Blog

QE3 Moves Freddie Mac Economists to Revisit Projections

Freddie Mac is revisiting its economic projections</bfor the remainder of 2012 and 2013 due to the announcement by the FederalrnReserve of its Maturity Extension Program known as "QE3.” Under the program the Fed will increase itsrnpurchases of agency mortgage-backed securities (MBS) by $40 billion per monthrnwhile continuing the term extension (also known as Operation Twist) of its portfolio. Taken together the two programs will increasernthe Fed’s holdings of longer term securities by about $85 billion through thernend of 2012. </p

The Fed hopes to encourage lower long-term interestrnrates, especially on fixed-rate mortgages and through them stimulate furtherrnhousing market activity. Moreover, the increased housing demand stimulated by QE3 may partly offsetrn(albeit by a small amount) the substantial reduction in 2013 aggregate demand that would be expected if thernso-called “fiscal cliff“rnoccurs.</p

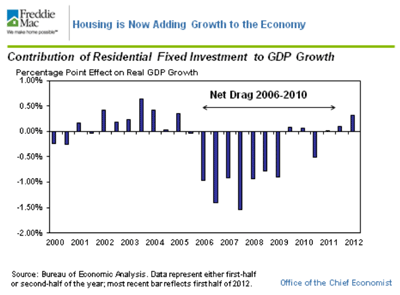

Freddie Mae points to the housing sector’srnperformance in the recovery from the recession as unlike any other recoveryrnover the last 65 years; it did not lead the recovery but has lagged it. “In fact, residential fixed investment (RFI) (the component of gross domestic product (GDP) that includes expenditures on new housing construction, additions and alterations to the existing housing stock, and broker commissions on property sales) was a net drag on GDP growth during 2006-2010 and added less than one-tenth of a percentage point to GDP growth in 2011.” </p

This year,rnhowever RFI added 0.3 percentage points to the first-half 2012 real GDP growth of 1.7 percent (annualized) and will likely add similarly during the second half of the year. The gradual turnaround in housing activity reflects, in part, the Feds accommodative monetary policy. With mortgage rates at their lowest levels since atrnleastrnthern1940s, housing demand has begun to improve. New housingrnstarts were up 25 percent and existing home sales gained 8 percent over the firstrneight months of 2012 compared withrnthe same period last year. </p

</p

</p

Property value indexes for the U.S. have alsornturned up, with the FHFA purchase- only house price index uprn3.8rnpercent over the 12 months through July and the National Council of Real Estate InvestmentrnFiduciaries’ value index for apartment buildings uprn7.6rnpercent over the four quarters throughrnmid- 2012.</p

The rates have also spiked a refinance boom</bwhich accounts for roughly three-fourths of all loanrnapplications this year. rnFreddie Mac's refinancings have lowered rates for the average borrowerrnby about 1.5 percentage points saving an average of $2,100 a year for arnborrower with a $200,000 loan. Therncompany's new projection has about 7 millionrnborrowers refinancing overrnthe next year which, if this reduction holds, will result in $15 billion in mortgage payment savings,rna substantial infusion of funds to help strengthen savings and consumption spending byrnowners.</p

Freddie Macrnboosted its projection of single-family mortgage originations for the remainderrnof this year and to 2012 first because the September release of the 2011 HomernMortgage Disclosure Act (HMDA) data led to an upward revision in estimates ofrn2011 origination volume. Lenders coveredrnunder HMDA reported $1.43 trillion in originations in 2011 which, extrapolatedrnto all lenders, equates to about $150 trillion. rnThis larger volume for 2011 also increased estimates for 2012 which arernbased in part on estimates of purchase-money and refinance growth between therntwo years.</p

Second, the expectation of an extended period of low mortgage rates ushered in by QE3 hasrncaused an increase in the new purchase-money and refinance volume during the second half of 2012 and into 2013. Freddie Mac says it expects single-family origination volume to come in close to $2 trillion inrn2012, about a 30-percent rise from 2011, and then drop by 15 to 20 percent in 2014 as refinance ‘burnout’, somewhat higher mortgage rates, and the scheduled expiration of HARP lead to substantially less refinancernactivity.</p

Freddie Mac’s economists say the QE3 initiative will take on even more importance if the assortment of temporary tax cuts arernallowedrnto expire at year-endrnandrngovernmentrnspending levels are reducedrnwith the start of 2013. These “fiscal cliff,” items include (but are not limitedrnto) the expiration of the 2 percentage-point payroll-tax cut and Bush-era tax-rate reductions, and the spending cuts related to long-term unemployment benefits and automatic reductions required underrnthe Budget Control Act of 2011. </p

The Congressional Budget Office has estimated that if all the temporary tax cuts expire and government spending levels are reduced, that 2013 GDP growth would be reduced by at least 2.2 percentage points from what it otherwise would have been, possibly pushing the U.S into recession with unemployment rising to 9 percent. Moody’srnAnalytics also concluded the economy would be much weaker in 2013 in such a scenario, withrngrowth estimated to be 2.8 percentage points slower and unemployment rising to 9.2 percent.1 With QE3 already in place and helping to bolster housing demand in the near term, the economic effects of experiencingrnthern”fiscal cliff” will bernsomewhat less than they otherwise wouldrnbe.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment