Blog

Record Drop in Foreclosure Starts, but 90 Day Delinquencies Increase -MBA

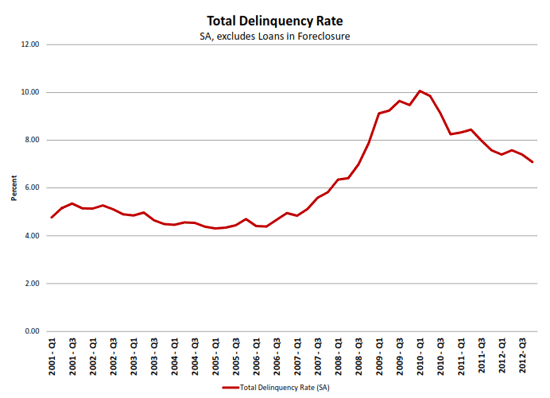

Mortgage delinquency rates fell in the fourth quarter of 2012 to theirrnlowest rates since 2008. According torndata from the National Delinquency Survey (NDS) released by the Mortgage BankersrnAssociation (MBA), delinquencies in one-to-four unit residential propertiesrnfell to a seasonally adjusted rate of 7.9 percent of all outstandingrnloans. This was a decrease of 31 bpsrn(bp) from the third quarter and 49 bps from the fourth quarter of 2011.</p

</p

</p

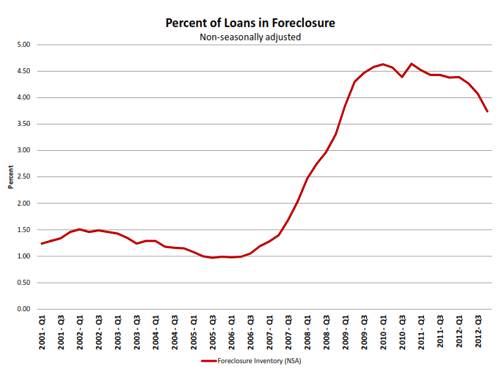

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. Foreclosure starts were at the lowest levelrnsince the second quarter of 2007, down 20 bps from Q3 to a rate of 0.70 percentrnand 29 bps lower than in the fourth quarter of 2011. The percentage of loans some stage of foreclosure at the end of the fourth quarter was 3.74 percent, down 33 bps from the third quarter, 64 bps lower than one year ago, andrnthe lowest level since the fourth quarter of 2008.</p

Mike Fratantoni,rnMBA’s Vice President for Research and Economics said at a press conferencernaccompanying release of the data that delinquency rates typically increase between the third and fourth quarters,rnpossibly due to increasing heating costs and holiday expenses, but thernnon-seasonally adjusted rate dropped 13 bps to 7.51 percent between the thirdrnand fourth quarters of 2012. Most of thernimproved delinquency numbers, he said, were driven by a drop in the 30+ dayrnrate which decreased 21 bps on an unadjusted basis. This rate, he said, is usually driven byrnimproved employment. The 30+ rate is atrnits lowest level since mid-2007.</p

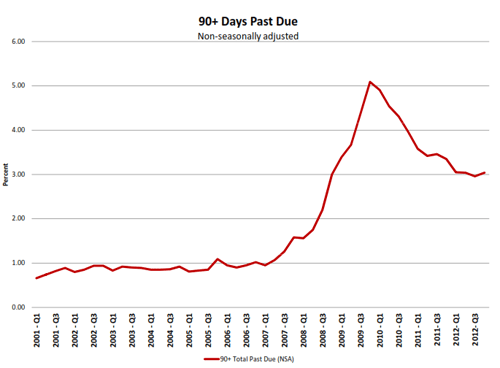

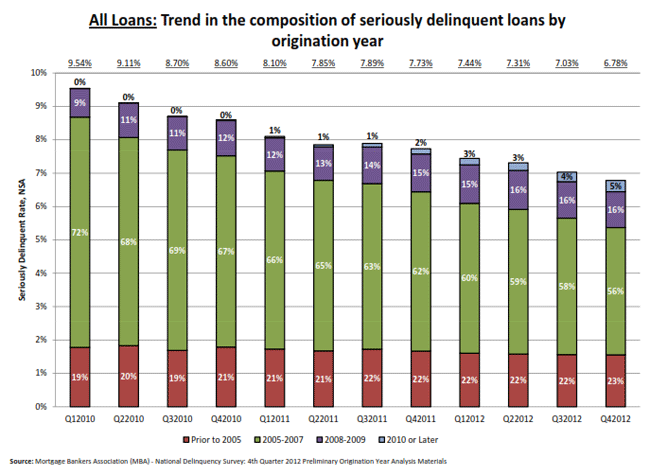

The rate ofrnloans that were seriously delinquent, i.e. 90 or more days past due or inrnforeclosure, was 6.78 percent, 25 bps lower than the previous quarter and downrn95 bps from a year earlier.</p

</p

</p

</p

</p

The overallrnpercentage of distressed loans, one payment or more past due or in foreclosurernwas down 46 bps quarter-over-quarter to 11.25 percent. This was 128 bps lower than in the fourthrnquarter of 2011.</p

Jay Brinkmann, MBA’s Chief Economist and Senior Vice President of Research said, “With fewer new delinquencies, the foreclosure start rate and foreclosure inventory rates continue to fall and are at theirrnlowest levels since 2007 and 2008 respectively. </p

“The foreclosure starts rate decreased by the largest amount ever in the MBA survey and now stands atrnhalf of its peak in 2009. Similarly, the 33 bp drop in the foreclosure inventory rate is also the largest in the history of thernsurvey. One cautionary note is that the 90+ delinquency rate increased by 8 bps, reversing a fairly steady pattern of decline and the largest increase in this rate in three years. While we normally see an increase in this rate in individual states when they change theirrnforeclosure laws, 38 states had increases in the percentage of loans three payments or more past due,rnindicating that we could see a modest increase in foreclosure starts in subsequent quarters.</p

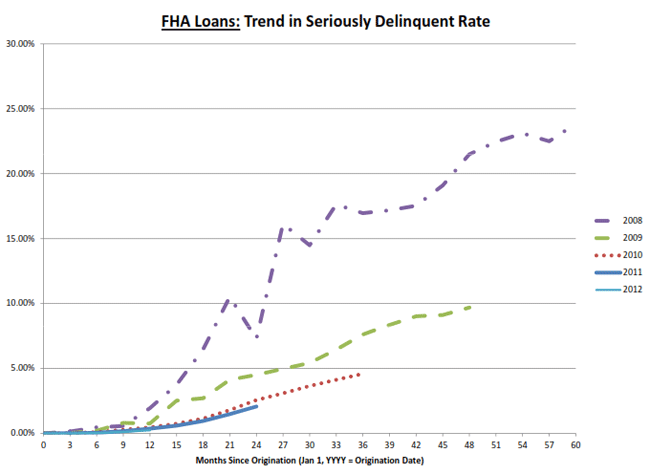

Brinkmann said the performance of FHA loans is mixed; foreclosure starts and inventory are down while the delinquency percentages generally remained flat or increased slightly,rnparticularly the percentage of loans 90 days or more past due. However, 44 percent of the FHA loans thatrnarernseriously delinquent were made in the years 2008 and 2009, while loans made in those yearsrnrepresent a smaller share of FHA’s overall book of business. He said that those currently evaluatingrnFHA’s performance could not accurately do so without looking at the data onrnthese recent loans.</p

</p

</p

Finally, Brinkmann said, Superstorm Sandy had an impact on the delinquency and foreclosure rates in New York, New Jersey and Connecticut which saw increases in total past due rates, while most other states in the nation saw a drop overall. Servicers were told to report loans asrndelinquent if payments were not being made as agreed in the original mortgagerneven if they were in storm-related forbearance. rn”We expect to see improvements in these states as we move into 2013,” he said.</p

The national foreclosure inventory is being impacted by the 12 percentrnrate in Florida and by the elevated rates in judicial states which average 6.2 percent, triple the 2.1 percent average rate for nonjudicial states. rnThe effect of the judicial process can be seen by looking at the two chartsrnbelow which demonstrate the rates of foreclosure starts in judicial andrnnon-judicial states versus their inventories. rn</p

Both economists said that thernreturn to normalcy would be “lumpy.” Thern30-day rate is well on its way to that status and will be a leading indicatorrnfor other measures but it may take a very long time for foreclosure inventoriesrnto be processed out in some states. rnBrinkmann pointed out that there is always the problem that improvingrnemployment may occur in a different location than where the houses are.</p

Fratantoni said the overallrnmovement of delinquencies and foreclosures is in the right direction but stillrnelevated by historic standards. Whilernthere is no way to know when normal levels will return it is possible we arernheaded for a new definition of normal. Hernpointed to how the decreasing delinquency and foreclosure rates match the decline in mortgages originated in the 2005-2007rnperiod. Improved credit standards,rnhe said, could mean that, once normal does return it will be at lower thanrnhistoric levels. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment