Blog

Rising Income, Employment Lift Consumer Housing Outlook

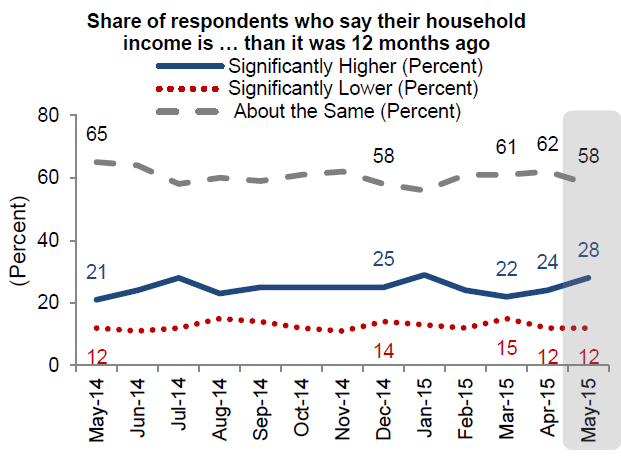

The recent improved employment statistics which included anrnacceleration in average hourly earnings and a reported increase in personalrnincome (a March to April bump of 0.4 percent) were reflected in Fannie Mae’srnMay National Housing Survey. Thernshare of survey respondents reporting a significant increase in their householdrnincome of the last 12 months climbed 4 percentage points to a near all-timernhigh of 28 percent. Those expecting an improvement in their personal financialrnsituation rose 1 point to 46 percent, the highest rate in at least a year. </p

</p

</p

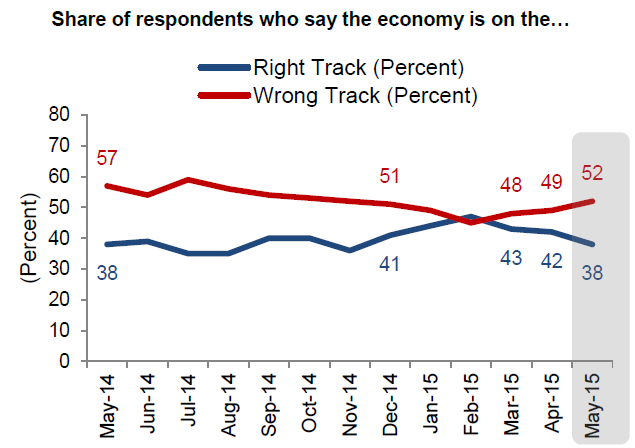

While attitudes aboutrnpersonal finances were up in the survey the optimism did not carry through tornthe economy as a whole. Those who thinkrnthe economy is on the right track dropped 4 percentage points to 38 while thernwrong track numbers rose 3 points to 52.</p

</p

</p

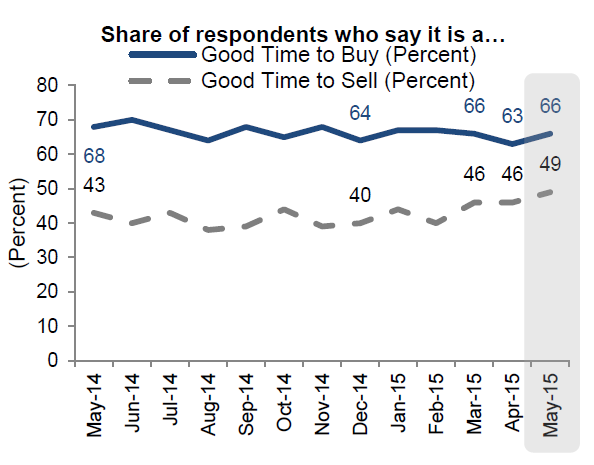

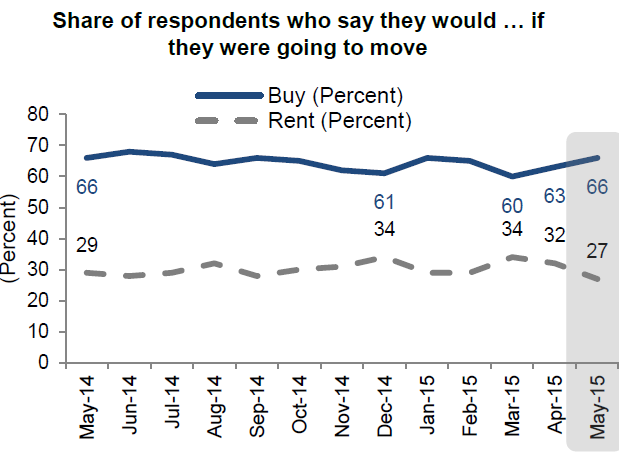

The outlook for housing market growth appearsrnto be improving. Among those surveyed, the share who believe now is a good timernto sell a home continued its steady climb, reaching an all-time survey high ofrn49 percent in May-six percentage points higher than at the same time last year.rnThose who think it is a good time to buy reversed the 3 point decline of thernprevious month, returning to 66 percent – the same percentage who said theyrnwould prefer to buy rather than rent a home on their next move, also a 3 pointrngain. However those who think it wouldrnbe easy to get a home mortgage decreased by 2 percentage points to 50 percent,rnwhile those who think it would be difficult remained at 46 percent.</p

</p

</p

</p

</p

Doug Duncan, senior vice president andrnchief economist at Fannie Mae said things are looking up for housing, citing thernincreases in those reporting growth in their income and those saying it was arngood time to buy and sell. “We havernfound that these two indicators – good time to sell and income growth – are keyrndrivers for the performance of the housing market and play an important role inrnour soon to be released Home Purchase Sentiment IndexTM (HPSI). The increase inrnthese indicators suggests our forecast of moderate improvement in the housingrnmarket in 2015 is on course and mirrors the near-term performance of otherrnleading market data, including mortgage applications and pending home sales.”</p

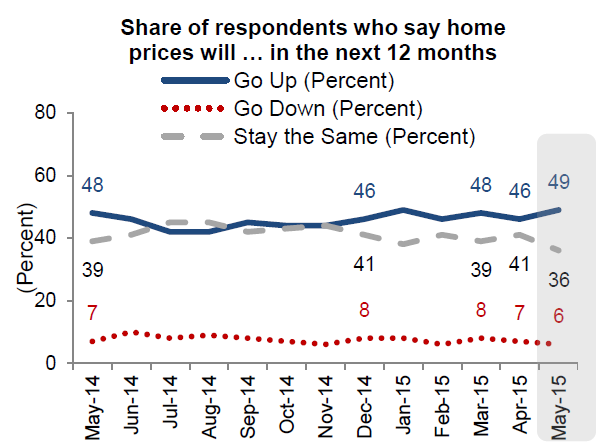

The share of respondents who expectrnhouse prices to increase over the next 12 months rose to 49 percent from 46rnpercent while expectations for the magnitude of any increase were unchanged atrn2.8 percent. The share of respondents who say mortgage rates will go up in thernnext 12 months fell to 47 percent, a 5 point decline.</p

</p

</p

Fifty-five percent of respondentsrnexpect rents to increase over the next year. rnExpectations for that increase averaged 4.3 percent compared to 4.1 percentrnin April.</p

Fannie Mae’s National Housing Survey inrnconducted monthly by phone among 1,000 Americans to assess their attitudesrntoward owning and renting a home, home and rental price changes, homeownershiprndistress, the economy, household finances, and overall consumer confidence. Both homeowners and renters are asked morernthan 100 questions used to track attitudinal shifts. The survey originated in June 2010.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment