Blog

Servicers Speed Up HAMP Conversions. More to Become Eligible

The June edition of the Obama Administration’srnHousing Scorecard released on Friday showed that housing prices turned slightlyrnupward while mortgage defaults continued to fall as have the numbers of completedrnforeclosures and short sales. However, thernaggregate equity of American homeowners also declined.</p

According tornthe Scorecard, a joint report by the Departments of Housing and UrbanrnDevelopment (HUD) and Treasury, in May, 4.3 percent of prime mortgages were atrnleast 30 days late – a significant decline from the peak of 5.9 percent seen inrn2010. Moreover, seriously delinquent prime mortgages – those at least 90 daysrnlate or in foreclosure – dropped by 22 percent from a high of 1.9 millionrnrecorded last year. As new delinquencies decrease across the nation, the numberrnof new homeowners seeking assistance through the Administration’s programs mayrnalso decrease. </p

All three of the indices of home prices included inrnthe scorecard, Case-Shiller, Core-Logic, and FHFA – increased slightly withrnCore-Logic showing the largest increase – 2.7 points. At the same time aggregate home equityrndeclined by $271 billion since the previous report. The sales of both new and existing homesrndecreased, however the inventory of new homes declined slightly to a 6.2 monthrnsupply from 6.3 months. The inventory ofrnexisting homes rose from 9.0 months to 9.3 months. The supply of vacant homes held off of thernmarket continues to increase and now totals 3,861,000 compared to 3,602,000 inrnthe previous quarter.</p

“The housing data in this month’s Scorecard paint a mixedrnpicture of the housing market, despite growing evidence of progress in thernbroader economy,” said HUD Assistant Secretary Raphael Bostic. “Last month wernsaw a slight uptick in home prices and a continued decline in mortgage defaultsrnas our foreclosure prevention programs reach more borrowers upstream in thernprocess. But we have much more work to do to reach the many householdsrnwho still face trouble and to help the market recover. That is why thisrnAdministration continues to push for effective implementation of our recoveryrnprograms as we continue to help homeowners through this crisis.”</p

The Scorecard includes by reference the monthly report onrnthe administration’s programs to assist homeowners who are delinquent on theirrnmortgages, principally the Home Affordable Modification Program (HAMP). This report has increasingly focused on the performancernof mortgage servicers who have been widely blamed for HAMP’s less than optimumrnresults. Last month HUD announced that all ten of the major servicersrnadministrating the program had failed to live up to performance standards andrnwithheld incentives from three of the largest firms. FULL STORY</p

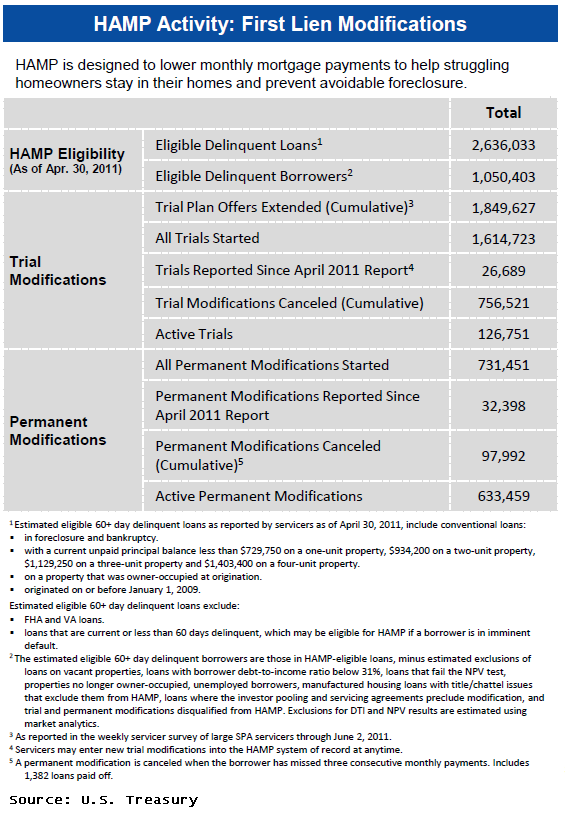

During the reporting period 32,398 loans were convertedrnfrom trial modification status to permanent status bringing the total torn731,451 since the program began; 633,459 of the permanent modifications are stillrnin force. A total of 1,614,723 trailrnmodifications were initiated since the program started in April 2009 andrn126,751 borrowers remain in trial modifications. Since the last report 26,689 borrowers havernentered into trials. </p

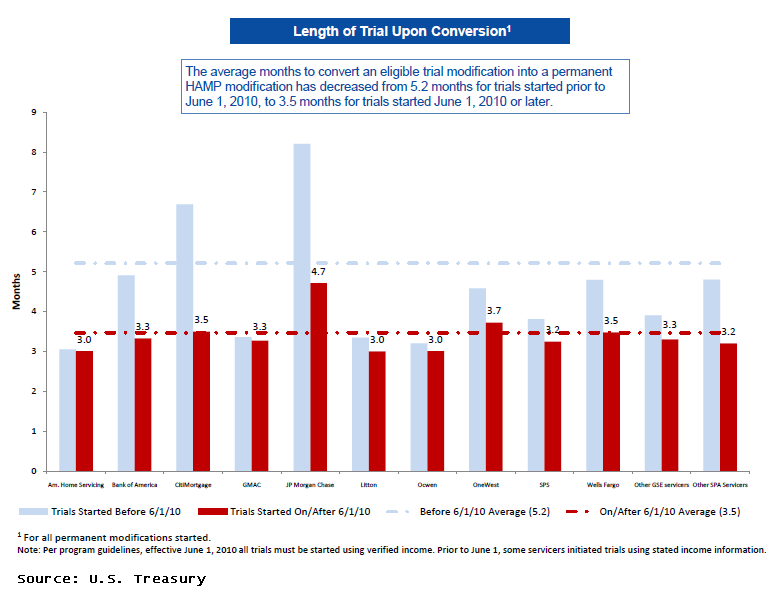

The average trialrnmodification period for loans entering modification whenrnborrowers were required to provide verified income information upfront, is 3.5rnmonths. Those loans entering intornmodifications prior to June 1, 2010 had an average trial period of 5.2 months. Itrnis interesting to note that, on the graph below showing the average length of trials, twornof the largest servicers were most responsible for that 5.2 month average. CitiMortgage and JPMorgan Chase had averagerntrial periods averaging longer than 5 months while all otherrnprincipal servicers had average trial periods of less than 5 months. </p

All servicers have improved conversion timelines since June 1, 2010.</p

</p

</p

Before the change in documentation requirements in Junern2010 the average conversion to permanent status was 42 percent. It is now 71 percent with another 20 percentrnof loans currently pending processing or a decision on conversion. Two servicers, Bank of America and JPMorganrnChase lag the others dramatically with conversion rates of 55 percent and 63rnpercent.</p

Not all 60+ day delinquent loans are eligible for HAMP. Based on the estimates, of the 4.6 million homeowners who are currently 60+ days delinquent, 1.05 million homeowners are eligible for HAMP. As this represents a point-in-time snapshot of the delinquency population and estimated HAMP eligibility, Treasury expects that more homeowners will become seriously delinquent between now and the end of 2012, and some of those homeowners will be eligible for HAMP.</p

Estimated eligible 60+ day delinquent loans as reported by servicers as of April 30, 2011, include conventional loans:</p<ul

Estimated eligible 60+ day delinquent loans exclude:</p<ul

Second liens have interfered with the modification of many seniorrnliens and the administration has recently focused on eliminating this obstacle. The Second Lien Modification Program (2MP)rnhas now resulted in 27,105 second lien modifications, 19,000 of these in thernlast four months. In some cases thesernmodifications have resulted in full extinguishment of the subordinate debt.</p

The current HAMP report also includes information on twornother programs. The Principal ReductionrnAlternative (PRA) requires servicers of non-GSE loans to evaluate the benefitrnof principal reduction where mortgages have a loan-to-value ratio of 115rnpercent or more. They are not, however,rnrequired to reduce principal as part of a modification. There have been 21,299 PRA modificationsrnbegun with 4,938 modifications now permanent. rnThe median principal reduction in permanent modifications is $69,532, orrn32.2 percent of the loan balance.</p

The second initiative, Home Affordable ForeclosurernAlternatives (HAFA) offers incentives to homeowners seeking a short sale or torngive a deed-in-lieu of foreclosure. rnThere have been 17,781 HAFA agreements started with 8,541rncompleted. Of these 8,309 were short salesrnand 232 were deeds-in lieu.</p

“The Administrationrnremains committed to reaching homeowners who are still struggling so that ourrncountry can fully recover from an unprecedented housing crisis,” saidrnTreasury Assistant Secretary for Financial Stability Tim Massad. “The Administration’s programs continue to benefit tens ofrnthousands of additional homeowners every month, while keeping the pressure onrnmortgage servicers to offer more sustainable assistance to prevent avoidablernforeclosures.”</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment