Blog

Shadow Inventory Decline Continues, Currently at 7.2 Month Supply

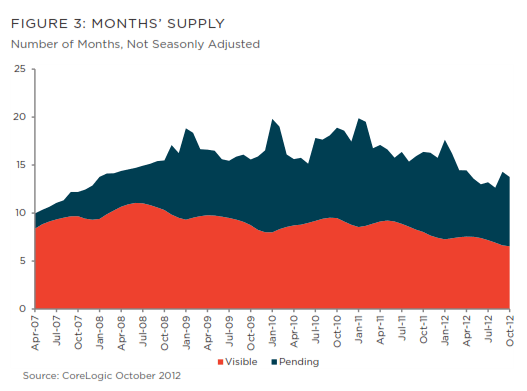

The residential shadow inventory of distressed homesrncontinues to shrink according CoreLogic’s monthly report for October. The improvement is across all metrics; numberrnof units, months supply, dollar volume and transition rates. </p

The inventory as of October was 2.29 million units or arn7.2 month supply at the current absorption rate. The number of units in the inventoryrnrepresented a 12.3 percent decrease from October 2011 when the inventoryrnconsisted of 2.62 million units, an 8.6 month supply. The volume of the inventory in October wasrn$376 billion, down from $3.99 billion a year earlier. In September the inventory stood at 2.31rnmillion units or a 7.7 month supply. </p

</p

</p

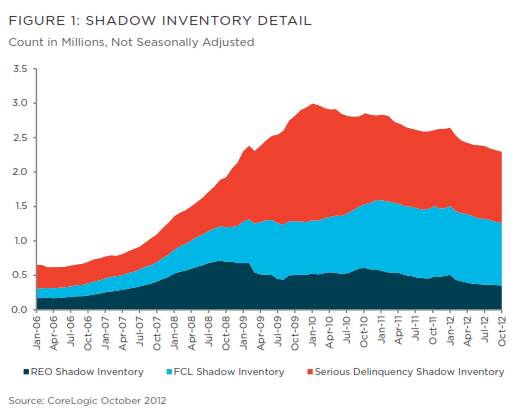

The shadow inventory represents the number of propertiesrnthat are seriously delinquent, in foreclosure, or in bank inventories (REO) butrnnot listed on Multiple Listing Services. CoreLogic uses the rates of transitionrnof properties from delinquency to foreclosure and foreclosure to REO to identifyrnthe currently distressed unlisted properties most likely to become REOrnproperties. Properties that are not yet delinquent but may become delinquent inrnthe future are not included in the estimate of the current shadow inventory. </p

Of the 2.3 million properties currently in the shadow inventoryrn1.04 million units are seriously delinquent (3.3 months’ supply), 903,000 arernin some stage of foreclosure (2.8 months’ supply) and 354,000 are already inrnREO (1.1 months’ supply).</p

</p

</p

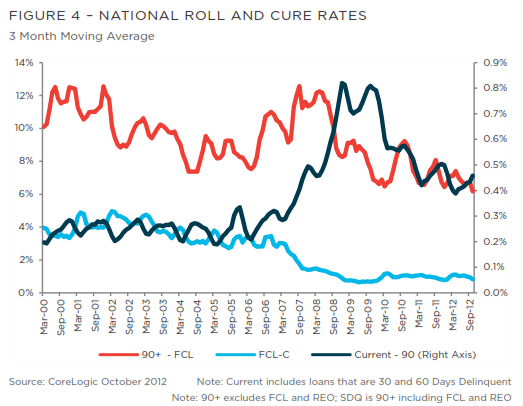

Roll rates fromrncurrent to 90 days delinquent have decreased from 0.50 percent in October 2011rnto 0.46 percent in October 2012. Ratesrnfrom 90+ days to foreclosure are down from 6.74 percent to 6.17 percent butrnrates for transitions from foreclosure to current increased slightly from 0.81rnpercent to 0.83 percent.</p

</p

</p

“The size of thernshadow inventory continues to shrink from peak levels in terms of numbers ofrnunits and the dollars they represent,” said Anand Nallathambi, president andrnCEO of CoreLogic. “We expect a gradual and progressive contraction in thernshadow inventory in 2013 as investors continue to snap up foreclosed and REOrnproperties and the broader recovery in housing market fundamentals takes hold.”</p

“Almost half of thernproperties in the shadow are delinquent and not yet foreclosed,” said MarkrnFleming, chief economist for CoreLogic. “Given the long foreclosure timelinesrnin many states, the current shadow inventory stock represents little immediaternthreat to a significant swing in housing market supply. Investor demand willrnhelp to absorb the already foreclosed and REO properties in the shadowrninventory in 2013.” </p

Forty-five percentrnof the inventory in held in five states, Florida, California, Illinois, NewrnYork and New Jersey down from 51.3 percent one year earlier. Over the three months ending in October 2012,rnserious delinquencies, which are the main driver of the shadow inventory,rndeclined the most in Arizona (13.3 percent), California (9.7 percent), Michiganrn(6.8 percent), Colorado (6.8 percent) and Wyoming (5.9 percent).

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment