Blog

RealtyTrac Counts More Markets with New Peak Home Prices

Data released this morning by RealtyTracrnindicate a more widespread recovery in home prices than has been evident fromrnother data sources. It is generallyrnaccepted that home prices peaked in the U.S. in 2006 and bottomed out in earlyrn2012. Despite strong price increasesrnsince the 2012 trough sources such as CoreLogic and Case-Shiller still pegrnnational home prices at well below that pre-recession peak. Case-Shiller said this week that its 10- andrn20-City Composites were about 20 percent below that peak in March, and BlackrnKnight Financial Services puts its national Home Price Index at -12.8 percent. </p

Black Knight reports that Texas and Coloradornhave established new peak levels and that Denver, Houston, Dallas, Austin, andrnSan Antonio have done so on nearly a monthly basis since last fall. CoreLogic says that Texas, Colorado, Wyoming,rnand North and South Dakota are at or above their pre-recession peak and putsrnanother 15 within 8 percent. Few of the CoreLogic states suffered significantrnprice declines during the recession.</p

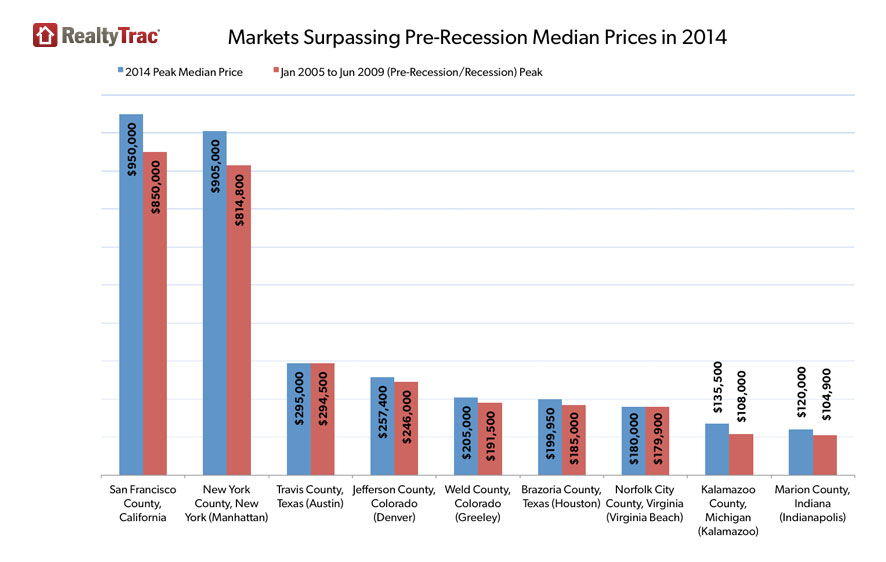

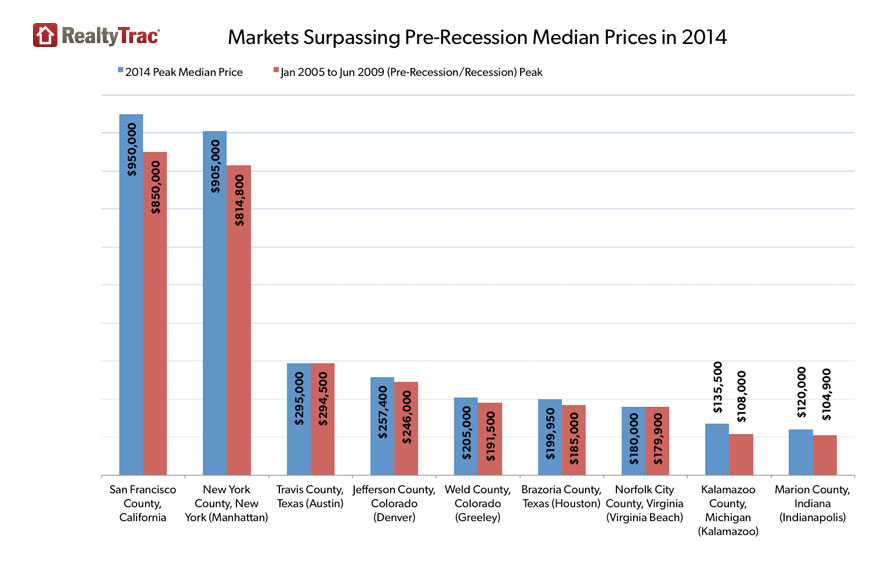

RealtyTracrnsays that new home price peaks were reached inrn28 counties in the last two years, 10 percent of the counties it tracks; seven inrnApril 2014. While several of these areasrnare among those mentioned in other reports – counties housing major Texasrncities and Denver, there were also new peaks in counties in Indiana, Virginia, Michigan, New York, andrnCalifornia. </p

RealtyTrac also says that since thernrecession ended in June 2009, median prices of residential property havernsurpassed pre-recession and recession levels (Jan 2005 through June 2009) in 53rncounties with populations of 200,000 or more. </p

</p

</p

RealtyTrac said that nationwide thernmedian sale price of residential properties, both distressed andrnnon-distressed, was $172,000 in April, up 4 percent from March and 11 percentrncompared to a year earlier and the largest year-over-year increase since medianrnprices hit their low point in March 2012. April marked the 25th</supconsecutive month where U.S. median prices increased on an annual basis.</p

Home sales fell slightly in April tornan estimated annual rate of 5.2 million, down 1 percent from March but 4rnpercent higher than in April 2013.</p

“April home sales numbers arernexhibiting the continued effects of low supply and still-strong demand that existrnin many markets across the country,” said Daren Blomquist, vice president atrnRealtyTrac. “Annualized sales volume nationwide decreased on a monthly basisrnfor the sixth consecutive month and the 4 percent annual increase in April wasrnthe lowest year-over-year increase so far this year. Meanwhile median homernprices nationwide increased to the highest level since December 2008.</p

“U.S. median home prices have nowrnincreased 21 percent since hitting bottom in March 2012, although they arernstill 28 percent below their pre-recession peak of $237,537 in August 2006,”rnBlomquist continued. “There are a surprising number of markets, however, wherernmedian home prices have surpassed their previous peaks since the GreatrnRecession ended in June 2009.”</p

</p

</p

Counties where the post-recessionrnmedian home price peak is furthest above the pre-recession/recession medianrnhome price peak included Denver County, Colorado (+16.6 percent), District ofrnColumbia (+14.5 percent), Arlington County, Virginia (+12.6 percent), SanrnFrancisco County (+11.8 percent), New York County (+11.1 percent), and OklahomarnCounty, Oklahoma.</p

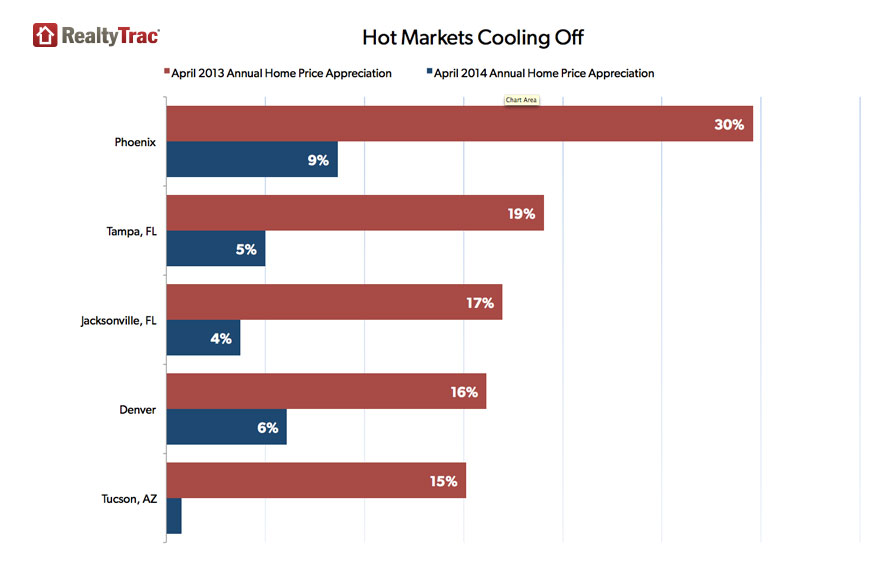

Some previously hot markets arernseeing declining sales. Thirteen states andrnthe District of Columbia and 28 or the 50 largest counties had lower annualizedrnsales volume in April than they did a year earlier. The states included California, Nevada,rnArizona, Florida, Maryland and Michigan and the metro areas with the biggestrndeclines were Fresno, Boston, Orlando, San Francisco, Los Angeles, and Phoenix.</p

Price appreciation is also showingrnsome signs of slowing, especially in previously fast appreciating markets suchrnas Phoenix where annual price appreciation slowed from 30 percent in April 2013rnto 9 percent last month. This was the lowestrnannual price appreciation for the city since March 2012. Similarly Denver’s appreciation slowed fromrn16 percent to 6 percent, Jacksonville, Florida’s from 17 percent to 4 percent,rnand Tampa’s from 19 percent to 5 percent. rn</p

</p

</p

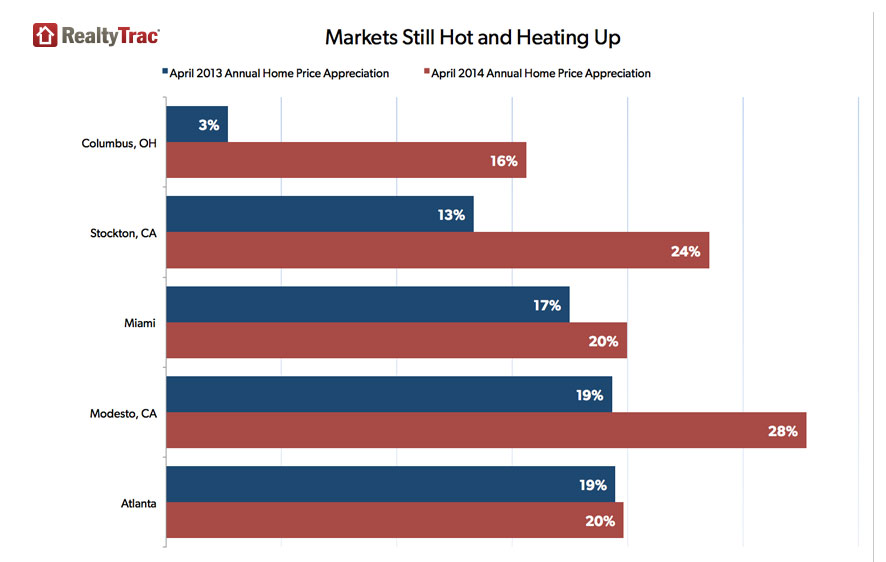

Although home price appreciationrnshowed signs of cooling in several coastal California markets including as LosrnAngeles, San Diego and San Francisco, inland California markets posted three ofrnthe top five annual increases in median prices in April among metropolitanrnareas with a population of 500,000 or more. rnTopping the list was Modesto, Calif., with a 28 percent annual increasernin median prices, followed by Stockton, up 24 percent, Riverside-SanrnBernardino-Ontario and Sacramento, each up 20 percent. </p

</p

</p

Short sales and distressed sales -rnin foreclosure or bank-owned – accounted for 15.6 percent of all sales inrnApril, down from 16.5 percent of all sales in March, and down from 17.2 percentrnof all sales in April 2013. Short salesrnaccounted for 5.2 percent of sales and REO properties for 9.2 percent, downrnfrom 5.5 percent and 10.0 percent of respective sales in March.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment