Blog

RealtyTrac: Housing Market Worse Off than Four Years Ago

RealtyTrac, the Irvine Californiarncompany that tracks foreclosure filings, just issued a pre-election “exclusivernreport on the health of local housing markets compared to four years ago,” whichrnconcludes that 65 percent of local housing markets nationwide “are worse offrnthan four years ago.” The report drawsrncomparisons between conditions in the period of January to September 2008 andrnsame period in 2012. The company lookedrnat five metrics in compiling its report, unemployment rates, average homernprices, foreclosure inventory, foreclosure starts, and the share of distressedrnsales in 919 counties. The countiesrncounted in the report were those that had data supporting all five metrics.</p

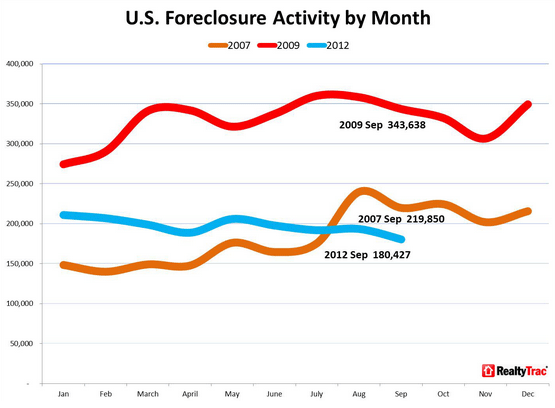

The study is interesting in that, byrnpicking a point in time when the economy was just beginning a rapid downwardrnspiral, the final conclusion of the report flies in the face of the most recentrn(September 2012) U.S. Foreclosure Report also issued by RealtyTrac which showsrnforeclosure activity at the lowest level it has been since July 2007.</p

</p

</p

RealtyTrac says it data shows thatrnhome prices are lower than they were four years ago in the majority of countiesrnnationwide.</p

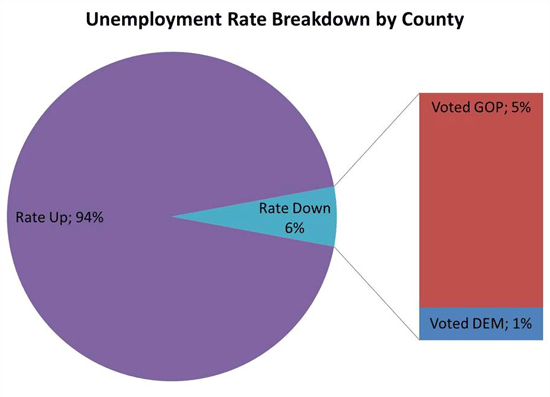

Unemployment rates are up in morernthat 90 percent of the counties for which data were available.</p

</p

</p

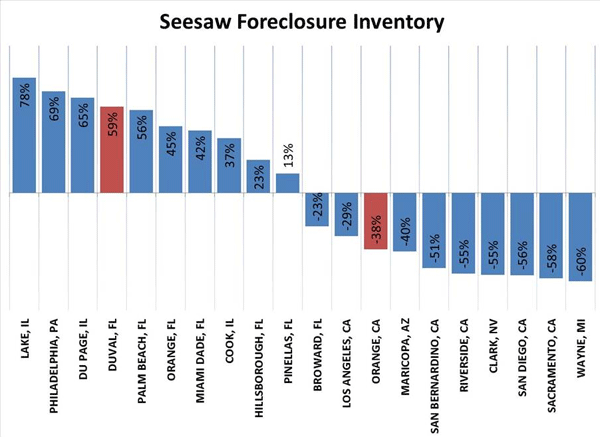

Slightly more than half of allrncounties reported a lower foreclosure inventory and fewer foreclosure startsrnthan four years ago.</p

</p

</p

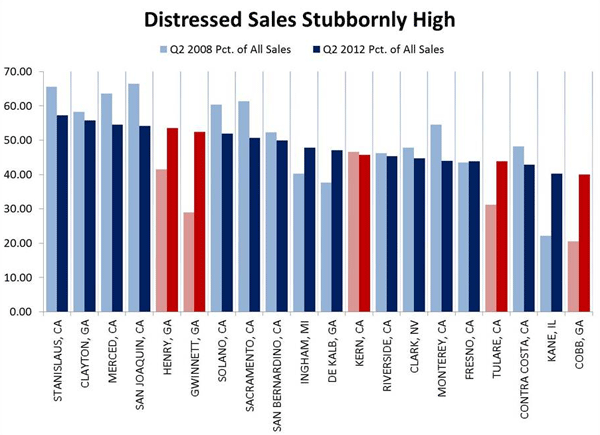

Distressed sales, that is sales ofrnbank-owned real estate or short sales of properties in some stage ofrnforeclosure represented a smaller share of home sales than four years ago inrnabout half of the counties but had at least a 10 percent share of all sales inrnthe majority of counties. Distressedrnsales account for one-quarter of all sales in about 20 percent of counties.</p

</p

</p

“The U.S. housing market has shownrnstrong signs of life in recent months, but many local markets continue tornstruggle with high levels of negative equity as the result of home prices thatrnare well off their peaks. In addition, persistently high unemployment rates arernhobbling a robust real estate recovery in most areas,” said Daren Blomquist,rnvice president at RealtyTrac. “While the worst of the foreclosure problem is inrnthe rear view mirror for a narrow majority of counties, others are stillrnworking through rising levels of foreclosure activity, inventory and distressedrnsales as they continue to clear the wreckage left behind by a bursting housingrnbubble.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment