borrowers.

With that in mind, it is imperative that housing use this tax credit and seasonal momentum to establish a solid recovery foundation. The recuperation of buyer confidence needs confirmation that stabilization is steady.

(Do not read “stabilization” as growth, read as “finding a bottom”)

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment