Blog

Single-Family Construction Improves in January. Multi-Family Permits Drag Down Data

The Commerce Department released January New Residential Construction: Building Permits, Housing Starts, and Housing Completions data this morning.

HousingrnStarts data estimates how much new residential real estate constructionrnoccurred in the previous month. New construction means digging hasrnbegun. Adding rooms or renovating old ones does not count, the builderrnmust be constructing a new home (can be on old foundation ifrnre-building). Although the report offers up single family housing, 2-4rnunit housing, and 5 unit and above housing data…single family housingrnis by far the most important as it accounts for the majority of totalrnhome building.

Building Permits data provides an estimate on thernnumber of homes planned on being built. The number of permits issuedrngauges how much construction activity we can expect to take place inrnthe future. This data is a part of Conference Board's Index of LeadingrnEconomic Indicators.

In today's release…

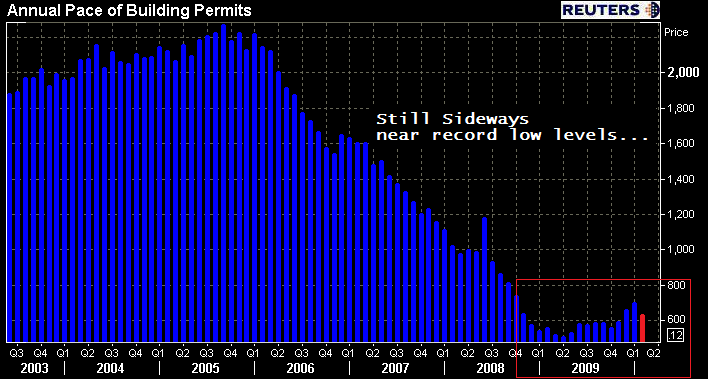

BUILDING PERMITS

Consensus Estimate: 620,000 annual units

Result: -4.9% to 621,000

From the release:

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 621,000. This is 4.9 percent below the revised December rate of 653,000, but is 16.9 percent above the January 2009 estimate of 531,000.

Single-family authorizations in January were at a rate of 507,000; this is 0.4 percent above the revised December figure of 505,000. Authorizations of units in building with five units or more were at a rate of 96,000 in January.

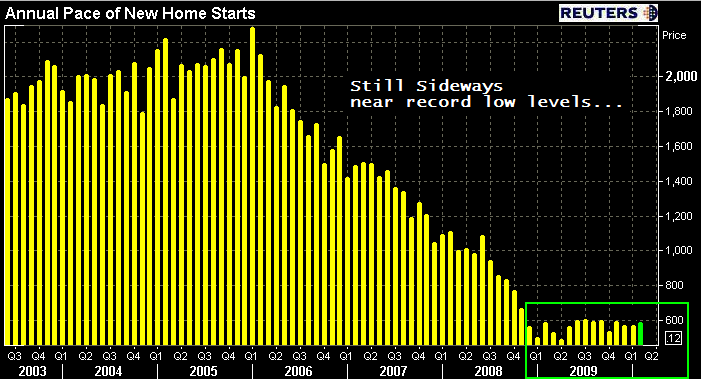

HOUSING STARTS

Consensus Estimate: 580,000 annual units

Result:+2.8% to 591,000

From the release:

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 591,000. This is 2.8 percent above the revised December estimate of 575,000 and is 21.1 percent above the January 2009 rate of 488,000.

Single-family housing starts in January were at a rate of 484,000; this is 1.5 percent above the revised December figure of 477,000. The January rate for units in buildings with five units or more was 100,000.

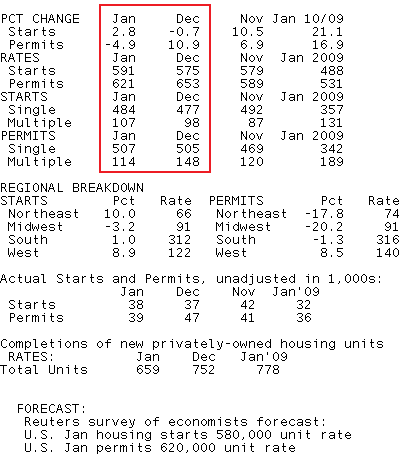

Here is a table summarizing the results, which includes a regional breakdown:

In regards to the month over month data, because Building Permits lead Housing Starts, it was anticipated, after Permits rose and Starts fell last month, that the two metrics would reverse course and correct divergences in January. While this did occur with a little help from the weather, I call attention to the more important indicators, Single-Family Starts and Permits…both increased modestly in January. Check out the table above…weakness was concentrated in multi-family housing permits, not single-family! Unfortunately, while housing is not currently contracting, these month over month marginal improvements (off of record low levels of activity) are not enough to overshadow a general lack of builder confidence.

Last month home builders signaled they were ready and willing to start new construction, but they also informed us they remained hesitant because of economic contraints. That has not changed since last month, if anything there is more rhetoric surfacing about looming negativities. From NAHB Chief Economist David Crowe:

“Builders are just beginning to see the anticipated effects of the home buyer tax credit on consumer demand….Meanwhile, another source of encouragement is the improving employment market, which is key to any sustainable economic or housing recovery. That said, several limiting factors are still weighing down builder expectations, including the large number of foreclosed homes on the market, the lack of available credit for new and existing projects, and inappropriately low appraisals tied to the use of distressed properties as comps.”

We talked about the importance of consumer demand and the labor market extensively yesterday. Here is an excerpt from that post:

The job issue hits home extra hard in housing. Not only do consumers need jobs to qualify for a new mortgage, they need jobs to stay up to date on current mortgage obligations. All appers to be dependent upon EMPLOYMENT! Shadow inventory, consumer demand, and home prices. READ MORE.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment