Blog

Severe Economic Downturn could Trigger GSE Bailout

The Federal Housing Finance Agency reports that the tworngovernment sponsored enterprises (GSEs) Fannie Mae and Freddie Mac mightrntogether require government assistance of as much as $157.3 billion in thernevent of an extremely severe economic downturn. rnThe figure comes as a result of a stress test mandated by the Dodd-FrankrnWall Street Reform and Consumer Protection Act for certain financial institutionsrnwith more than $10 billion in assets, criteria which includes the two companiesrnwhich are in Federal conservatorship.</p

Therntest, an annual requirement, is designed to determine whether an institution canrnabsorb losses as a result of hypothetical adverse economic conditions. The Severely Adverse Scenario involves a deeprnand protracted recession in which unemployment increases by 4 percentage pointsrnfrom the beginning of the test horizon to a peak level of 10 percent by the middlernof 2016. The real GDP declines by 4.5rnpercent from its beginning point to the end of 2015 and begins to recover inrn2016. Short-term interest rates remainrnnear zero though out the period and long-term rates drop significantlyrnto 1 percent in the 4th quarter of 2014. Other conditions prevail such as a fall inrnequity prices of 60 percent and of home prices by 25 percent. </p

</p

</p

For the GSEs the combined projected credit losses under thernscenario would be $43 billion, $24.9 billion for Fannie Mae and $18.1 billionrnfor Freddie Mac. This represents 92rnpercent of their combined portfolios. rnTotal projected comprehensive losses have a considerable range, betweenrn$73.4 billion and $162.1 billion depending on whether or not the GSEsrnreestablish a valuation allowance on deferred tax assets. </p

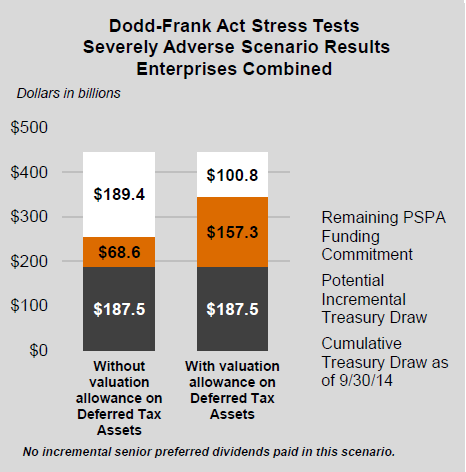

As of September 30, 2014 the GSEs have drawn a combinedrn$187.5 billion from the Treasury under the terms of the Senior Preferred StockrnPurchase Agreement (PSPA) negotiated when the they were placed into FederalrnConservatorship and renegotiated in 2012. rnThe remaining commitment under the agreement ranges between $189.4rnbillion and $100.8 billion depending again on the treatment of deferred taxrnassets. </p

Under the Severely Adverse Scenario the GSEs, which underrnthe terms of the renegotiated PSPA the GSEs are not permitted to rebuildrncapital, would require incremental Treasury draws between $68.6 billion andrn$157.3 billion depending again on the tax treatment.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment