Blog

Real Estate Great Investment, but Maybe not Right Now – Gallup

Although a press release last week about a Galluprnsurvey showed Americans view real estate as a better long term investmentrnthan stocks, gold, savings accounts, or bonds, another report from the companyrnindicates they are less enthusiastic about buying a home. </p

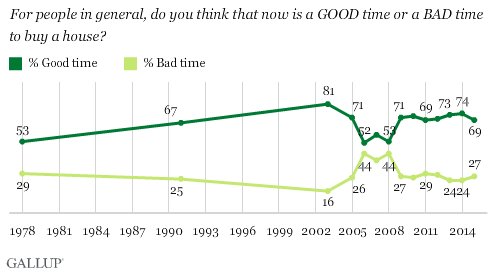

Gallup said today that 69 percent of Americans responding torntheir survey said it was a good time to buy a home while 74 percent thoughtrnthis in both 2013 and 2014 surveys. The currentrnnumber is similar to that measured by Gallup from 2009 to 2012 and showed a morernpositive attitude toward buying than between 2006 when home values stoppedrnrising and interest rates increased and 2008, after the housing bubble burst. During that period only 50 percent thought itrnwas a good time to buy. </p

</p

</p

The survey resultsrnwere gathered through Gallup’s annual Economy and Personal Financernsurvey, conducted April 9-12. Therncompany said the less positive views of home buying may have been influenced byrnlackluster and probably bad-weather related home sales earlier this year, Thernnewest data on home sales, released last week, showed a surge in existing home salesrnin March. While the size of the universe differs very slightly, it appears thatrnthis is the same audience and survey that provided responses for the earlierrnGallup report about the investment potential of real estate. </p

Since 1978, Americans have generally been optimistic about the home-buyingrnclimate, with majorities saying it is a good time to buy even in times when therneconomy struggles, including after the housing bubble burst. Thus, the measurernlikely reflects the value Americans put on homeownership in addition to theirrnviews of the prevailing housing market. </p

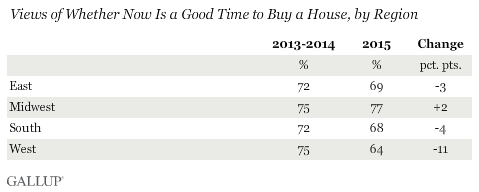

Gallup noted that positive responses to the question about homebuyingrndropped the most in the current survey among respondents residing in thernWestern part of the country, with 64% viewing it as a good time to buy, downrnfrom an average 75%. There were smaller drops among those living in the Eastrnand South, while views in the Midwest are steady if not up slightly.</p

</p

</p

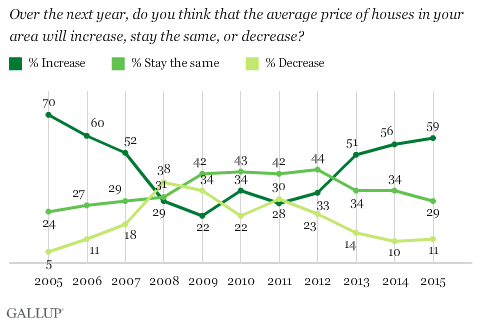

Despite the decline in positive attitudes toward homebuying the majority of respondents,rn59 percent, expect prices in their local areas to rise while 29 percent expectrnno change and 11 percent anticipate a decrease in value. This was the highest percentage expecting anrnincrease since 2006 when 60 percent did. </p

</p

</p

Seventy-six percent of those living in the West expect price increasesrnwhich, Gallup said, may explain why fewer Westerns think it is a good time tornbuy. Southern residents are thernnext-most optimistic about local home prices, with 61% expecting an increase,rnfollowed by those living in the Midwest (51%) and East (46%).</p

Gallup concludes that Americans remain generally positive about the housingrnmarket, although they are slightly less inclined right now to believe buying arnhome is a good idea than they were during the past two years, possibly becausernexpectations for higher prices may also push them to conclude it is now more ofrna sellers’ than a buyers’ market. It is also unclear to what extent the recentrnnews aboutb surging U.S. home sales may cause Americans to become a bit morernpositive about home buying conditions. “Mortgage interest rates remain low, andrnhigher consumer confidence than in recent years works in favor of continuedrnstrong home sales, particularly if the slump in sales earlier this year wasrnmainly because of unusual weather conditions,” the Gallup release said.</p

The flip side is that a stronger economy has also moved the Federal Reservernto consider raising interest rates which could make financing a home morernexpensive and dampen the housing market in the coming year. </p

Results for this Gallup poll are based on telephone interviews conductedrnApril 9-12, 2015, with a random sample of 1,017 adults. The survey had a quota of 50 percentrncellphone respondents and 50 percent landline users and had additional quotasrnby time zone.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment