Blog

Settlement Monitor Reports on Progress, Servicer Compliance

Joseph A. Smith, Monitor of the NationalrnMortgage Servicing Settlement issued a progress report on Wednesday. Smith, former North Carolina BankingrnCommissioner, said the interim report was published to inform the public aboutrnthe nature of the settlement, the steps that have been taken to implement it,rnand the results to date. Smith is notrnrequired to issue his first report to the Federal Court until the secondrnquarter of 2013.</p

The report includes a summary of thernmaterial terms of the various judgment and agreements comprising thernsettlement, a review of actions taken to date to implement the settlement, andrninformation about the relief that has been extended to consumers under thernsettlement during the second quarter of 2012.</p

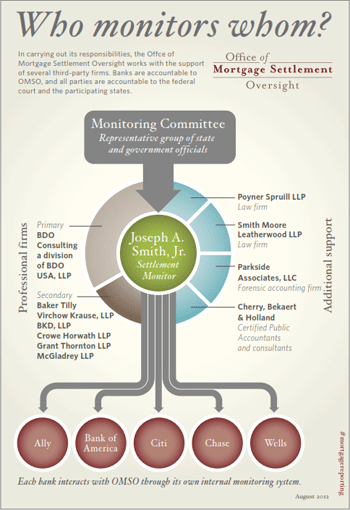

Smith was authorized by the settlementrnto employ a primary professional firm (PPF) to ensure the quality of servicers’rnmonitoring and has hired BDO USA, LLP. rnFive servicer performance firms (SPF) have also been employed to monitorrnthe five individual servicers involved in the settlement. Smith said in picking the six companies hernplaced great emphasis on the independence of each with regard to its assignedrnservicer. </p

Each servicer has an Internal ReviewrnGroup (IRG) comprised of employees and/or independent contractors andrnconsultants of the servicer that is responsible for performing reviews of the servicer’srncompliance with the Settlement. IRG membersrnmust be separate and independent from the line of business being reviewed.</p

Also assisting in the review are a lawrnfirm, an accounting firm and a forensic accounting firm, and a communicationsrnfirm. These firms assisted in selectingrnthe PPF and negotiating work plans. rnSmith has also sponsored a non-profit Office of Mortgage SettlementrnOversight (OMSO) to provide administrative support and enable the Monitor torncarry out his duties independently and transparently. This office will accept payment of money and maintainrnbooks and records.</p

</p

</p

Under the settlement the Servicers willrnprovide specific dollar amounts of relief to borrowers over a three yearrnperiod. The servicers have thernflexibility to provide relief in a variety of forms including loanrnmodifications, transitional funds, short sale facilitation, deficiency waivers,rnforbearance, and anti-blight activities and must report quarterly to thernMonitor on the relief given and their progress toward meeting paymentrnobligations.</p

The Settlement is structured to providerncredits for relief given against Settlement commitments. To encourage servicers to make substantialrnearly progress they will be given an additional 25 percent credit for principalrnreductions or credited refinancing activities that take place within the firstrn12 months of the program. If servicersrndo not meet their total commitment within three years they will be penalized nornless than 125 percent of the unmet commitment amount.</p

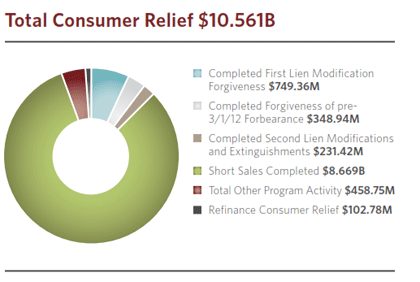

While the amounts have not yet beenrnconfirmed, scored, or credited, servicers have submitted documentation for thernfollowing during the first quarter of the Settlement period.</p<ul class="unIndentedList"<liArntotal of $10.56 billion in relief was provided to 137,846 borrowers; an averagernof $76,615 per borrower.</li<liFirstrnlien modifications were completed for 7,093 borrowers and resulted in loanrnforgiveness of $749.4 million or $105,650 per borrower.</li<liAnrnadditional 5,500 borrowers received forgiveness of pre-March, 2012 forbearancernin the amount of $348.9 million.</li<liSecond-lienrnmodifications and extinguishments were provided to 4,213 borrowers; $231.4rnmillion in relief.</li<liAlmostrn23,000 home loans were refinanced with an average interest rate reduction ofrn2.1 percent.</li<liShortrnsales or deeds in lieu were authorized for 74,614 borrowers at an average ofrn$116,200 per borrower.</li<liThroughrnvarious other consumer relief programs the servicers provided $458.8 million inrnrelief to 24,353 borrowers.</li<liFirstrnlien modification trials were extended to 21,104 borrowers and 28,047 borrowersrnwere in an active trial.</li</ul

</p

</p

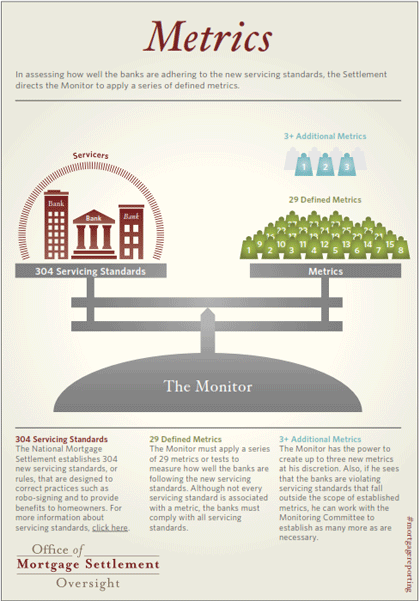

ThernSettlement contains 304 actionable Servicing Standards and each servicer hasrnagreed to a timeline for phasing in implementation of these standards. By July 5, each of the servicers hadrnimplemented between 35 and 72 percent of the standards. Among the standards that all servicers havernput into operation are standards relating to the integrity of documents, singlernpoints of contact for borrowers, and a variety of customer service standards includingrncommunicating with representatives from state attorneys general and regulatoryrnagencies who act upon a written complaint filed by a borrower. Servicers are also establishing reasonablernstandards and training requirements for loss mitigation staff, eliminating compensationrnarrangements favoring foreclosure over other alternatives, and having adequaternstaffing and systems to track borrower documentation and information.</p

Inrnthe area of loss mitigation servicers report that they have designed proprietaryrnfirst lien modification programs, eliminated any application or processing feesrnfor loan modifications, and are performing independent evaluations of denialsrnof requests for modifications. Servicersrnare also complying with the Servicemembers Civil Relief Act and related staternlaws and have engaged independent consultants to review all foreclosures inrnwhich a military service member is known to have been on the loan.</p

Servicersrnalso report ant they have developed and implemented anti-blight policies forrntheir owned real estate (REO) and are complying with state and federal lawsrnrelated to the rights of tenants in foreclosed properties.</p

ThernSettlement establishes 29 metrics for servicing standards and the Monitor isrnauthorized to develop three more at his own discretion. He can also establish an unlimited number ofrnother new metrics to address any patterns of non-compliance that emerge. For that reason, Smith stresses that it isrnimportant that consumers and their advocates report any negative experiencesrnthrough the OMSO website. The website, www.mortgageoversight.com, isrndesigned to inform the public about the settlement and invite comments. Smith said to date the website has receivedrnabout 1,300 distinct submissions from consumers about their experience and aboutrnthree-fourths of them report problems with their servicers.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment