Blog

Renters Largely Satisfied to Remain that way

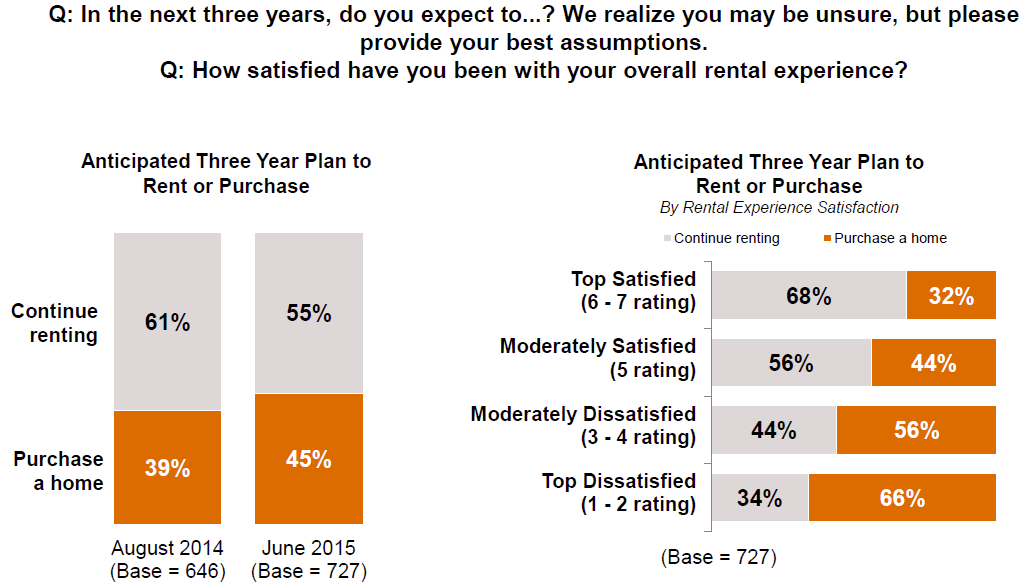

It appears that people who are currently renting their homes are not necessarilyrnmerely homebuyers in waiting as conventional wisdom has held. Freddie Mac said its recent research showsrnthat 55 percent of renters have no plans to buy in the next three years. Renters are overall fairly satisfied withrntheir rental experience the company says, and it is those who are dissatisfiedrnwho are most likely to be being driven toward wanting to buy. In the U.S. about 15 million households rentrna single-family house and 25 million rent an apartment, according to U.S.rnCensus Data.</p

In the third of an anticipated series of quarterly surveysrnFreddie Mac commissioned Harris Poll to question more than 2,000 U.S. adultsrnonline about their perceptions regarding renting. The most recent survey was conductedrnbetween June 19-23, 2015 and included 2,024 adults, 727 of whom werernrenters. Similar surveys were conductedrnin August 2014 and last March. </p

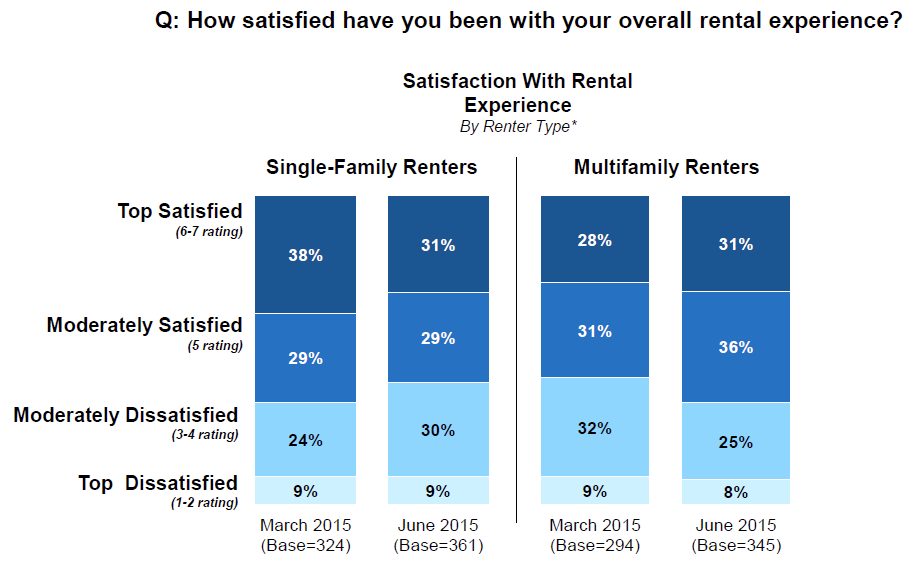

Less than one-third of those surveyed said they wererndissatisfied with their rental experience with the remainder almost evenlyrndivided between those who said they were very satisfied and those who expressedrnmoderate satisfaction. Howeverrnsatisfaction was more prevalent among apartment dwellers than those rentingrnsingle family homes. Sixty-seven percentrnof the former expressed a degree of satisfaction compared to 60 percent ofrnsingle family renters.</p

</p

</p

This satisfaction may be a factor in deciding to buy. Renters who are most satisfied with theirrnrental experience are more likely to continue renting (68 percent) than tornpurchase a home (32 percent). The degreernof satisfaction and dissatisfaction exactly mirrors the desire to remain arnrenter or buy.</p

</p

</p

“As we gather data each quarter, we are finding the old perception thatrnrenting is something people do until they buy is not always true. The trendrnshows that satisfied renters are more likely to continue renting, even as wernare seeing rising rents in the market,” said David Brickman, executivernvice president of Freddie Mac Multifamily. “Dissatisfaction may drivernrenters to buy, and we are seeing a slight decrease in satisfaction amongrnsingle-family renters. We will continue to monitor this for stronger indicatorsrnand trends, but for now, the single-family rental home market may be a goodrnplace to look to find potential home buyers.”</p

Rent increases also appear to be a motivation for buying a home. Forty-four percent of renters who have livedrnin their home for two years or more say they have had their rent increase inrnthe last two years, two percentage points more than in the March survey. Of those who experienced a rent increase, 70rnpercent agreed that they would like to buy a home but cannot afford to do so atrnthis point while 44 percent indicate they’d like to buy a home and have startedrnlooking. Forty-nine percent say they like where they live and will stayrnregardless of rent increases, a slight increase in this response from March. </p

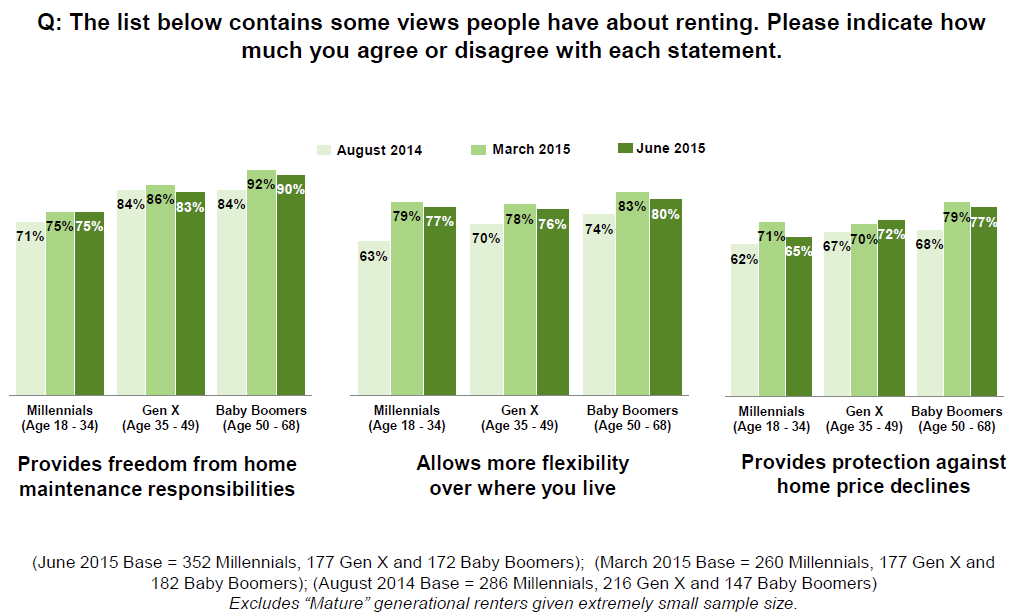

Renters cite as the top favorable factors for renting the freedom from homernmaintenance, more flexibility over where you live and protection againstrndeclines in home prices. These choices changed little among the three surveysrnand are similar across age groups.</p

</p

</p

Despite rent increases 55 percent of renters say they are not changing theirrncurrent spending plans and 49 percent plan on staying put in their currentrnhousing. Of those who are making rent increase-driven changes, 51 percent arernspending less on essentials, 29 percent are contemplating getting a roommate andrn20 percent say they need to move into a smaller rental property. </p

Brickman added, “The number of U.S. renter households is up again forrnthe tenth straight year, according to the U.S. Census Bureau. More householdsrnof all sizes, income levels and age ranges now rent their homes. Renters arernleading household formations, which are expected to keep climbing due to thernimproving economy, Millennials continuing into adulthood and immigration.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment