Blog

S&P: Second Mortgage Defaults at Lowest Point in 7 Years

Default rates fell in May for all typesrnof loans tracked by the S&P/Experian Credit Default Indices. For most loan types it was the fifthrnconsecutive drop and four loan types posted their lowest rates since the end ofrnthe recession.</p

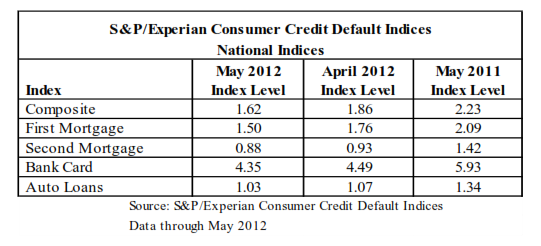

The national composite default raterndeclined to 1.62 percent in May from 1.86 percent in April and the firstrnmortgage rate was down to 1.50 percent from 1.76 percent. Second mortgage defaults were at 0.88 percent,rncompared to 0.93 percent and bank card defaults dropped to 4.35 percent fromrn4.49 percent. Auto loans fell four basisrnpoints to 1.03 percent, a low point in the eight year history of the index.</p

Second mortgage defaults were at theirrnlowest point in seven years and first mortgage and credit card defaults werernthe lowest since May 2007 and 2008 respectively.</p

“May 2012 data show continuedrnimprovements in consumer credit quality,” says David M. Blitzer, ManagingrnDirector and Chairman of the Index Committee for S&P Indices. “Consumerrndefault rates continue to fall and we are reaching new lows across all the loanrntypes. In the last recession, default rates peaked in the spring of 2009, sincernthen the decline has been bumpy but consistent. Only bank cards remainrnabove their pre-recession lows.</p

S&P/Experian covers fivernmetropolitan statistical areas (MSAs) and all five saw their default rates fallrnto post-recession lows. Chicago declinedrnfor the fifth straight month to 1.85 percent, down nearly a percentage pointrnsince December. Miami and New York recordedrntheir fourth consecutive decreases with Miami down by 59 basis points and NewrnYork by 17. Dallas hit an index low atrn0.94 percent, down from 1.25 percent in April and Los Angeles moved downrnslightly from 1.88 percent to 1.82 percent.</p

The table below summarizes the Mayrn2012 results for the S&P/Experian Credit Default Indices. These data arernnot seasonally adjusted and are not subject to revision.</p<p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment