Blog

RealtyTrac: Most Metro Areas Past Worst of Foreclosure Crisis

Sixty-two percent of major metropolitanrnareas saw an improvement in foreclosure activity during the third quarter ofrn2012 with 141 of the nation’s 212 MSAs posting lower foreclosures rates thanrnthey did during the third quarter of 2011. rnAccording to RealtyTrac 134 or 63 percent of the MSAs showed decreasedrnactivity compared to the second quarter of 2012. The Irvine California firm reports on MSAsrnwith populations over 200,000. </p

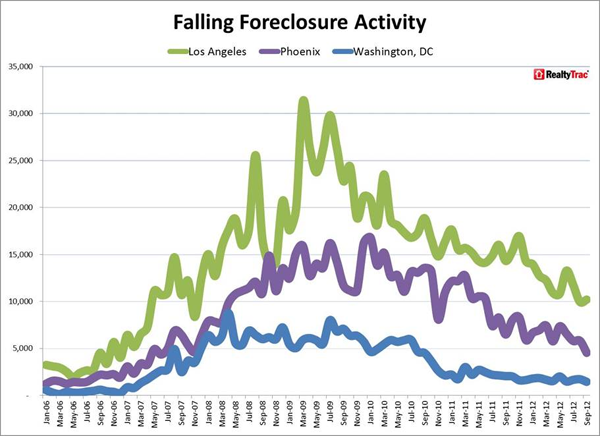

Three of the five MSAs showing thernlargest decreases were in California with San Francisco leading the list at -36rnpercent. Detroit (-31 percent), LosrnAngeles (-29 percent), Phoenix (-27 percent) and San Diego (-26 percent) werernthe other cities with large declines. </p

</p

</p

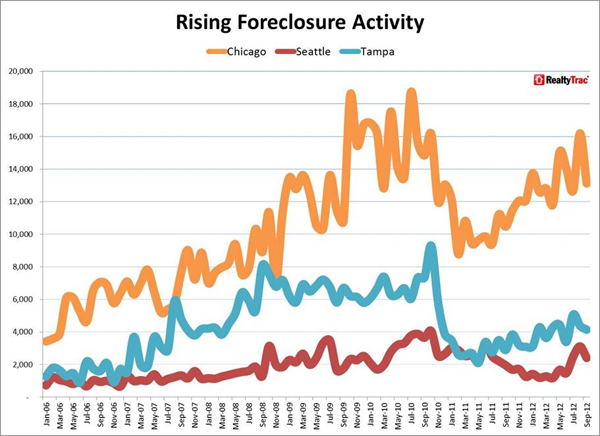

The largest increases in the annualrnrate of foreclosures were in New York (+69 percent), Tampa (43 percent),rnPhiladelphia (34 percent), Chicago (34 percent), and Seattle (20 percent).</p

“Two-thirds of the nation’s largestrnmetros posted decreases in foreclosure activity in the third quarter,rnindicating that most of the nation’s housing markets are past the worst of thernforeclosure problem” said Daren Blomquist, vice president at RealtyTrac. “Inrnfact foreclosure activity in September 2012 was below September 2007 levels inrn58 percent of the metro markets we track.</p

“Still, rebounding foreclosurernactivity in some markets remains a threat to home price stability and growth inrnthose markets,” Blomquist continued. “The rebounding foreclosure activity tendsrnto be in markets where the foreclosure process slowed down most dramatically inrnthe last two years, resulting in a buildup of foreclosures in limbo thatrnlenders are finally working through this year.</p

Despite the improvement in its threernlargest cities California still has pockets of distress. The seven highest rate of foreclosure filingsrnin the country were in the state with Stockton at the top of the list. Stockton’s foreclosure filing decreased 21rnpercent on an annual basis but one of every 67 houses in the MSA received arnforeclosure filing during the quarter, nearly three times the nationalrnaverage. Stockton was followed byrnRiverside-San Bernardino (1 in 73 units), Vallejo-Fairfield (1 in 78), Modestorn(1 in 79), Merced (1 in 83), Bakersfield (1 in 87) and Sacramento (1 in 96). Rockford Illinois and Chicago each hadrnfilings on one of every 98 housing units and Miami, number 10, had a rate of 1rnper 100. Foreclosure activity rates inrnall seven of the California MSAs were down from a year earlier while rates inrnMiami and the two Illinois MSAs increased. </p

</p

</p

The top 20 MSAs in terms ofrnforeclosure rates included six other Florida cities and additional MSAs inrnCalifornia. The only cities in the toprn20 outside of California or Florida were Atlanta and Phoenix at numbers 15 andrn16 respectively.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment