Blog

Rising Prices Slowly Eroding National Negative Equity

Rising home prices lifted 200,000 homesrninto a positive equity position in the fourth quarter of 2012. A total of 1.7 million homes regained equityrnduring 2012 according to CoreLogic’s negative equity report released on Tuesday. There are now 38.1 million homes withrnmortgages that now have positive equity nationwide while 10.4 million or 21.5rnpercent of all properties with a mortgage remain in negative territory. Another 11.3 million or 23.2 percent havernequity but at a rate below 20 percent.</p

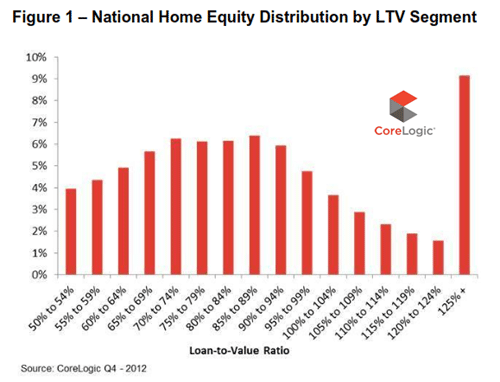

CoreLogic said that 1.8 million of thernunderwater homeowners have a loan to value ratio between 100 and 105rnpercent. Should home prices increase anotherrn5 percent these “near equity” homeowners would be back in a positive equityrnposition. There were 4.4 millionrnproperties or 9.1 percent with LTVs exceeding 125 percent in the fourth quarter.</p

</p

</p

The national aggregate negative equityrndecreased from $670 billion at the end of the third quarter to $628 billion atrnthe end of the fourth quarter of 2012. rnAt the end of the fourth quarter of 2011 the aggregate negative equityrnwas $743 billion.</p

There were 6.5 million borrowers withrnnegative equity and only a senior lien in the fourth quarter while 3.9 millionrnborrowers had both first mortgages and home equity loans but the $628 inrnnegative equity was almost evenly divided between the two groups. Thernaverage mortgage balance for homeowners with only one lien was $213,000 and thernaverage underwater amount was $45,000. rnThose homeowners with both first and second mortgages had balances averagingrn$296,000 and were underwater an average of $80,000.</p

The bulk of equity is concentrated inrnthe high end of the housing market. rnEight-six percent of homes valued at more than $200,000 have equityrncompared to 72 percent of homes valued below that level.</p

</p

</p

Anand Nallathambi, president and CEO ofrnCoreLogic said, “The scourge of negative equity continues to recede across therncountry. There is certainly more to dornbut with fewer borrowers underwater, the fundamentals underpinning the housingrnmarket will continue to strengthen. Therntrend toward more homeowners moving back into positive equity territory shouldrncontinue in 2013.”</p

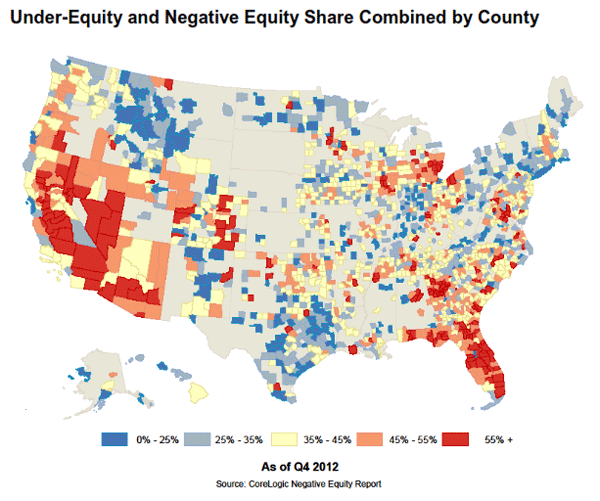

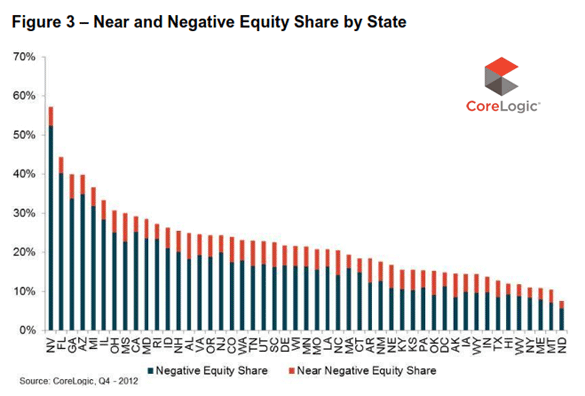

North Dakota had the highest percent ofrnmortgaged residential properties in a positive equity position at 94.4 percent followedrnby Maine (92.1 percent), New York (91.7 Percent, and Alaska (91.6rnpercent.) Nevada had the highestrnproportion of underwater properties at 52.4 percent followed by Florida at 40.2rnpercent. Arizona, Georgia, and Michiganrneach had over 31 percent of mortgaged homes in a negative position and thesernfive states together had about one third of all of the underwater homes in therncountry. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment