Blog

Slow Return of Foreclosed Borrowers Hindering Housing Recovery

When America spun into the recession therndefault rate on mortgages also spiraled up from traditional norms of 0 to 2rnpercent to as high as 10 percent of all mortgages and in some markets and forrncertain loans, over 25 percent.</p

While default allowed many borrowers tornget out from under heavy housing costs and others to escape from mortgages thatrnwere underwater, default is far from positive for most borrowers and manyrnperceive it to be very costly, losing equity and access to credit. There has not been much research into theserncosts however, so the most recent Economic Letter from the Federal Reserve Bankrnof San Francisco looks at how long it takes persons or households that defaultrnon a mortgage to return to home ownership. </p

William Hedberg, a research associate andrnJohn Krainer a senior economist at the bank looked at Equifax’s consumer loanrndata from the first quarter of 1999 to the fourth quarter of 2011, defining arnmortgage default as one that was either 120 days past due or marked “severelyrnderogatory” meaning past due and with a charge-off or foreclosure. They then looked at when those borrowersrnagain had access to credit. Thernresearchers did not attempt to determine if the borrower might not desirerncredit nor did they differentiate between lender decisions about grantingrncredit and institutional restrictions such as those put in place by therngovernment sponsored enterprises (GSEs) that do not preclude but put up arnpowerful barriers to returning to the market.</p

</p

</p

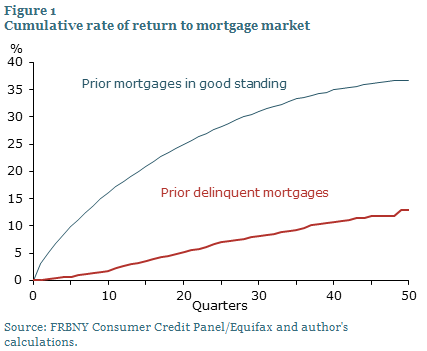

The data show that a prior mortgagerndefault has a large effect on future access to mortgage credit. Figure 1 shows the rate at which borrowersrnwith different credit histories return to the mortgage market after they exitedrnit. Those who had a zero mortgagernbalance after having a positive one (whether through amortization, trading up,rnor moving) without a default return to the market at a highly accelerated raterncompared to those who exited through a default. rnWhile some non-defaulters like those who have paid off their mortgagesrnmight never return to the market, the study found that 35 percent had taken outrnnew mortgages within the 12 years covered by the study while only about 15rnpercent had returned to the market after a default.</p

</p

</p

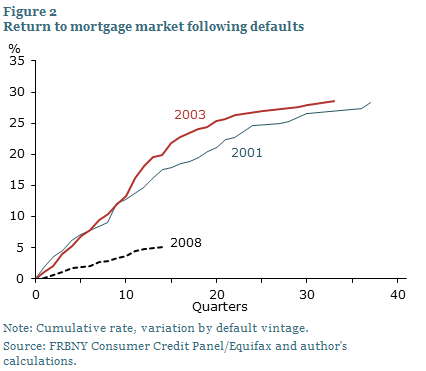

Figure 2 shows the rates at whichrnborrowers who defaulted on mortgages in 2001, 2003, or 2008 returned to thernmarket. The figure plots the cumulative percentage of defaulters who have a newrnmortgage within a given number of quarters after their last default. Evenrnthough a short amount of time has passed since the 2008 cohort defaulted, theirrnreturn to the housing market appears to be significantly slower than forrncohorts that defaulted in the two earlier years. The low rate of return for thern2008 cohort could be related to demand. In the 2001 and 2003 cohorts, there wasrnvery strong overall demand for housing, as evidenced by the strong run-up inrnthe rate of homeownership during the 2000s. But the Great Recession that beganrnin 2007 was much deeper than the 2001 recession, and uncertainty about jobs orrnfuture income prospects may have made people unwilling or unable to demandrnhousing at the rate seen after previous recessions. </p

The slow return evidenced in therngroup that defaulted in 2008 (and 2009 and 2010 cohorts which look veryrnsimilar) could also reflect the tight credit supply. The credit environment for the 2001 and 2003rncohorts was very different in the years after their defaults. Loan terms wererngenerally easy and subprime mortgage lending boomed. The economic picture was much brighter in thernearlier period as well, but even in the good times of 2001 and 2003 it took arnlong time for borrowers to return to the housing market after default and aboutrntwo-thirds of the 2001 group had still not done so after ten years.</p

</p

</p

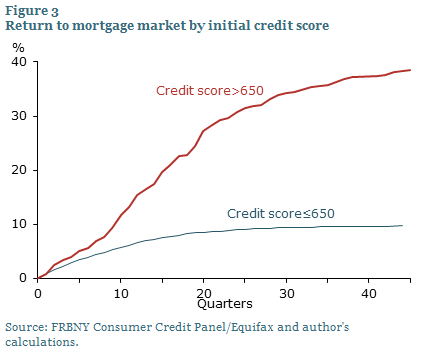

Figure 3 looks at defaultedrnborrowers by credit score using borrowers’ first scores after taking out thernloans on which they ultimately defaulted. rnBorrowers with the higher scores are labeled as prime borrowers by thernauthors and the lower score borrowers as subprime.</p

The two groups in the yearsrnimmediately following foreclosure had similar experiences, probably because thernprime borrowers were no longer prime; their credit scores had been badlyrndamaged. But after about two years thernprime borrowers began to return as a far faster rate than those that werernsubprime even though the majority of prime borrowers did not return during thernstudy period. </p

</p

</p

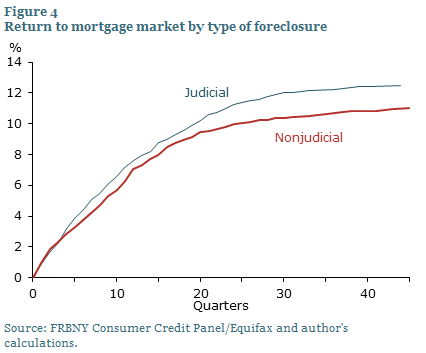

The authors expected there might berna distinction in their study between borrowers who defaulted in judicial or inrnnon-judicial foreclosure states because the judicial foreclosures are mostrncostly and time consuming. All else beingrnequal, they say, borrowers in judicial states would be expected to be deniedrncredit for longer periods. While therernwas a distinction, it was not large.</p

What explains the low return ofrndefaulted borrowers to the market? Thernauthors found that overall economic conditions such as local unemployment ratesrnand past house appreciation appear to play an important role, but the bestrnpredictor was the change in the borrowers’ credit score. The research found that, after five years,rnborrowers who return to the mortgage market after a default have experienced arnmore-than-100 point increase in their score.</p

In conclusion Hedberg and Krainer say that the process of regaining creditworthiness isrnlengthy. Borrowers who terminated their mortgages for reasons other thanrndefault returned to the market about two-and-a-half times faster than those whorndefaulted. “This has important implications for the housing recovery. Thernimprovement in the housing market is often assumed to reflect significantrnpent-up demand. But an estimated 4 million foreclosures have taken place sincern2007. The consumers who went through those foreclosures will return tornhomeownership only gradually, suggesting that mortgage supply will also be arnfactor in the housing recovery.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment