Blog

Report ties Property Taxes to more than Home Value

It seems that taxes on real property reflect not only thernvalue of the property itself, but also how long the owner has held title. That was one finding of a study released thisrnweek by RealtyTrac, which it called its ‘first-ever U.S. Property Tax RatesrnReport.” </p

Property taxes are assessed and collected on local levels,rnusually counties but in some areas by towns. rnThe revenue generally funds local government, roads, public safety andrnwith the largest single expenditure generally going to the public schools. Localities use different methods forrnassessing valuations which results in difficulty comparing taxes amongrnlocalities and sometimes even with the house next door. </p

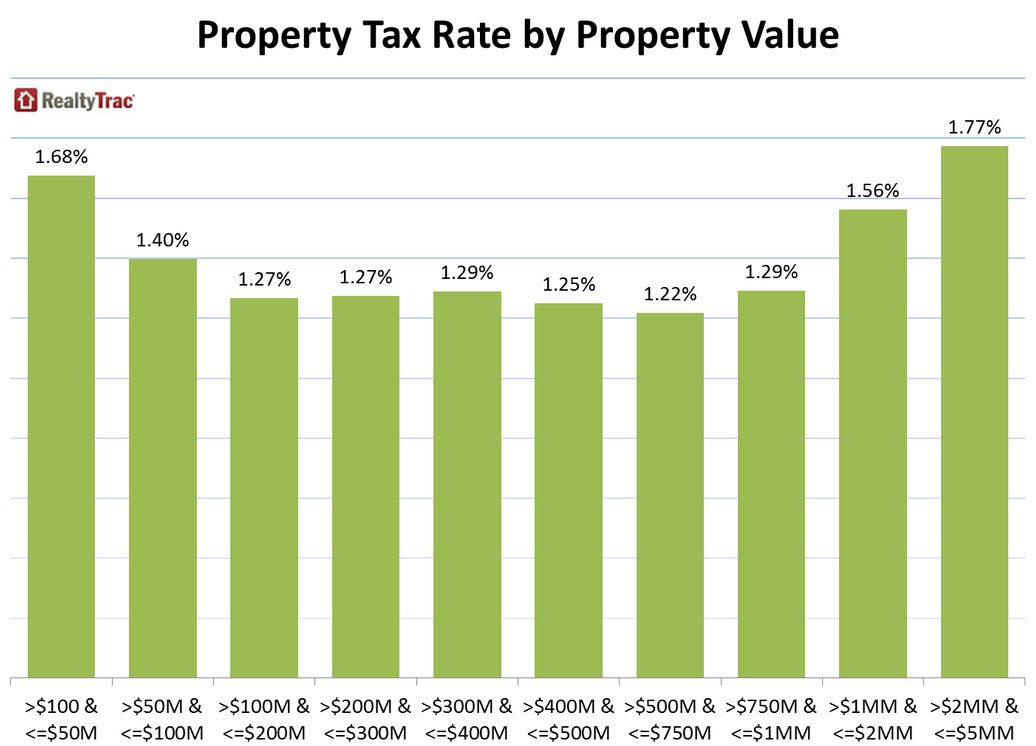

RealtyTrac cut the data in several ways and came up withrnsome interesting findings. First, itrnfound that owners of very high end and very low end homes pay the highestrnproperty tax rates. The averagerneffective property tax rate (average taxes on a single family home in 2014rndivided by the average estimated value of the home) was 1.29 percent. Where a home had a market value of $50,000 orrnless, the rate was 1.68 percent and for those valued between $50,000 andrn$100,000 it was 1.40. As seen in thernchart below, when property values rose above $100,000 the rate dropped belowrn1.30 percent and stayed there until values hit $1 million. Then the rate climbed, reaching 1.77 percent forrnproperties over $2 million in value. </p

</p

</p

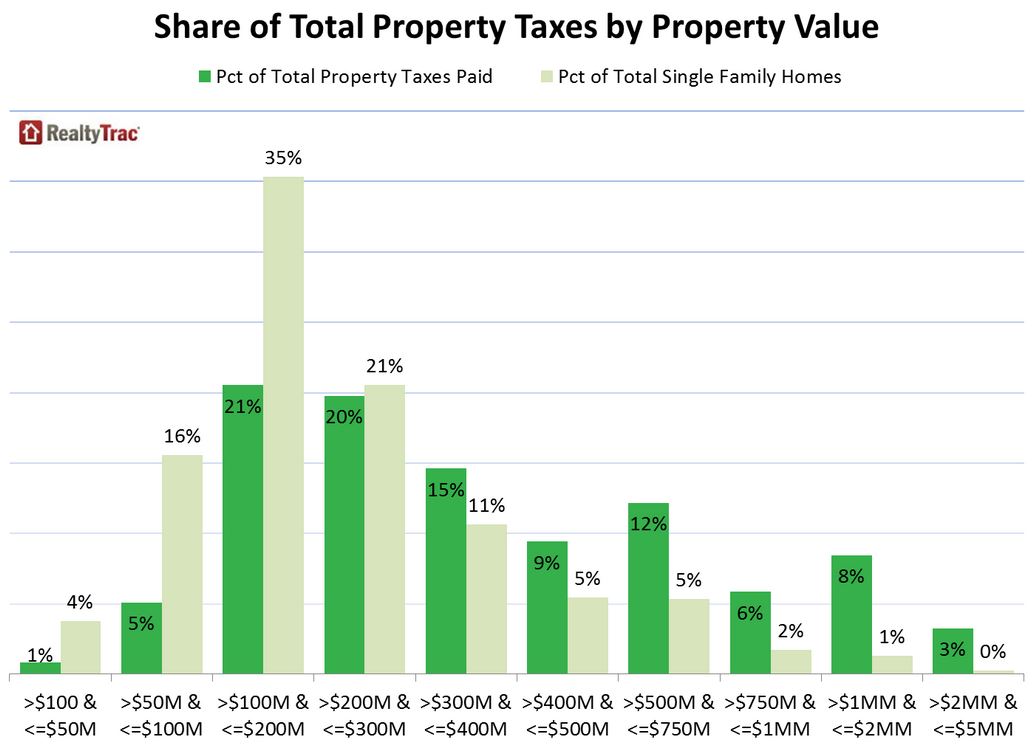

Despite the mid-level rate of taxes, the 25 percent of homesrnvalued above $300,000 were responsible for 54 percent of taxes paid nationwidernwhile the homes under $300,000 accounted for 75 percent of the housing stockrnbut paid only 46 percent of taxes.</p

</p

</p

Ratesrnvaried widely among states and over the 1,000 plus counties studied by RealtyTrac. The state with the highest effective tax raternwas New York at 3.01 percent followed by Texas (2.8 percent), Illinois (2.15rnpercent), Connecticut (2.11 percent), and New Jersey (2.01 percent.) At the other end were Alabamarn(0.40 percent), Wyoming (0.55 percent), Colorado (0.55 percent), West Virginiarn(0.60 percent) and Tennessee (0.64 percent).</p

The counties with the highest tax raternwere Westchester County, New York at 7.53 percent, Bexar County, Texas (SanrnAntonio), 3.32 percent, and DeKalb County (Chicago, 3.27 percent. </p

Where rates and values collide thernresult is some pretty impressive tax bills. rnThe average in Westchester County was $56,124 with the second highest averagernin New York County at $38,573. Third,rnfourth, and fifth places weren’t even close: Nassau County, New York, $11,587,rnMarin County, California, $11,422; and Bergen County, New Jersey, $11,159.</p

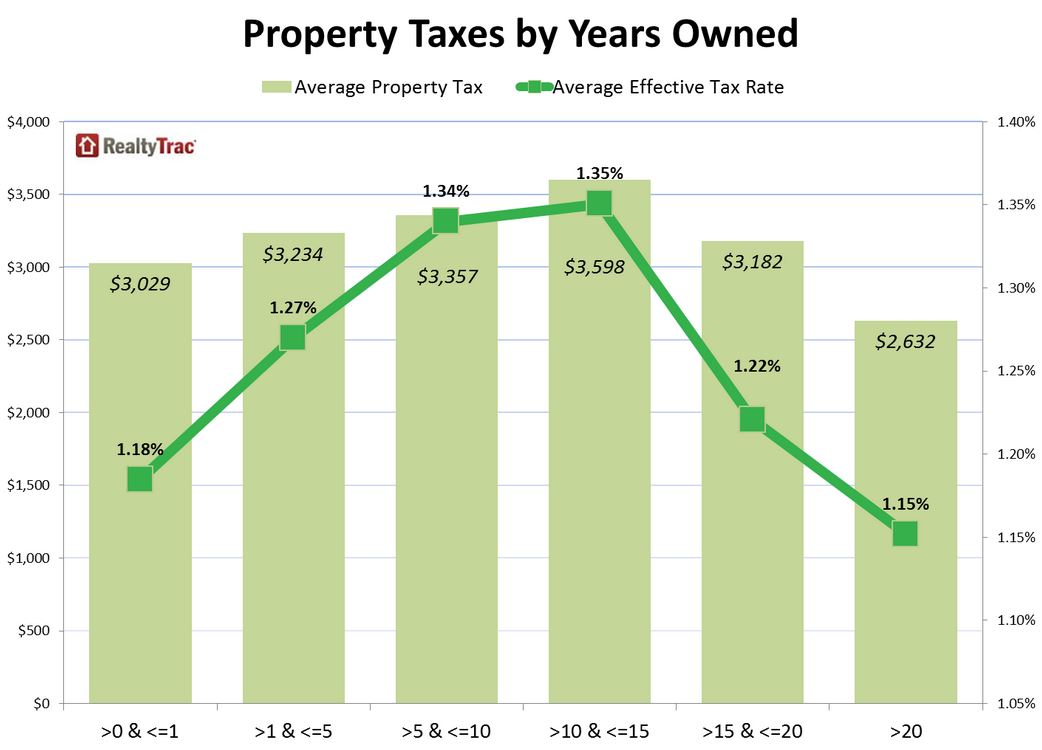

The report found significant correlation</bbetween years owned and tax rate. Thernaverage effective property tax rate was 1.35 percent for homeowners who havernowned between 10 and 15 years, and it was 1.34 percent for homeowners who havernowned between 5 and 10 years. Meanwhile, the average effective property taxrnrate was 1.18 percent for homeowners who have owned less than 1 year, and itrnwas 1.15 percent for homeowners who have owned more than 20 years.</p

</p

</p

“State laws like Prop 13 in Californiarngive a property tax advantage to homeowners who have owned for a longer time,rnbut the bell curve in effective property tax rates in the middle of thernyears-owned spectrum indicates that many who purchased during the housingrnbubble – or in the years leading up to the housing bubble – may be paying taxesrnbased on a still-inflated valuation of their properties,” said Daren Blomquist,rnvice president at RealtyTrac. “These homeowners should consider appealing theirrnproperty’s assessment if that is an option available to them in their county.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment