Blog

Rental Market is Clear Winner in Recession Aftermath

The financial crisis was obviously better for the rental housing market thanrnit was for the purchase market but the health of the former appears to berncontinuing well into the recovery. FrankrnNothaft, who is now chief economist for CoreLogic after years in that positionrnwith Freddie Mac, calls the outcome of the recession, “A vibrant rental market.“rn</p

Writing in CoreLogic’s Insights</iblog, Nothaft says apartment vacancy rates are at their lowest levels since thern1980s, multifamily rental construction is the healthiest in more than 25 years,rnrents are up, and the property values of apartment buildings are at or aboverntheir prior peaks.</p

But he points out that traditional high-rise apartment buildings are not thernentire picture; in fact they provide only 42 percent of the rental market. Two-to-four unit buildings provide 18 percentrnbut the foreclosure crisis created both a supply of and demand forrnsingle-family rentals. Investors swarmedrnto buy distressed properties and turn them into rentals – some 3 million singlernfamily detached homes, many once owner occupied, became rentals between 2006rnand 2013, an increase of 32 percent. Singlernfamily homes now comprise 40 percent of the rental stock. Many of these homes are now occupied byrnhouseholds who exited homeownership as a result of foreclosures, short sales,rnand bankruptcies. </p

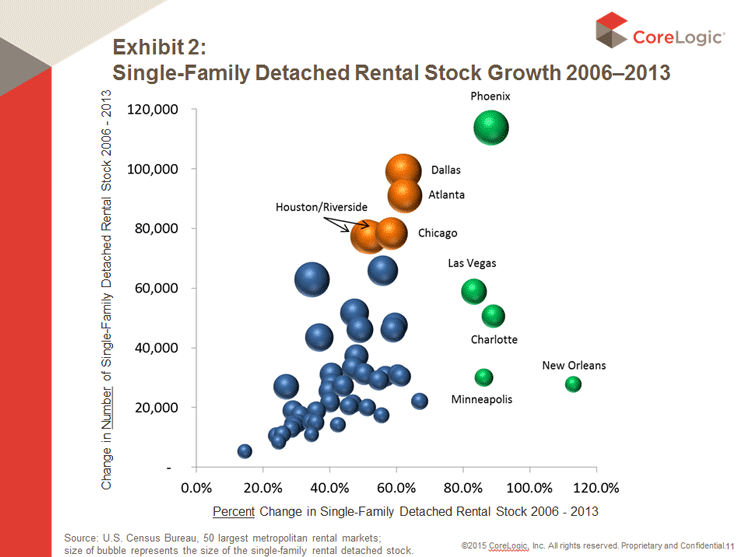

The increase in single family rentals is most dramatic in those metropolitanrnareas hardest hit by the housing crisis. rnPhoenix and Las Vegas saw single family rental units nearly doublernbetween 2006 and 2013. Other larger citiesrnsaw smaller percentage increases but still had huge numbers of these rentalsrnadded. Nothaft cites Dallas and Atlanta,rneach of which added 100,000 units.</p

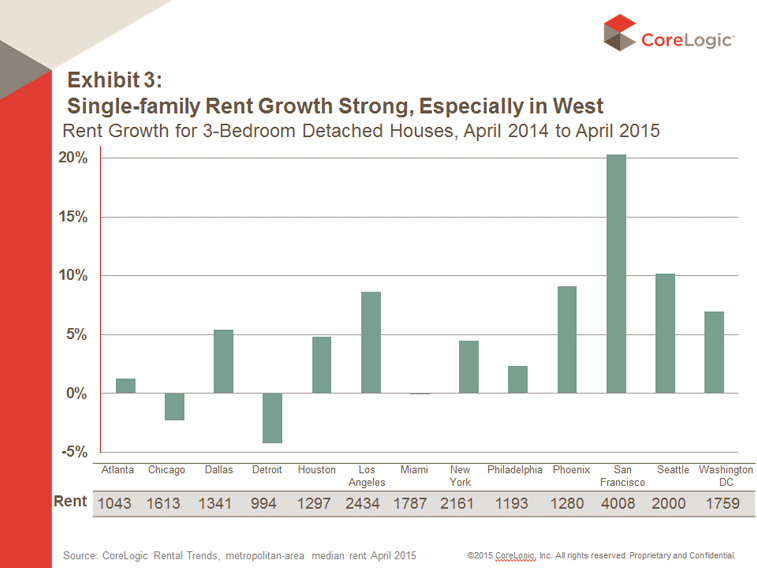

Strong demand for rental houses, not only from displaced homeowners but fromrnmillennials who have finally begun to form households, has also translated into rent increases,rnespecially in markets with strong employment growth and that have attractedrnyounger households. Single family rentsrnhave increased by more than 10 percent in some West Coast cities over the pastrnyear, making cities like San Francisco and Seattle even less affordable. Nationally a three-bedroom home has seen a 4rnpercent rise in rent – well above overall inflation. Rents, of course, are stagnant or haverndeclined in some areas such as long-suffering Detroit where the median rent forrna three-bedroom home is down 4 percent over the past year.</p

Nothaft sees this robust pattern for rentals continuing for a while. Millennials are expected to rent their firstrnhomes as they increasingly form households which may initially affect primarilyrnapartment rentals but as millennials also begin to form families it could shorernup continued demand for single-family rental homes as well.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment