Blog

RealtyTrac Rates Best Places to Buy Foreclosures in 2012 as Activity Climbs 57%

RealtyTrac, the Irvine, California firm that tracksrnforeclosure activity nationwide, reports that foreclosure activity increasedrnlast year in 57 percent of large metropolitan areas. Foreclosure filing increased in 120 of thern212 cities with populations over 200,000 that the firm follows and in eight ofrnthe 20 largest ones.</p

RealtyTrac measures activity through court filings ofrnNotices of Default or Lis Penis, notices of sale or scheduled auctions, andrnbank repossessions or actual foreclosure sales. The company reports that,rndespite the increases in 2012, activity in 181 of the 212 cities was below thatrnof 2010 when filing peaked in most markets. </p

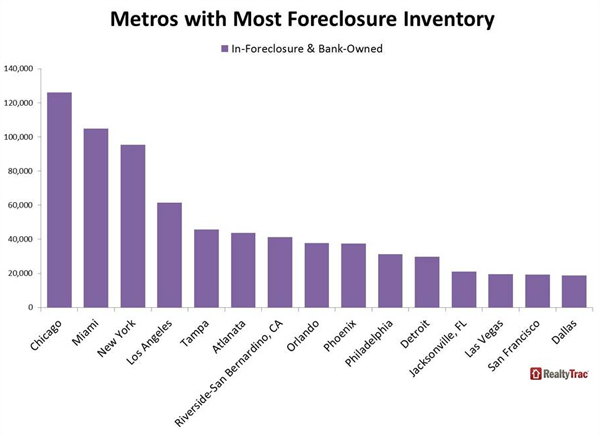

Top among the eight largest metros in whichrnforeclosure activity increased in 2012 were Tampa (80 percent increase), Miamirn(36 percent), Baltimore (34 percent), Chicago (30 percent), and New York (28rnpercent). Among the 12 that decreasedrnfrom 2011 to 2012 were Phoenixrn(-37 percent), San Francisco (-30 percent), Detroit (-26 percent), Los Angelesrn(down 24 percent), and San Diego (down 24 percent).</p

</p

</p

“Marketsrnwith increasing foreclosure activity in 2012 took the first step in finallyrnpurging delayed distress left over from the bursting housing bubble,” saidrnDaren Blomquist, vice president at RealtyTrac. “Meanwhile, the underlyingrnfundamentals in many of those markets are slowly improving, making it anrnopportune time to absorb additional foreclosure inventory this year – and thatrnis particularly good news for buyers and investors hungry for more inventory tornpurchase in those markets.” </p

Whilernstatewide activity dropped by double digits in California four of its citiesrnled the nation in the rate of foreclosure activity. At the stop was Stockton, California wherernforeclosure filings affected one in 25 housing units or 3.98 percent. This was nearly three times the nationalrnaverage. The Riverside-San Bernardino-Ontariornarea was second at 3.86 percent, followed by Modesto (3.82 percent), andrnVallejo-Fairfield (3.73 percent). rn Three other California cities were among the top 20 but all sevenrnposted improvements compared to 2011.</p

Floridarncities accounted for eight of the 20 highest metro foreclosure rates and threernof the top ten, led by Miami at No. 5 with 3.71 percent of housing units with arnforeclosure filing during the year and Palm Bay-Melbourne-Titusville at No. 6rn(3.60 percent). Foreclosure activityrnincreased from 2011 in all but one of the eight most distressed Floridarncities </p

Otherrncities with foreclosure rates among the nation’s 10 highest were Atlanta at No.rn7 (3.51 percent of housing units with a foreclosure filing), Orlando at No. 8rn(3.46 percent), Chicago at No. 9 (3.31 percent), and Rockford, Illinois at No.rn10 (3.28 percent). </p

</p

</p

RealtyTrac scored the largest cities (populationsrnover 500,000) by their inventory of foreclosed properties, the percentage ofrnforeclosure sales, foreclosure discount, and percentage increase in foreclosurernactivity in 2012 and rated the Palm Bay-Melbourne-Titusville metro areas inrnFlorida as the best place to buy foreclosures in 2012, Five otherrnFlorida cities ranked among the Top 20 best places to buy foreclosures:rnLakeland, Tampa, Jacksonville, Orlando, and Miami.</p

FivernNew York cities ranked among the 20 best places to buy foreclosures in 2013,rnbased largely on big backlogs of foreclosure inventory and big increases inrnforeclosure activity in 2012: Rochester, Albany, New York, Poughkeepsie, andrnSyracuse.</p

Otherrncities in the Top 20 were Chicago, El Paso, Philadelphia; Allentown,rnPennsylvania; Youngstown, Ohio; Bridgeport, Connecticut; Cleveland, New Haven,rnConnecticut, and Indianapolis.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment