Blog

Refinance Loan Applications Rebound 21% After Holiday Season

The Mortgage Bankers Association today released the Weekly Survey on Mortgage Application Activity for the week ending January 8, 2010.

ThernMBA survey covers over 50 percent of all US residential mortgage loanrnapplications taken by mortgage bankers, commercial banks, and thrifts. rnThe data gives economists a look into consumer demand for mortgagernloans. A rising trend of mortgage applications indicates an increasernin home buying interest, a positive for the housing industry andrneconomy as a whole. Furthermore, in a low mortgage rate environment,rnsuch a trend implies consumers are seeking out lower monthly paymentsrnwhich can result in increased disposable income and therefore morernmoney to spend on discretionary items or to pay down other debt.

In the week ending January 1, 2010, mortgage applications rose byrn0.5 percent thanks to a 3.6 percent increase in purchase loan apps, thernrefinance index fell by 1.6 percent. The refinance share of mortgagernactivity was 68.2 percent, a decrease from 69.6 percent in the previousrnweek. The average contract interest rate for 30-year fixed-raternmortgages increased to 5.18 percent with points decreasing to 1.28. Thernaverage contract interest rate for 15-year fixed-rate mortgagesrnincreased to 4.62 percent, with points increasing to 0.98.

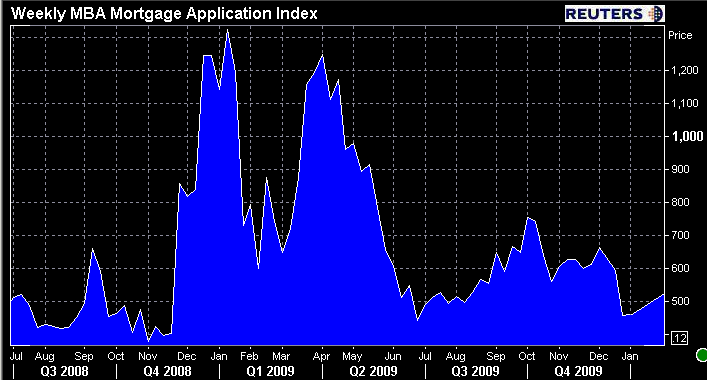

In today's release which reports on the week ending January 8, 2010,rnmortgage applications increased 14.3 percent on a seasonally adjustedrnbasis. On an unadjusted basis, the Index increased 66.0 percentrncompared with the previous week, which was a shortened week due to thernNew Year's holiday. The four week moving average for the seasonallyrnadjusted Market Index is down 6.4 percent.

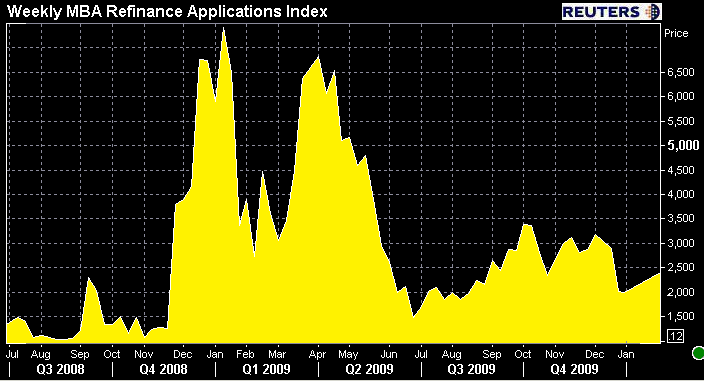

The Refinance Index increased 21.8 percent from last week's holidayrnadjusted index and increased 73.9 percent from last week's unadjustedrnindex. The four week moving average is down 8.0 percent for thernRefinance Index. The refinance share of mortgage activity increased torn71.5 percent of total applications from 68.2 percent the previous week.

The seasonally adjusted Purchase Index increased 0.8 percent fromrnone week earlier. The unadjusted Purchase Index increased 48.8 percentrncompared with the previous week and was 24.9 percent lower than thernsame week one year ago. The four week moving average is down 3.2rnpercent for the seasonally adjusted Purchase Index. Last week thernpurchase apps index hit a 12 year low….

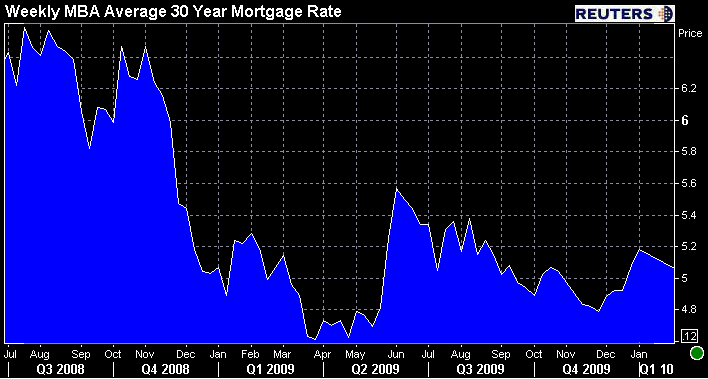

Thernaverage contract interest rate for 30-year fixed-rate mortgagesrndecreased to 5.13 percent from 5.18 percent, with points decreasing torn1.17 from 1.28 (including the origination fee) for 80 percentrnloan-to-value (LTV) ratio loans.

The average contract interestrnrate for 15-year fixed-rate mortgages decreased to 4.45 percent fromrn4.62 percent, with points increasing to 1.04 from 0.98 (including thernorigination fee) for 80 percent LTV loans.

The averagerncontract interest rate for one-year ARMs increased to 6.83 percent fromrn6.42 percent, with points decreasing to 0.31 from 0.50 (including thernorigination fee) for 80 percent LTV loans.

If you missed the mortgage apps storylast week, I called attention to a changing supply and demand dynamicrnin the primary mortgage market. I think I should share that observationrnagain…

Fence sitters and ARM adjusters are not expected to be a majorrnsource of business in 2010 as anyone who was qualified to refinancernlikely already did so in 2009 when rates were at all time lows. Thisrnwould imply total loan production will continue to decline in 2010,rnsomething we have already pointed out. More importantly it meansrnoriginators will be fighting it out for purchase applications when thernspring buying season picks up.

LOAN ORIGINATORS: if you haven't already put together a marketing campaign for a purchase driven lending environment….you are way behind.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment