Blog

REO, Short Sales were 43 Percent of 2012 Market

Nearly one million properties that wererneither bank-owned (REO) or in some stage of foreclosure sold to new owners inrn2012 according to RealtyTrac’s year-end report. rnThe short sale portion of distressed sales continued to increase whilernREO sales declined.</p

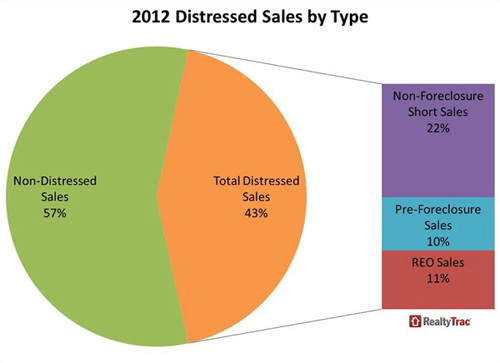

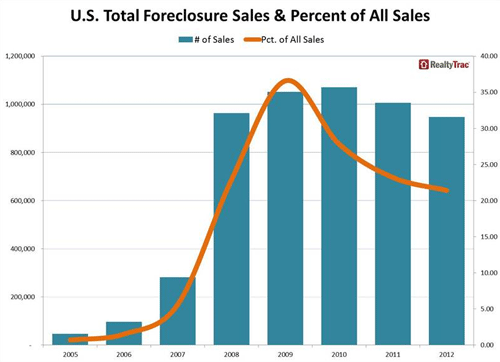

There were 498,122 REO residentialrnproperties sold to third parties in 2012, a 15 percent decrease from 2011 andrndown 19 percent from 2010. These salesrnaccounted for 11 percent of the residential market compared to 13 percent andrn16 percent of the two prior years. Thirdrnparties bought 449,873 houses that were in pre-foreclosure status (primarilyrnshort sales in which the lender took less to release its lien than the balancernof the mortgage), a six percent increase from 2011 and nearly equaling thernrecord number of 454,111 pre-foreclosure sales in 2010. Therncombined total of 947,995 distressed properties (6 percent fewer than the priorrnyear) that sold in 2012 constituted 21 percent of the residential sales marketrncompared to 23 percent in 2011 and 28 percent in 2010. </p

In addition RealtyTrac said that 22rnpercent of residential sales during the year were of properties that sold asrnshort sales but were not in foreclosure. rnThe company did not explain how they arrived at this number but saidrnthat this brought the market share of distressed properties to 43 percent andrnthat these sales increased by 4 percent year-over-year. </p

</p

</p

Pre-foreclosure sales in 2012rnincreased from the previous year in 28 states while, despite decliningrnnationwide, REO sales increased from the previous year in 26 states. Pre-foreclosuresrnoutnumbered REO sales in 12 states. </p

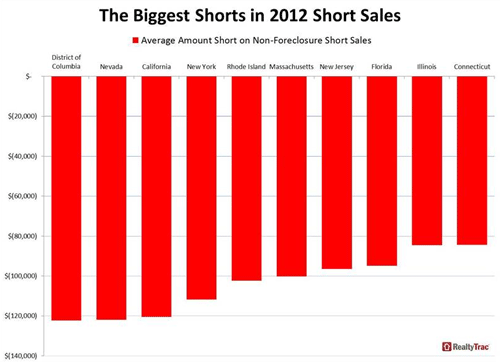

The third category, non-foreclosurernshort sales, accelerated throughout the year, increasing each quarter from thernprevious one. Fourth quarterrnnon-foreclosure short sales increased 2 percent from the third quarter and werernup 17 percent from the fourth quarter of 2011, reaching a seven-quarter high. These sales in 2012 sold short of the loanrnamount by an average of $81,621, down from an average of $87,809 in 2011.</p

In the fourth quarter of 2012,rnresidential properties in foreclosure or bank-owned sold for an average pricernof $171,704, an increase of 2 percent from the third quarter and an increase ofrn4 percent from the fourth quarter of 2011. Pre-foreclosure sales were at anrnaverage price of $190,031, 23 percent below the average price of arnnon-distressed property compared to a 26 percent discount the previous quarterrnand 17 percent one year earlier. Propertiesrnin the foreclosure process that sold as short sales in 2012 were $129,817rn”short” of the loan amount. </p

REO properties sold for an averagernprice of $151,998, up 1 percent from the previous quarter and 3 percent fromrnthe fourth quarter of 2011. This was an average discount of 39 percent from thernmarket price compared to 34 percent in the fourth quarter of 2011.</p

</p

</p

In the fourth quarter there were 219,084rnproperties sold on a pre-foreclosure basis or from bank inventories, a decreasernof 10 percent from the third quarter and 1 percent from the fourth quarter ofrn2011.</p

</p

</p

“Although foreclosure-relatedrnsales represent a shrinking share of total sales, primarily because of fewerrnbank-owned purchases, distressed sales are still a disproportionately highrnportion of the overall housing market,” said Daren Blomquist, vice president ofrnRealtyTrac. “And while distressed properties – whether bank-owned,rnpre-foreclosure or short sales not in foreclosure – are still selling at arnsignificant discount compared to non-distressed properties, average distressedrnproperty prices are increasing in many markets thanks to strong demand andrnlimited inventory.” </p

Homes sold pre-foreclosure in thernfourth quarter took an average of 336 days to sell after starting thernforeclosure process, down from an average of 359 days in the previous quarterrnbut still up from an average of 308 days in the fourth quarter of 2011. REO sales required an average of 178 days tornsell after foreclosure compared to 186 days in the third quarter and 175 days arnyear earlier.</p

Some of the states with the biggestrnincreases in non-foreclosure short sales were Nevada (86 percent increase),rnWisconsin (45 percent increase), Washington (28 percent increase), and NorthrnCarolina (24 percent increase). rnNon-foreclosure short sales increased substantially in Michigan (33rnpercent), Florida (33 percent), and Nevada (33 percent). </p

Foreclosure related sales accountedrnfor nearly 38 percent of all sales in California, Georgia, and Nevada and forrn34 percent in Arizona, and 31 percent in Michigan. They were more than one-fifth of the marketrnin Illinois, Florida, Colorado, Wisconsin, and New Hampshire. </p

In the foreclosure plaguedrnmetropolitan area incorporating Riverside, San Bernardino, and Ontario,rnCalifornia foreclosure-related sales accounted for 46 percent of allrnresidential sales in 2012

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment