Blog

Realtors Report Multiple Offers, Quick Sales but Continuing Appraisal and Credit Issues

The National Association of Realtors® (NAR) conducts arnmonthly survey of its members and uses their responses to construct a REALTORSrnConfidence Index (RCI). Similar in somernrespects to the builder confidence survey conducted by the National Associationrnof Homebuilders but more extensive, the NAR survey tracks Realtor’srnexpectations about overall market conditions, buyer/seller traffic, homernprices, and issues of concern. The RCIrnreport released today reflects information collected from about 3,700rnrespondents from November 26 to November 30. rnNAR cautions that “all real estate is local and conditions inrnspecific markets may vary from the national trend. </p

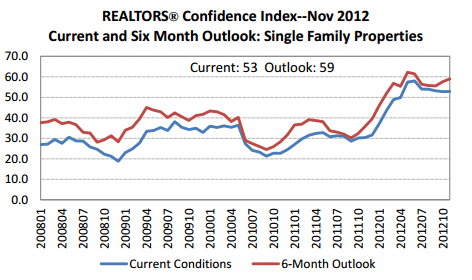

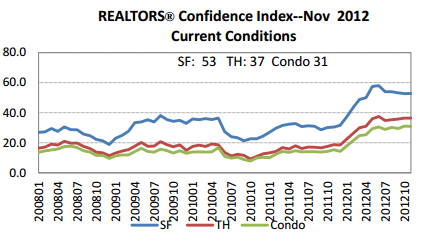

The RCI for single family homes held steady at 53 and those for townhouses andrncondominiums were both below 50. Anrnindex of 50 indicates moderate expectations. rnThe single-family index has risen from 30 one year ago while the otherrntwo were below 20. </p

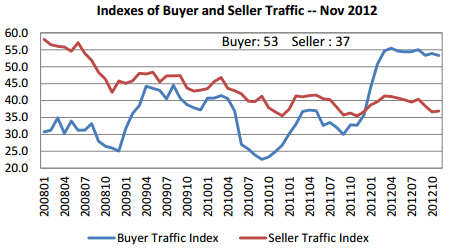

The buyer traffic index isrnat 53, while the seller traffic index is essentially unchanged at 37, down from a peakrnof 42 last year. Buyerrntraffic dipped slightly, reflecting in partrnthe seasonal slowdown and possibly a wait-and -see stance asrnbuyers andrnsellers awaitrnclearer directionrnwith regard to measuresrnto avert the fiscal cliff. </p

</p

</p

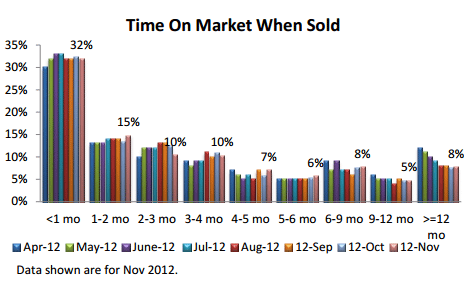

Inventory has been generally tightrnand agents report that sellers appear to be holding back waiting for higherrnprices or for better appraisal values. rnRespondents report numerous cases of multiple bids especially for bankrnowned real estate (REO) which go under contract in a little as seven to tenrndays The medianrndaysrnon the market for allrnproperties was 70 days in November compared to 98 days arnyear earlier.</p

MorernRealtors have above average expectations for business over the next sixrnmonths. The single family sales indexrnrose to 59 from 58 in October and 36 one year ago and the confidence level alsornimproved for townhouses and condos as well. Still, Realtors report that thernmarket remains hampered by a “demanding and rigid loan qualificationrnprocess.” This has led to cashrnbuyers and investors easing out first time buyers using mortgage financing. Policy uncertainties onrna variety of economic and taxrnissues as wellrnas tepid job growth continuernto dampen the market. Hurricane Sandy also causedrna temporaryrnmarketrnslowdown in the affected areas.</p

</p

</p

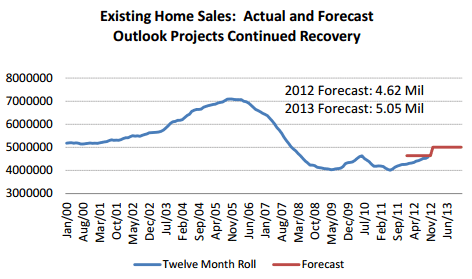

NAR’s latest economic projection is for continued increases in residential home salesrnalong with continued price improvement (althoughrnsales and price trends willrnvary fromrnmarket to market). Existing home salesrnare projected to expand to 4.6rnmillion in 2012 and to 5 million in 2013.</p

</p

</p

The median price for existing home sales</bis forecasted atrn$176,100 in 2012 and $185,200 in 2013. Shadow inventory is still high, but it is about 1rnmillion fewer homes than two years ago. rnDecreasesrnin sales inventory and a declinernin the distressed home sale of existing home salesrnare projected to lead to continued market improvement.</p

The incidence of multiple offersrnhas led to shorter marketing time and approximately a third of respondentsrnnoted that 57 percent of properties were sold within 3 months and many in lessrnthan a month. Only 20 percent of Realtorsrnreported selling houses that had been on the market for six months or morerncompared to 28 percent a year ago. Thernmedian marketing time in November was 70 days compared to 98 days in Novemberrn2011. Even the timeline on short salesrnwhile still protracted has dropped from a median of 119 days one year ago to 90rndays.</p

</p

</p

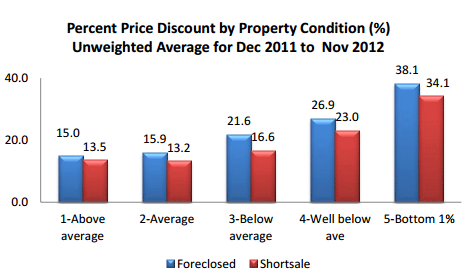

About 22 percent of respondentsrnreported they had sold a foreclosed or short sale property and that cash salesrnaccounted for about 46 percent of those sales compared to 41 percent inrnOctober. Distressed properties sold onrnaverage at a 20 percent discount and short sales at a 16 percent discount. Discounts were strongly affected by propertyrncondition. Those of above average conditionrnsold for a 13 to 15 percent discount while those in the poorest condition wererndiscounted 34 to 38 percent.</p

</p

</p

Approximately 30rnpercent of respondents who made a sale reportedrncashrnsales in November with mostrnreported to be investors and internationalrnbuyers. Approximately 9 percentrnof first-time homebuyers paidrncash,rncompared to 70 percentrnof investors who paid cash. A sale to a first-time buyer was reported byrn30 percent of Realtors, well below the 40 percent share historically enjoyed byrnnovice homebuyers. Respondents notedrnthat this reflects the difficulty in securing mortgage financing, delays withrnshort sales, and purchasesrnof lowerrnpriced propertiesrnbyrninvestors. </p

Second home sales accountedrnforrn12 percent of responses (relatively unchanged sincernAugust) and 1.6 percent of Realtors reported salesrnof U.S. residentialrnrealrnestate to foreignersrnnot residing in the U.S. (1.9% inrnOctober). Respondentsrnreported “lots of cashrninvestors from China and Canada”.</p

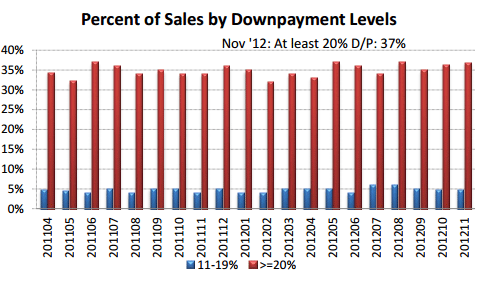

Approximately 37rnpercent of mortgage sales involved a downrnpaymentrnof 20 percent orrnmore (compared to 36 percentrnin October). Downrnpaymentsrnof 11-19 percent werernat 5 percent. The trendrnhasrnremained essentially unchanged since last year, in partrnreflecting creditrnconditions that have been generally reported asrn”tight”, “stringent”, and “difficult.”</p

</p

</p

One of the mostrnfrequent concerns expressed in the survey was “unreasonably tight creditrnconditions“, i.e. that some financialrninstitutions appear to lend only to individuals with the highestrnlevelsrnof credit scores.</p

NAR says there appearsrnto be an unnecessarily high level of riskrnaversion. Approximately 75 percent of Fannie Mae andrnFreddie Mac loans went to borrowers with credit scores over 740 in 2011rncompared to 40 percent in the 2001-2004 time period. EstimatesrnbyrnNAR economists have indicatedrnthat an additional 500,000 to 700,000 additionalrnsales could be made if creditrnconditions returned to normal which could generate an additional 250-350 thousand jobs on an annual basis across a wide spectrum of the economy, i.e., attorneys, painters, plumbers, landscapers, title companies, furniture manufacturers,rnetc.; jobs that could be generated at no cost and almost immediately.</p

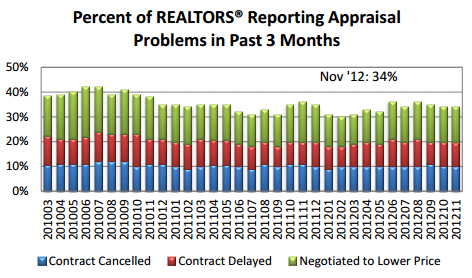

Realtors alsornnoted that appraisals continue to be a problem becausernvalues are not keeping pace with the appreciation in market values. Realtorsrncomplain that appraisers continue to use foreclosures as comps and they arernencountering out-of-area appraisers who do not know the local market. They alsornexpressedrnfrustration at the slow turn-around time andrnappraisal requirementsrnthatrnarernan unnecessary expense onrnthe buyer.</p

</p

</p

Thirty-four percentrnof Realtors reported a problem withrnan appraisalrnin the past 3 months (same asrnin September). rnApproximately 10rnpercent ofrnthe respondents reported that appraisal problemsrnled to contractrncancellation;rnabout 10 percent reported a delay asrna result of an appraisalrnproblem, andrnalmost 15 percent reportedrnthat the appraisal problems ledrnto lower prices.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment