Blog

S&P/Case-Shiller Home Price Index: -0.2% MoM. -3.1% YoY.

Standard and Poor's released the Case-Shiller Home Price Index this morning.

The S&P/Case-Shiller Home Price Indices are constructed to accurately track the price path of typical single-family homes located in each metropolitan area provided. Each index combines matched price pairs for thousands of individual houses from the available universe of arms-length single family homes sales data. The indices have a base value of 100 in January 2000; thus, for example, a current index value of 150 translates to a 50% appreciation rate since January 2000 for a typical home located within the subject market.

NOVEMBER S&P/CASE-SHILLER HOME PRICE INDEX

In last month's release, which reported on home price changes in November, both the 20 city index and 10 city index fell 0.2% on a month over month seasonally unadjusted basis. Year over year, home prices were down 4.5% while the 10 city index fell 5.3%. Seasonal influences were again obvious in last month's release. On an adjusted basis both the 10 city and 20 city were up 0.2% in November. Fall and Winter is a slow time of the year for housing, generally home prices have less support during this time of year.

DECEMBER S&P/CASE-SHILLER HOME PRICE INDEX

20-CITY CONSENSUS ESTIMATE: +0.0% Month over month. -3.2% Year over Year

SEASONALLY UNADJUSTED: Home prices in 20 U.S. cities fell 0.2% in Decemeber. Home prices are down 3.1% since last December. The month over month print was slightly worse than expected, the YoY was marginally better than anticipated but not far from forecasts.

SEASONALLY ADJUSTED: Home prices in 20 U.S. cities rose 0.3% in December.

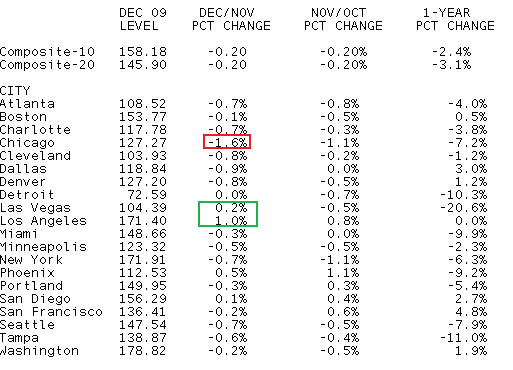

Here is a table of the unadjusted data.

More to come…

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment