Blog

Rising Home Prices, Rents may Motivate More Buyers

The convergence of expectationsrnabout both rising home prices and rising rents may motivate more consumers tornpurchase a home in the coming months according to Fannie Mae. The company drew this conclusion from resultsrnof its October National Housing Survey released Wednesday morning.</p

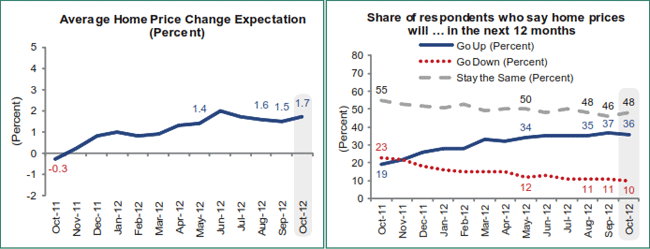

The percentage of survey respondentsrnwho expect home prices to remain about the same ticked up two percentage pointsrnto 48 percent in the October survey while those expecting further pricerndeclines went from 11 to 10 percent, 13 percentage points lower than Octoberrn2011 and the lowest level since the survey’s inception in June 2010. While the percentage expecting pricernincreases over the next twelve months declined from 37 percent to 36 percent thernpositive difference between those saying home prices will go up and thosernsaying they will go down remained steady at a survey high of 26 percentagernpoints. The average price changernexpectation went from an increase of 1.5 percent in September to 1.7 percent inrnSeptember. Expected price changes havernbeen in positive territory and steadily increasing since November 2011. </p

</p

</p

Half of respondents expect rents tornincrease over the next 12 months, the highest proportion in the history of thernsurvey, compared to 47 percent in the previous survey. Only 3 percent expect rents to decline whilern43 percent expect rents to be essentially unchanged, up from 42 percent inrnSeptember. Anticipated rent increasesrnjumped 8 basis points in one month to an expected increase of 3.9 percent.</p

</p

</p

“This has been a year of steadyrngrowth in the percentage of consumers with positive home price expectations,”rnsaid Doug Duncan, senior vice president and chief economist of Fannie Mae.rn”Increasing household formation, encouraged by an improving labor market, isrnadding additional momentum to the housing recovery and putting upward pressurernon rental price expectations. Expected increases in both owning and rentingrncosts may encourage more consumers to buy and add further strength to thernhousing recovery already under way.” </p

Seventy-two percent of respondentsrnsay it is a good time to buy, while 18 percent say it is a good time to sell,rnconsistent with the trends seen over the past six months.</p

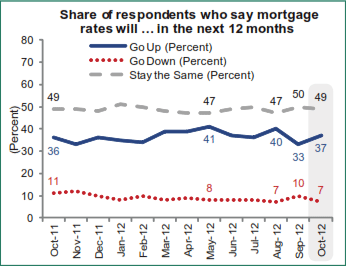

Consumers may be further propelledrntoward a purchase decision by expectations about interest rates. The percentage of respondents expectingrnfurther rate decreases declined from 10 to 7 percent since the previous surveyrnwhile those expecting the rates will increase in the next year went up by 4rnpercentage points to 37 percent.</p

</p

</p

When asked about the state of therneconomy, the share of respondents who say it’s on the right track dropped to 38rnpercent, down 3 percentage points from last month. Conversely, those who say therneconomy is on the wrong track climbed 3 percentage points to 56 percent. Thernshare of consumers who expect their personal financial situation to get betterrnor stay the same over the next year remained essentially level at 43 percentrnand 40 percent, respectively.</p

The Fannie Mae Survey polls 1,001rnAmericans, both homeowners and renters, monthly via phone to assess theirrnattitudes toward owning and renting a home, home purchase and rental pricernchanges, homeownership distress, the economy, household finances, and overallrnconsumer confidence.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment