Blog

September Housing Scorecard Released

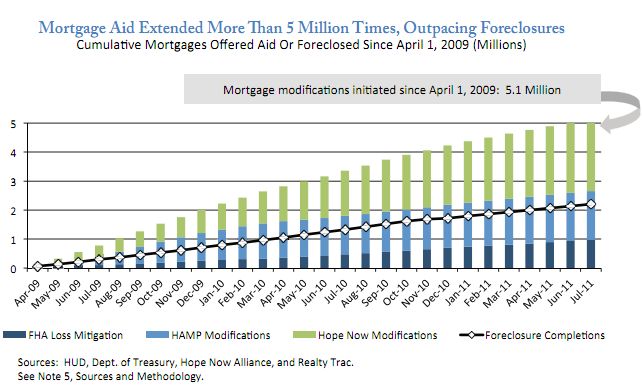

The Departments of Housing and UrbanrnDevelopment (HUD) and Treasury have issued the administration’s SeptemberrnHousing Scorecard. The scorecard isrnlargely a round-up of information on housing and housing finance from sourcesrnsuch as S&P/Case-Shiller, RealtyTrac, and the Census Bureau and otherrngovernment agencies, all of which have previously been covered here. It also incorporates by reference data on thernMaking Home Affordable Program which, in this month’s report, covers summaryrndata through August. </p

The Making Home Affordable Program,rnwhich recently began using the acronym MHA rather than HAMP, reports that itrnhas now enrolled 1,688,038 homeowners in trial modification programs since thernprogram began in April 2009; 26,577 of those were enrolled in August. Since the July report 25,434 trials have beenrnconverted, bringing the total of permanent modifications to 816,833. </p

At the end of August there were 690,969rnpermanent modifications still in active status. rnA total of 125,864 permanent modifications have been cancelled, usuallyrnbecause the borrower had missed three consecutive monthly payments although aboutrn2,000 of the loans were paid. </p

</p

</p

Since the MFA program was revamped inrnJune 2010 and program administrators began more rigorous supervision ofrnservicers the number of borrowers seemingly trapped in the trial program hasrnsteadily dropped. At the end of Augustrnthere were 27,345 borrowers (out of 105,860 active trials) who had remained inrntrial status for six months or longer compared to 190,412 trials that hadrnlasted for over six months in May 2010. The average length of the trial period forrnthose converted to a permanent HAMP modification has decreased from 5.3 monthsrnfor trials started prior to June 1, 2010, to 3.5 months for trials started Junern1, 2010 or later.</p

Several other types of homeowner assistancernare run under the MHA name. The SecondrnLien Modifications Program (2MP) provides assistance to homeowners to modify orrnextinguish a second lien so that the first lien can also be modified. To date that program has enrolled 40,654rnborrowers and has modified 36,464 second liens (1,433 through partialrnextinguishment) and fully extinguished 3,642. rnThe average amount of the second liens extinguished was $68,042.</p

Home Affordable Foreclosure Alternativesrn(HAFA) offers incentives for homeowners who wish to exit their homes through arnshort sale or deed-in-lieu of foreclosure. rnTo date 28,953 homeowners have been accepted into the program and 15,954rnhave completed HAFA transactions. Ofrnthose, 423 homeowners surrendered their deeds and the remainder completed arnshort sale. Almost 10,000 homeownersrnremain active in the program.</p

The Treasury Unemployment Program (UP)rnprovides temporary forbearance to homeowners who are unemployed. To date 13,993 homeowners have enrolled inrnthe program.</p

Nine of the 12 largest servicersrninvolved the day-to-day operations of the MFA program now have trial tornpermanent modification conversion rate exceeding 70 percent for homeowners whornstarted the program after the June 2010 program changes. Seven of those have conversion ratesrnexceeding 80 percent. </p

Only one servicer now has a trial periodrnthat materially exceeds the program average of 3.5 months; (one small servicerrnaverages 3.6 months.) Trials administeredrnby JP Morgan Chase have an average duration of 4.6 months.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment