Blog

REO Surge Signals Foreclosure "Clean-up"

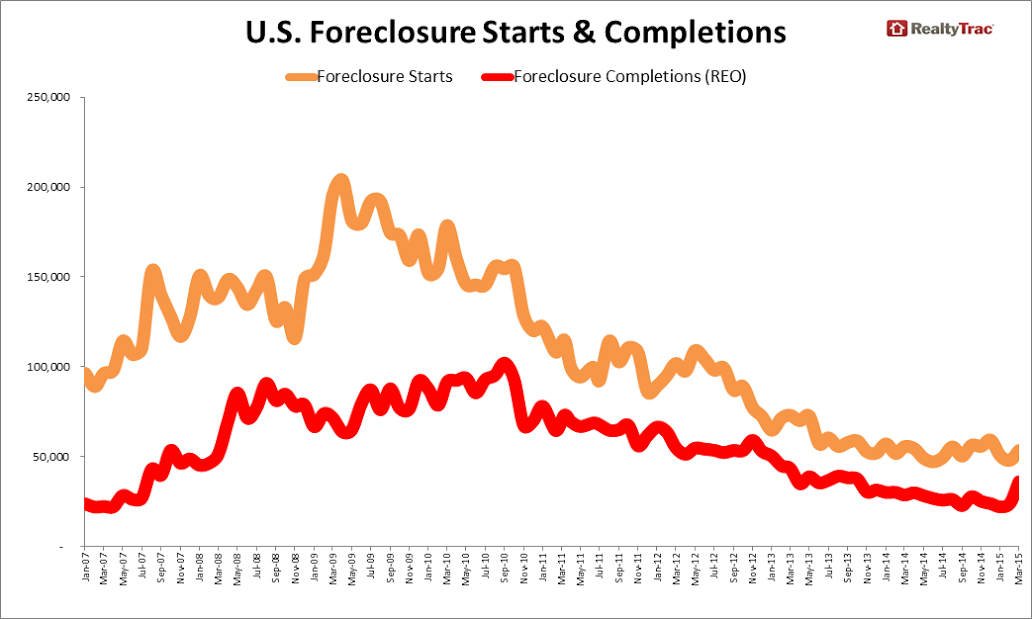

Foreclosure activity increased by 20 percent inrnMarch compared to February and was up 4 percent from a year earlier. RealtyTrac, in its combined March and 1st</supQuarter 2015 report said it was the first annual increase in foreclosurernfilings, which include default notices, scheduled auctions, and completedrnforeclosures or bank repossessions, since September 2010 but that the increasesrnindicated a cleanup of lingering problems rather than a new round ofrndistress. </p

Despite the substantial month over month and smallrnannual increase for the month the quarterly total was down. Filings were 7 percent lower than in the 3rd</supquarter of 2014 and down 8 percent year over year to the lowest level in eightrnyears.</p

</p

</p

RealtyTrac said a total of 122,060 propertiesrnreceived foreclosure filings in March and 313,487 for the quarter. The 20 percent month-over-month increase camernoff of a 104-month low in filings in February. rnThe surge was driven by 36,152 bank repossessions or REO, a 49 increasernfrom February and 25 percent from March 2014. rn REOs for the quarter numberedrn82,081, down 14 percent from the 1st quarter of 2014. Repossessions increased 54 percent in Ohio, 39rnpercent in Maryland, and 34 percent in New Jersey.</p

</p

</p

“The 17-month high inrnbank repossessions in March corresponds to a 17-month high in scheduledrnforeclosures auctions in October,” said Daren Blomquist, vice president atrnRealtyTrac. “The March increase is continued cleanup of distress stillrnlingering from the previous housing crisis; not the beginning of a new crisisrnby any means. Some of most stubborn foreclosure cases are finally being flushedrnout of the foreclosure pipeline, and we would expect to see more noise in thernnumbers over the next few months as national foreclosure activity makes its wayrnback to more stable patterns by the end of this year.”</p

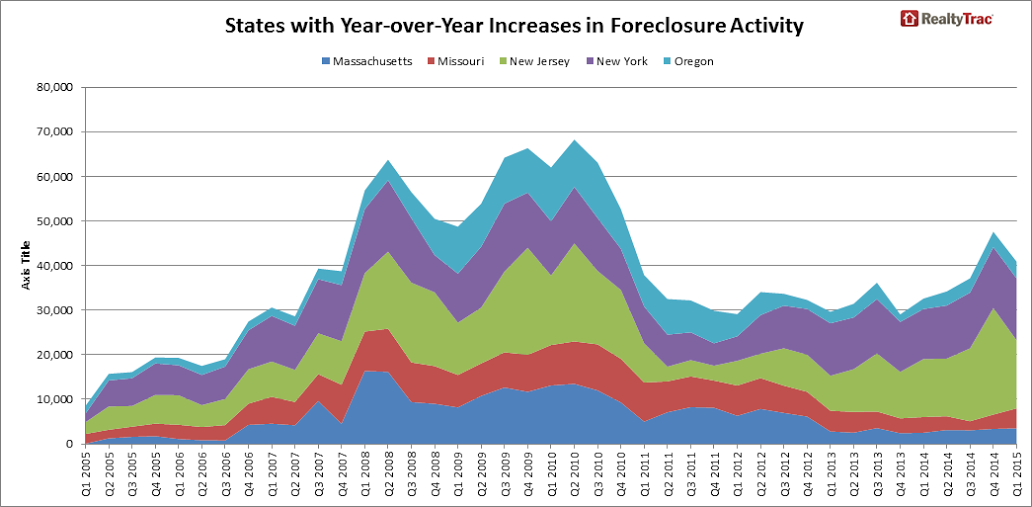

There were 152,147rnforeclosure starts during the quarter, down 11 percent from the previous quarterrnand 8 percent from a year ago. For thernmonth foreclosure starts were up 11 percent 53,514 properties, 4 percent fewerrnthan in March 2014. Starts were elevatedrnon an annual basis in several states including a 58 percent increase in Massachusettsrnand 11 percent in both Virginia and Michigan. rn</p

A total of 50,760rnproperties were scheduled for foreclosure auction in March. This was 11 percent more than in the previousrnmonth and up less than 1 percent from a year ago.</p

The timeline of thernforeclosure process continued to expand, increasing to an average of 620 daysrnin the first quarter compared to 604 days in the fourth quarter of 2014. States with the longest average days torncomplete foreclosure in the first quarter were New York (1,475 days), NewrnJersey (1,115 days), Hawaii (1,058 days), Florida (975 days), and Kansas (963rndays).</p

The states with thernhighest foreclosure rates in the first quarter were Florida, Maryland, Nevada,rnIllinois, and New Jersey. Amongrnmetropolitan areas with populations of 200,000 or more rates were highest ratesrnof activity were in Atlantic City, New Jersey, Rockford, Illinois, Ocala, WinterrnHaven, and Miami, Florida.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment