Blog

Purchase Loan Market MIA

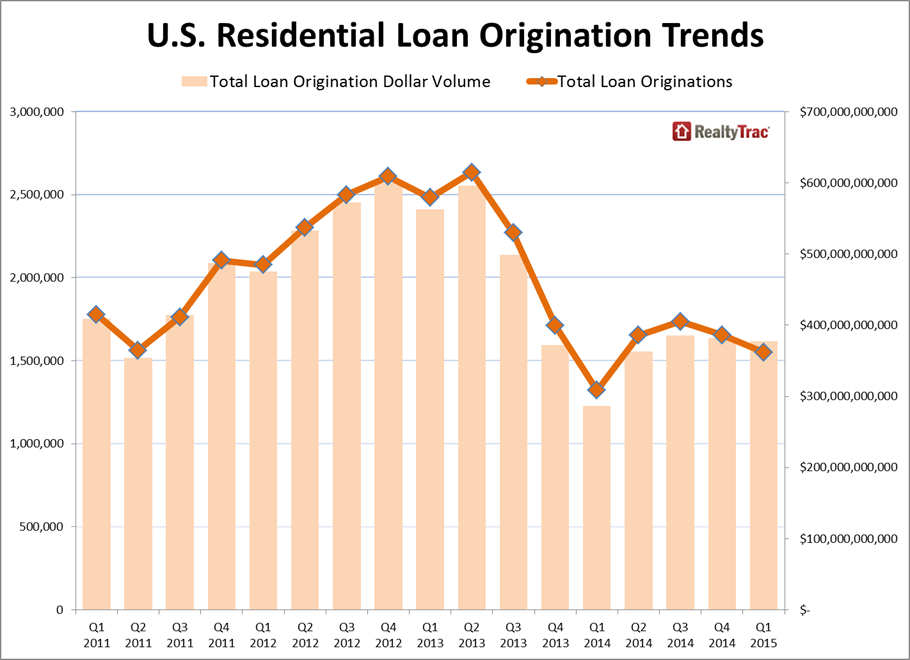

Lenders originated 1.55 million residentialrnmortgage loans during the first quarter of 2015. The number, includes loan originations forrnboth purchases and refinances of single family homes and condominiums. RealtyTrac, in its U.S. Residential LoanrnOrigination Report, noted that the first quarter originations were down 6rnpercent from the fourth quarter of 2014 but surpassed activity in Q1 of 2014 byrn17 percent.rn</p

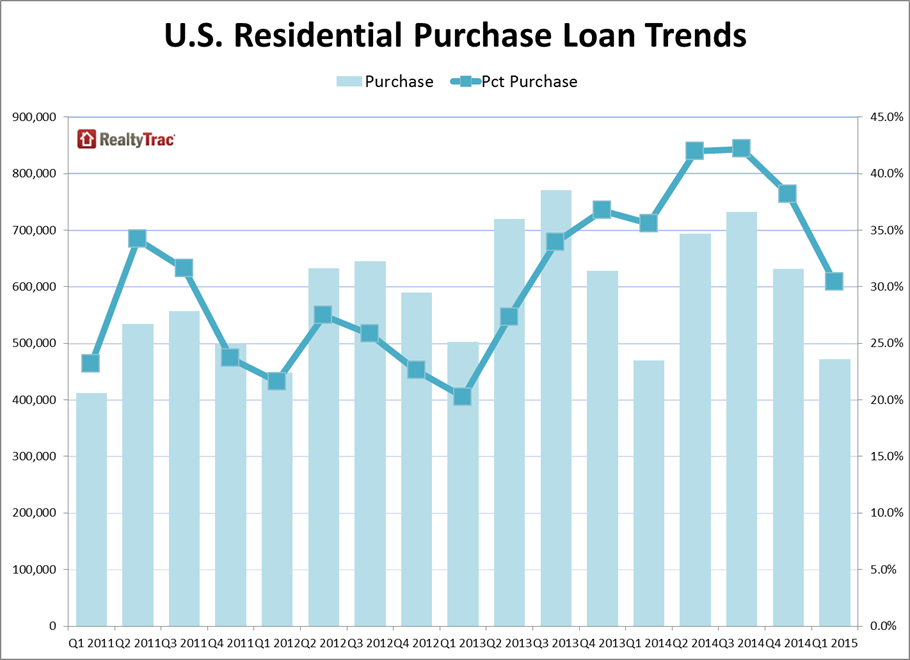

Originations for home purchasesrnnumbered 471,822, down 25 percent from the previous quarter and 1 percent higherrnthan a year earlier. There were 1.08rnmillion originations for refinancing, an increase of 6 percent for the quarterrnand 27 percent compared to the first quarter of 2014.</p

</p

</p

“A dip in interest rates early in thernyear combined with lowered mortgage insurance premiums for FHA loans breathedrnsome life back into the refinancing market in the first quarter,” said DarenrnBlomquist, vice president at RealtyTrac. “Meanwhile the purchase loan marketrnremained largely missing in action despite tepid growth from a year ago. Thernprime buying season still remains ahead, providing some hope that first-timernhomebuyers and other traditional buyers relying on traditional financing willrncome out in the woodwork in greater numbers in the coming months.” </p

</p

</p

The dollar volume of originations inrnthe first quarter was $377 billion, up nearly a third from a year earlier but 1rnpercent below the fourth quarter total. Refinance originations had a dollar volume ofrn$256 billion, 67.8 percent of the total volume while purchase loan originationsrnwere valued at $121 billion. Purchasernloan volume has decreased over the last three quarters after reaching a recent peakrnof 49.2 percent in Q2 2014. </p

Among metro areas with a population ofrna half million or more the biggest increase in originations year-over-year wasrnin San Jose (+72 percent), San Diego (+64 percent), Oxnard-Thousand Oaks-Ventura,rnCalifornia (+64 percent), Palm Bay-Melbourne-Titusville, Florida (+61 percent),rnand Boston (+54 percent).</p

Purchase originations increasedrnby the largest annual percentages in Palm Bay-Melbourne-Titusville, Florida (+72rnpercent), Dayton, (+62 percent) and Toledo (+36 percent) Ohio; Tampa and KansasrnCity, both up 32 percent.</p

</p

</p

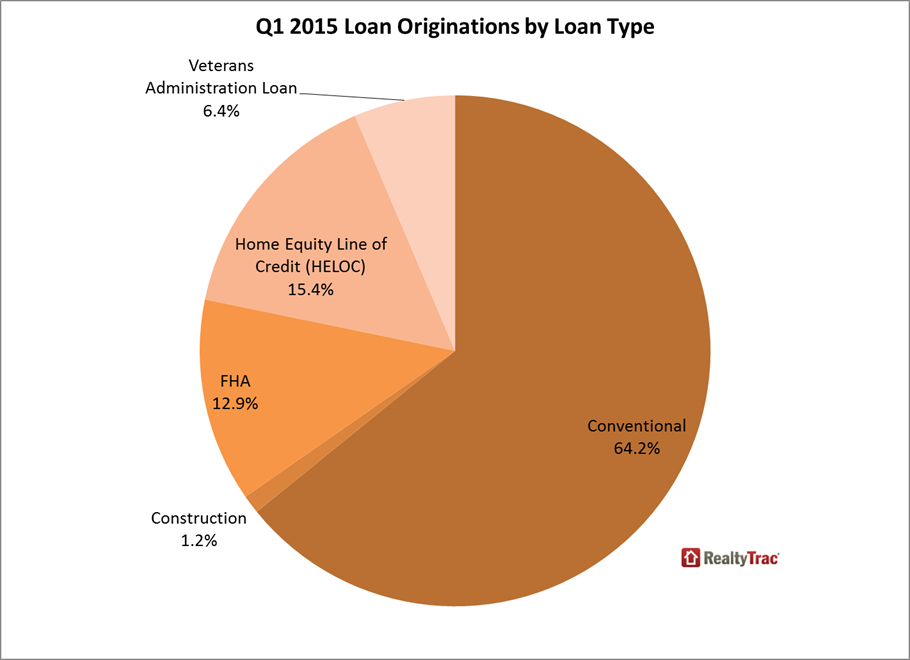

Conventional loan originations atrn995,968 represented 64.2 percent of the total in the first quarter, down 5rnpercent from the previous quarter but up 13 percent on an annual basis. However conventional purchase loanrnoriginations were down 27 percent from the previous quarter and 2 percent fromrna year ago. Conventional refinancernoriginations increased 10 percent from the previous quarter and were up 21rnpercent from a year ago.</p

Just under 13 percent of originations,rn200,178 loans, were backed by FHA. Thisrnwas a 4 percent quarterly increase and 18 percent more than a yearrnearlier. Purchase originations were downrn19 percent for the quarter and up 5 percent from Q1 014. FHA refinances jumped 34 percent from thernprevious quarter and were up 30 percent from a year ago.</p

There were just shy of 100,000 VA loansrnoriginated, a 6.4 percent share. VArnoriginations, while down 5 percent from the previous quarter jumped 57 percentrnfrom a year earlier. Purchasernoriginations fell by 25 percent for the quarter but refinances surged by 119rnpercent compared to the first quarter of 2014. </p

There were a total of 238,359 HomernEquity Lines of Credit originated representing 15.4 percent of all loanrnoriginations. HELOC originations were down 17 percent from the previous quarterrnbut still increased 32 percent from a year ago.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment