Blog

Refinance Volume Expected To Fall 26% in 2013: Fannie Mae

Fannie Mae has declared that housing is finally providingrna tailwind to economic growth. Therncompany’s December Economic and Strategic Report says that the marketrn”has turned the corner and a sustained recovery is under way.” It contributed, albeit in a small way, torneconomic growth in past few quarters and will be counted as a contributor on anrnannual basis for the first time since 2005.</p

“Withrndata pointing to soft economic conditions and the fiscal policy debate hangingrnin the balance, we expect growth in the current quarter to moderate from thernpace seen last quarter,” said Fannie Mae Chief Economist Doug Duncan.rn”On the bright side, the housing market has stayed resilient and continuesrnto show signs of a strong, sustained recovery.”</p

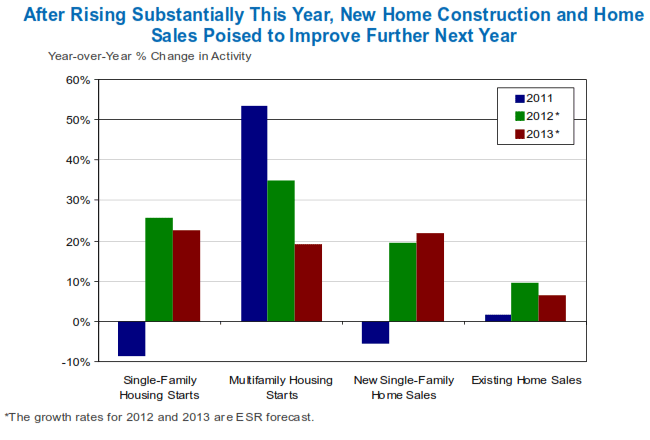

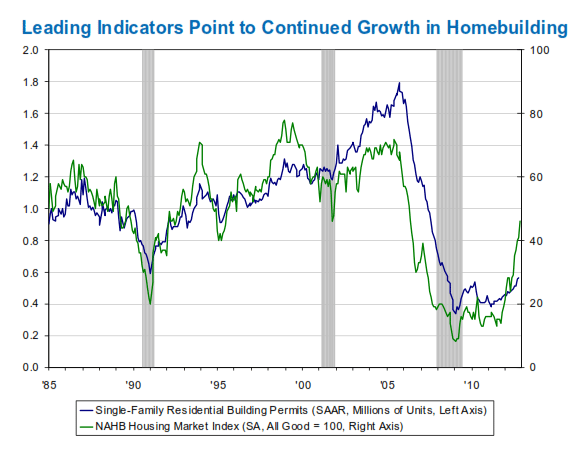

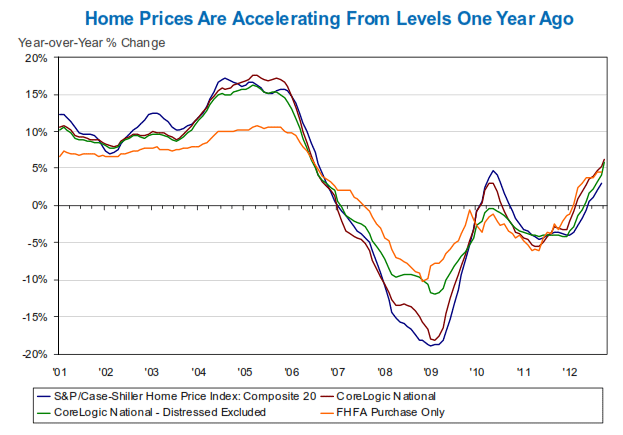

Home prices have seen traditional seasonal declines inrnthe last few months but year-over-year increases are growing. While new home sales were flat in October,rnthe 4.8 month inventory of homes which was well below the traditional averagernof 6 months and a pick-up in household formation create opportunities for newrnconstruction especially in the single-family sector. Housing starts rose in October to the highestrnlevel since July 2008 but that was largely on the strength of multi-familyrnconstruction while single family starts were essentially flat. Single family permits did continue to trendrnup.</p

</p

</p

Existing home sales rose in October for the third time in four months, while the inventory ticked down to 5.4 months -the lowest reading since February 2006. Contract signings for home sales and purchasernmortgage applications, both leading indicators of home sales, are up. Existing home sales took a sharp jump in Octoberrnto the highest level since early 2010.</p

</p

</p

Fannie Mae’srneconomists said that, “Overall, housing construction activity and home sales are onrnpace to grow substantially over lastrnyear’s levels, and we expect further improvement inrn2013.”</p

The shadowrninventory, as measured by the serious delinquency rate, is also declining. Fannie Mae expects the current trend to continue, thanksrnin part to increased modification efforts and short sales; newrndelinquencies have been declining with the new foreclosure rate downrnin the third quarter tornthernlowest level since the end ofrn2007.</p

Low mortgage rates will continue to aid the housing and mortgagernmarkets in the New Year as the Federal Reserve continues to purchase $40rnbillion in Agency mortgage-backed securities each month through the end ofrn2013. Operation Twist, where the Fed replacesrnshorter term securities with those of longer duration, is scheduled to expirernat the end of December but Fannie Mae expects the Fed to continue with arnsimilar-sized endeavor to directly purchasing long-term Treasuries. Fannie Mae expects that the 10-year Treasuryrnyield will rise about two basis points by the end of next year and 30-yearrnfixed rate mortgages to gradually move up to 3.5 percent.</p

The economists said, “Given our expectations of continued improvement in housing starts, home sales, and home prices in 2013,rnwe project that purchase mortgagernoriginations will rise to $595 billion from a forecast of $518 billionrnin 2012. However,rnrefinance originations shouldrndecline to $956 billion from a projected $1.3 trillion in 2012, resulting in a refinance share of 62rnpercent – a drop of 10 percentage points from thernprojected share in 2012. The Federal ReservernBoard’s Flow of Fundsrnshowed continuedrndeleveraging in total single-familyrnmortgage debtrnoutstanding, which fell at a 3.4 percentrnannualized raternin the third quarter of thisrnyear. We expect thatrnmortgage debt outstanding will decline an additional 1.0 percentrnin 2013, following arnprojected 2.4 percent decline inrn2012.”</p

While things arerndefinitely improving, the housing market will continue to face challenges, thernreport said, counting tight lending conditions among those hurdles and quotingrnFed Chairman Ben Bernanke’s recent statement that the lending standardsrnpendulum has “swung too far the other way, preventing creditworthy borrowers from purchasing a home and thereby impeding the economicrnrecovery.” rnThere are also significant uncertainties in the mortgage originationrnbusiness including Qualified Mortgage, Qualified Residential Mortgage and BaselrnIII rules. The Fiscal Cliff debate couldrnchange the mortgage interest rate deduction and other housing incentives andrnthe law exempting forgiven mortgage debt from taxation is due to expire.</p

Housing is also partially responsiblernfor the strengthening balance sheets of individual households. The FederalrnReserve Board’srnrecent Flow of Funds showed that,rnfollowing a modest decline in the secondrnquarter of this year,rnhouseholds’ netrnworth – assets minus liabilities – rosern$1.7 trillion in the third quarter, boosted by gainsrnfrom both the stock market and real estate values amidrndeclining household debt.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment