Blog

Radar Logic: Housing Prices Start Seasonal Fade

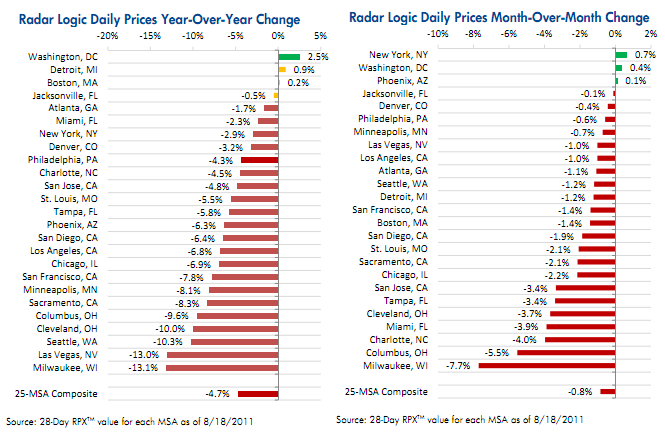

The seasonal decline in home prices that always proceeds the holidaysrnand continues through the cold winter months has already begun, appearingrnearlier and sharper than usual. Radar Logicrnreports that its RPX Composite Price which tracks housing prices in 25 metropolitanrnstatistical areas (MSA) fell 0.8 percent between the data points of July 18 andrnAugust 18 and was 4.7 percent lower than on August 18, 2010. This was the largest decline in the CompositernPrice at this time of year since 2008 and the year-to-date gain in the RPXrnthrough August was the smallest in the Composite’s history except for 2008, arnnotably terrible year for housing. </p

Month-over-month price changes were positive in only twornmetropolitan areas; Washington, DC saw an appreciation of 0.4 percent and NewrnYork City was up 0.7 percent. Thernbiggest losers pricewise were Milwaukee (-7.7 percent) and Columbus, Ohio (-5.5rnpercent). On a year over basis onlyrnWashington was up (2.5 percent) while Milwaukee saw a 13.1 percent decline andrnLas Vegas a 13.0 percent loss. Threerncities, Detroit, Boston, and Jacksonville, Florida were neutral as to price changesrnfor the year.</p

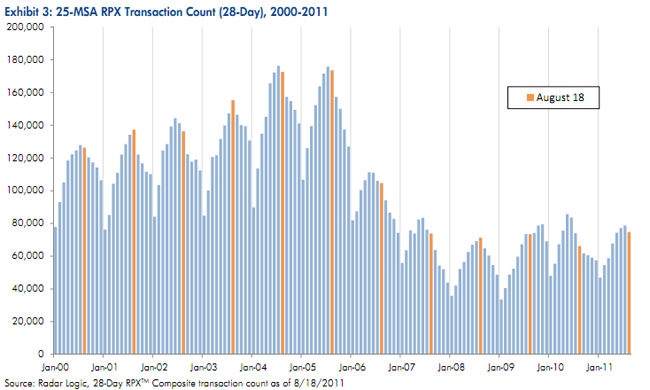

Home sales have also come down more quickly than is usuallyrnthe case in late summer. The 25-MSA RPXrntransaction count declined 5.2 percent from July to August. Looking back over the previous 10 years (withrnthe exception of 2010 where the June 30 expiration of the housing tax creditrnmade the remainder of the year anomalous,) the July to August change, whether positivernor negative, has been around 2 percent. rnThe transaction count increased 13 percent year-over-year throughrnAugust, but this change had more to do with disruptions caused by the taxrncredits than strong sales during the year. rnRPX said that these year-to-year gains from the tax credit reaction inrn2010 will disappear by the end of the year if home sales hold to their usualrnseasonal patterns.</p

</p

</p

St. Louis, Missouri had a spurt of nearly 40 percent in salesrnduring the month and an increase for the year-to-date of 46.7 percent. Other MSAs with positive changes inrntransactions since July are Las Vegas, and Boston. Transactions dropped 19 percent between Julyrnand August in Charlotte, North Carolina and 15.0 percent in Tampa. Charlotte is also in negative territory forrnthe year (-6.5 percent as is Detroit (-6.4 percent) and San Jose, Californiarn(2.2 percent.) The remaining 22 MSAsrnhave seen increases in transactions year-over-year; Boston has the highestrnpositive change (48.4 percent) followed by St. Louis and Minneapolis (29.2rnpercent).</p

Radar Logic restated its contention from May that the changernin conforming loan limits that were effective October 1 will not significantlyrnimpact the RPX Composite Price nor significantly affect most prices it tracksrnat the MSA level. The company said thatrna close look shows that rather than reducing the overall demand for homes andrnthereby reducing aggregate home prices, the new loan limits affect only a smallrnpercentage of sales because most housing markets were not considered high costrnareas. Even in those markets that wererndesignated high-cost, sales in the price band between the old elevated limitsrnand the new ones make up only a small percentage of total sales. For example, in the three areas with thernlargest percentage of sales in the “reduction zone,” New York, San Francisco,rnand San Jose, less than ten percent of sales will be affected by thernchange. “There may be a shift in the mixrnof sales out of the reduction zone toward lower price levels, but given thernsmall percentage of sales affected, the impact of such a mix-shift on MSA-levelrnRPX prices will probably be minimal.”</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment