Blog

Shadow Inventory Drops Below 2 Million Units, Valued at $314B

CoreLogic said today that completedrnforeclosures ticked up slightly in May compared to April, but thernnumber of homes in process of foreclosure, the foreclosure inventory,rnwas down to about the same degree. Both completed foreclosures andrnthe inventory are lower by double digits than they were one yearrnearlier.</p

The National Foreclosure Report fromrnCoreLogic said 52,000 homes were foreclosed in May compared to 71,000rnin May 2012, a year-over-year decrease of 27 percent. However in Mayrnthere were 2000 more foreclosures completed than in April, anrnincrease of 3.5 percent. By way of comparison completed foreclosuresrnaveraged 21,000 per month in the 2000-2006 period, prior to thernfinancial and housing crisis. Since September 2008 there have beenrnapproximately 4.4 million completed foreclosures nationwide.</p

As of May there were about 1.0 million homes in some stage ofrnforeclosure, down from 1.4 million a year earlier, a 29 percentrndecrease. The May inventory represented 2.6 percent of all mortgagedrnhomes in the U.S. While the May 2012 inventory represented a 3.5rnpercent rate. </p

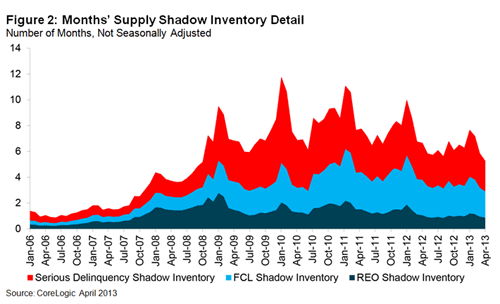

CoreLogic tracks a third measure, the shadow inventory, also knownrnas pending supply, by calculating the number of properties that arernseriously delinquent, in foreclosure or held as real estate ownedrn(REO) by mortgage servicers, but not currently listed on multiplernlisting services (MLSs). The April shadow inventory was under 2rnmillion homes, representing a supply of 5.3 months. At its peak inrn2010 the shadow inventory contained 3 million homes. </p

Of the less than 2 million shadow inventory properties 890,000rnare seriously delinquent (2.4 months’ supply), 761,000 are in somernstage of foreclosure (2 months’ supply) and 336,000 are already inrnREO (0.9 months’ supply). In May the shadow inventory represented 85rnpercent of the 2.3 million properties currently seriously delinquent,rnin foreclosure or REO. </p

</p

</p

The value of shadow inventory was $314 billion as of April 2013,rndown from $386 billion in April 2012 and down from $320 billion sixrnmonths prior, in October 2012. April’s number was down 18 percentrncompared to April 2012 when it was at 2.4 million units. </p

Total delinquencies at the end of May including those 90 or morerndays past due, in foreclosure or owned real estate (REO) was fewerrnthan 2.3 million mortgages or 5.6 percent of all mortgagedrnproperties. This is the lowest delinquency rate since December 2008.</p

Noting the nearly five year low in the delinquency rate, MarkrnFleming, chief economist for CoreLogic said, “Over the last yearrnit has decreased in 42 states by double-digit figures, resulting inrnrapid declines in shadow inventory for the first quarter of 2013.”</p

“We continue to see a sharp drop in foreclosures around therncountry and with it a decrease in the size of the shadow inventory.rnAffordability, despite the rise in home prices over the past year,rnand consumer confidence are big contributors to these positiverntrends,” said Anand Nallathambi, president and CEO of CoreLogic.rn”We are particularly encouraged by the broad-based nature of thernhousing market recovery so far in 2013.” </p

The five states with the highest number of completed foreclosuresrnfor the 12 months ending in May 2013 were: Floridarn(103,000),California (76,000), Michigan (64,000), Texas (51,000) andrnGeorgia (47,000).These five states account for almost half of allrncompleted foreclosures nationally. </p

The five states with the highest foreclosure inventory as arnpercentage of all mortgaged homes were: Florida (8.8 percent), NewrnJersey (6.0 percent), New York (4.8 percent), Maine (4.1 percent) andrnConnecticut (4.1 percent).

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment