Blog

Short Sales Take Growing Share of Distressed Sales

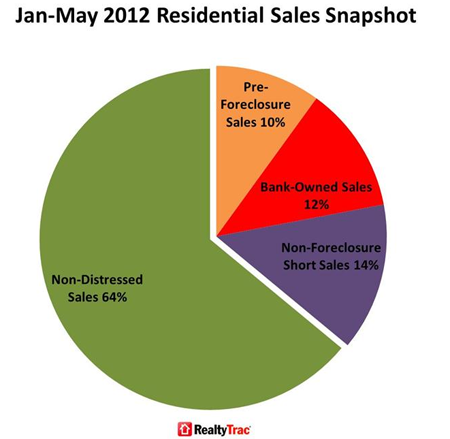

Foreclosed and pre-foreclosed homesrnmaintained their position as the source of over a fifth of U.S. home sales inrnthe second quarter of 2012. Twenty-threernpercent of all residential sales during the period were of bank-ownedrnproperties (REO) or homes in some stage of foreclosure, up from 22 percent inrnthe first quarter of the year and 19 percent in the second quarter of 2011. RealtyTrac, an Irvine, California firm thatrntracks foreclosure activity, reported that an additional 14 percent of allrnsales were short sales, where the bank agreed to a payoff lower than the actualrnoutstanding mortgage balance, that were unrelated to foreclosures.</p

</p

</p

RealtyTrac’s second quarter U.S. Foreclosure Sales Report noted thatrnthe market share of distressed sales increased even though the actual number ofrnthose sales fell 12 percent from the previous quarter and 22 percent from arnyear earlier. A total of 224,429rnforeclosure-related transactions were completed during the quarter.</p

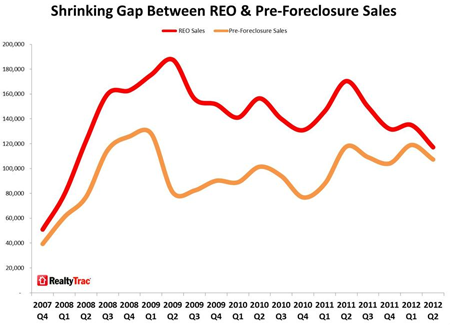

The number of pre-foreclosure salesrn(short sales) continued to rise relative to sales of REO. Foreclosure related short sales accounted forrn107,298 of the distressed sales during the quarter, only 9,733 fewer than bank-ownedrnproperty sales, the smallest difference between the two since 2007. Eleven percent of all sales during the secondrnquarter were pre-foreclosure sales, up from 8 percent in Q2 2011, and these outnumberedrnREO sales in 13 states and the District of Columbia. The 117,131 sales of REO represented 12rnpercent of all sales in the quarter, unchanged from Q1 and one point higherrnthan Q2 2011.</p

</p

</p

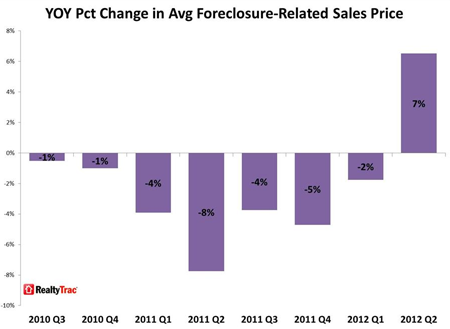

For the first time since the secondrnquarter of 2010 there was an annual increase in the sales price of distressedrnhomes. The average price of $170,040rnreflected a 6 percent increase from the first quarter and 7 percent from thernprevious year. It was also the largestrnbump in average price since late 2006. rnThe average price represented a discount of 32 percent from that of arnnon-foreclosure home, up from a 30 percent discount in both the previousrnquarter and a year earlier.</p

</p

</p

Pre-foreclosure sales closed at anrnaverage price of $185,062, a five percent increase from the previous quarterrnwhich had represented a low point in RealtyTrac reporting history, but thernprice was still 1 percent lower than a year earlier. These sales were at an average discount of 26rnpercent from a market rate sale, up from a 24 percent discount in Q1 and an 18rnpercent discount in Q2 2011.</p

Bank-owned real estate sold for an averagernprice of $155,892, 6 percent higher than in the first quarter and 10 percentrnabove the price in the same quarter of 2011. rnThis represented an average discount of 37 percent unchanged from thernfirst quarter and slightly below the 38 percent discount a year earlier. Thernhighest discounts for distressed property sales were recorded in Texas (41.64rnpercent) and Massachusetts (40.12 percent).</p

“The second quarterrnsales numbers provide solid statistical evidence of what we’ve been hearingrnanecdotally from real estate agents, buyers and investors over the past fewrnmonths: there is a limited supply of available foreclosure inventory to choosernfrom in many markets,” said Daren Blomquist, RealtyTrac Vice President. “Givenrnthis shortage of supply and the seasonally strong buyer demand in the secondrnquarter, it’s no surprise that the average foreclosure-related sales pricernincreased both on a quarterly and annual basis.</p

“Three straight monthsrnof increasing foreclosure starts through July may ease the inventory shortagernsomewhat in the coming months when many of these foreclosure starts translaterninto listed short sales or bank-owned homes,” Blomquist added. “The increase inrnshort sales of properties that have not even started the foreclosure processrnindicates that lenders are moving further upstream to deal with theirrndistressed inventory, thereby avoiding the increasingly complex and lengthyrnforeclosure process altogether.”</p

Short sales took anrnaverage of 319 days to sell after starting the foreclosure process, up from 306rndays in the previous quarter and 245 days in the second quarter of 2011. Itrntook an average of 195 days for REOs to sell after completing the foreclosurernprocess, up from 178 days in both the first quarter and a year earlier.</p

Pre-foreclosure salesrnincreased on a year-over-year basis in 16 states, including Michigan (42rnpercent increase), Illinois (35 percent increase), Connecticut (27 percentrnincrease) and Massachusetts (27 percent increase).</p

Foreclosure sales accountedrnfor 43 percent of all residential sales in both Georgia and Nevada in thernsecond quarter, the two highest percentages among the states despite decreasingrnforeclosure-related sales activity in both states.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment