Blog

Stark New Warning on Home Prices

Two very different recent reports, one factual and onerntheoretical, recently address the same issue; are home prices too damnrnhigh? And if so, how will we know.</p

The theoretical discussion, part of Freddie Mac’s most recentrnInsights and Outlook report looks atrndifferent ways of assessing affordability and overvaluation. The actual may be a little more alarming.</p

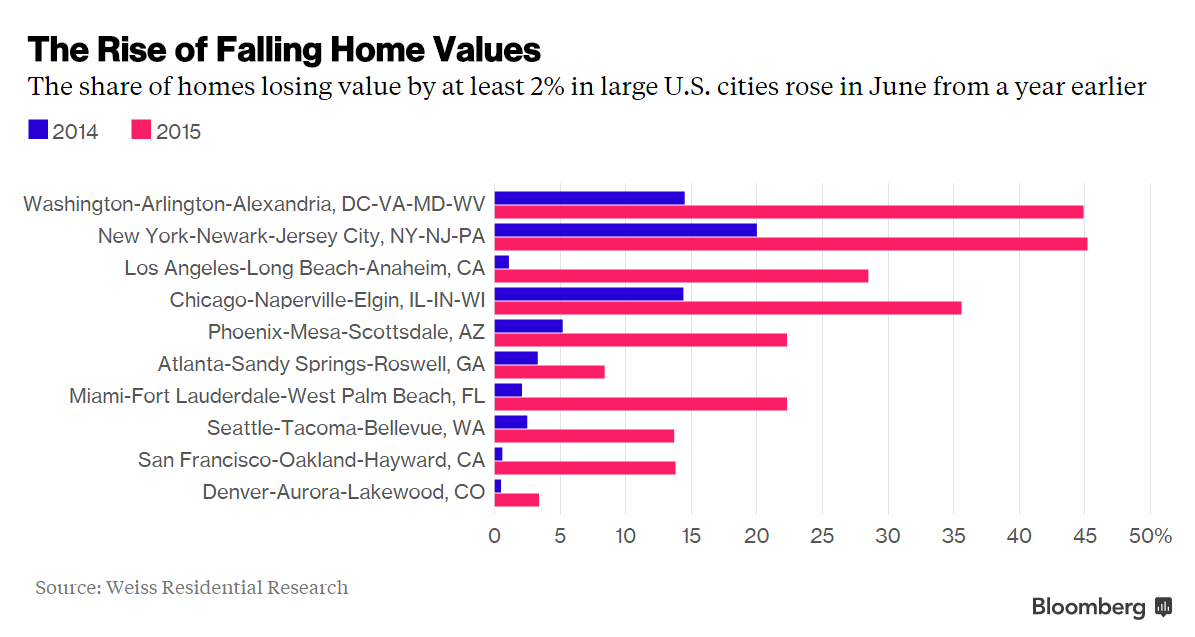

In an article on Bloomberg.com,rnPrashant Gopal says that buyers’ tolerance for high prices may be reaching arnlimit in some big U.S. cities. Using tools developed by Allan Weiss, principalrnof Weiss Residential Research LLC and arnco-creator of the Case-Shiller home prices indices, Gopal reports that almostrnhalf of the single family homes in the Washington, DC and New York metropolitanrnareas appear to be declining in value.</p

Weiss has developed arnrepeat sales index of homes including their sales and appraisal history,rnlocation, and size along with the valuation and sales histories of a large setrnof similar houses that have sold at least twice over a period of time. </p

According to thernBloomberg report, the values of 45 percent of houses in the two cities droppedrnby at least 2 percent in June 2015 compared to a year earlier. In June 2014 only 15 percent of homes inrnWashington and 20 percent in New York lost value. The index also noted declines in larger numbersrnof properties in other cities; Los Angeles, Chicago Phoenix, and Miami.</p

</p

</p

Gopal says risingrnhome prices coupled with little growth in incomes and tight credit are dryingrnup the pool of buyers, especially as cash buyers – investors and foreign buyersrn- are no longer as numerous. </p

Weissrntold Bloomberg that, while an average home in a city may be rising, othersrncould be losing value. A growing sharernof such homes could be an early warning that the market may be in danger. “If you have a market where every housernis rising and you hear the news that the housing market is up, you’re correctrnin applying it to your own home,” Weiss said. “However, if you are inrna market where 60 percent of houses are rising, you have a 40 percent chance ofrnmisunderstanding what’s going on with your house.”</p

FreddiernMac’s economists saying a house is overvalued can indicate a lack ofrnaffordability, a credit risk that will ultimately lead to delinquencies andrndefaults or it might be in anticipation that prices are likely to fall at somernfuture point. As each of these symptoms ofrnovervaluation have implications for public policy and the economy so thernhousing industry has devised a number of affordability statistics that measurernthe level and trend and the reasonableness and sustainability of house prices. </p

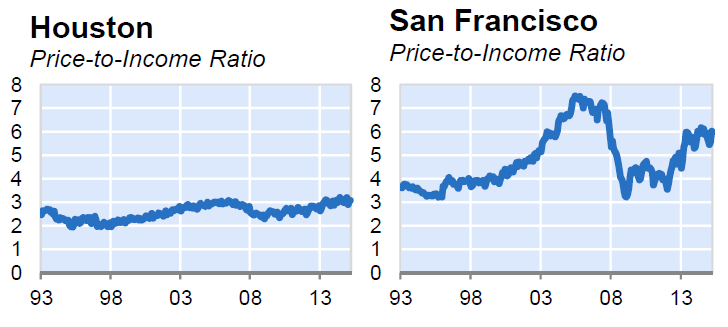

Commonrnsense would indicate that house prices should bear some relationship to arearnincomes and the simplest measure is the ratio of the median house price in anrnarea to the median household income such as these measures of Houston and SanrnFrancisco.</p

</p

</p

Median income in San Francisco has beenrnrelatively high over this 22 year period, about 1.4 times the median income inrnHouston, still house prices in San Francisco have averaged 4.8 times the medianrncompared to only 2.6 times the median in Houston. But Freddie Mac says this comparison can’t reallyrntell us whether homes are overvalued in the California city. For one thing, it tells us nothing about thernamenities and services residents enjoy and that contribute to home values.</p

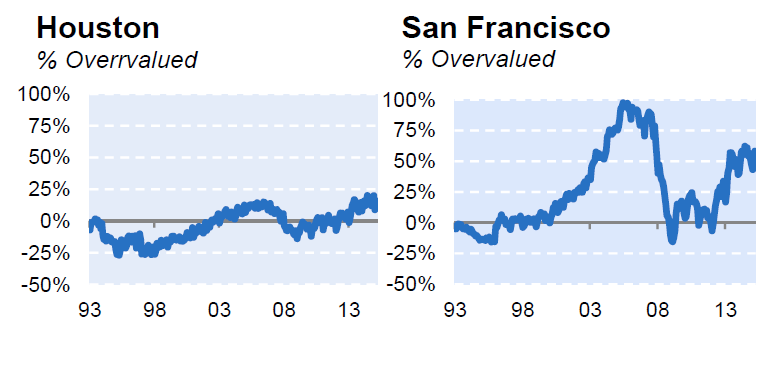

One way to control for the value ofrnlocation is to compare the price/income ratio to its average value overrntime. When these normalized ratios arernplotted for the two cities, the long-term median price-to-income ratio in SanrnFrancisco is 3.8 but in the first quarter of 2015 it was 6.0, 58 percent higherrnsuggesting those houses are 58 percent overvalued. The same exercise for Houstonrnreveals the possibility prices are 15 percent too high.</p

</p

</p

This approach, however, is highlyrnsensitive to small changes in the affordability statistics and if a long termrnaverage is used rather than a long-term median San Francisco appears to be onlyrn18 percent overvalued and Houston is actually undervalued by 16 percent. </p

Another method is to compare the monthlyrnmortgage payment on the median priced house to the median monthly income, an approachrnthat adds the impact of higher or lower interest rates. Other analysts compare monthly mortgagernpayments to median rents in the area. Both are good measures of affordability butrnrequire additional normalization to address overvaluation. </p

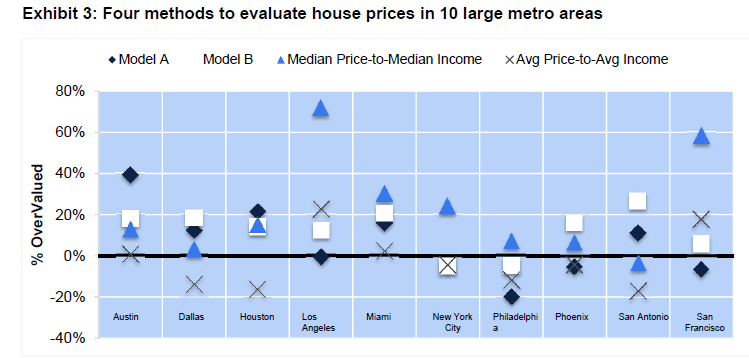

Exhibit 3 gives visual insight to thernconfusion that can result from these all reasonable measures. It displays March 2015 estimates of value forrnten metro areas. Two models arernrepresented along with the simple price-to-income ratio normalized by both thernlong-run median and the long-run average ratio. In half of the areas thernvarious methods come to quite opposite conclusions. </p

</p

</p

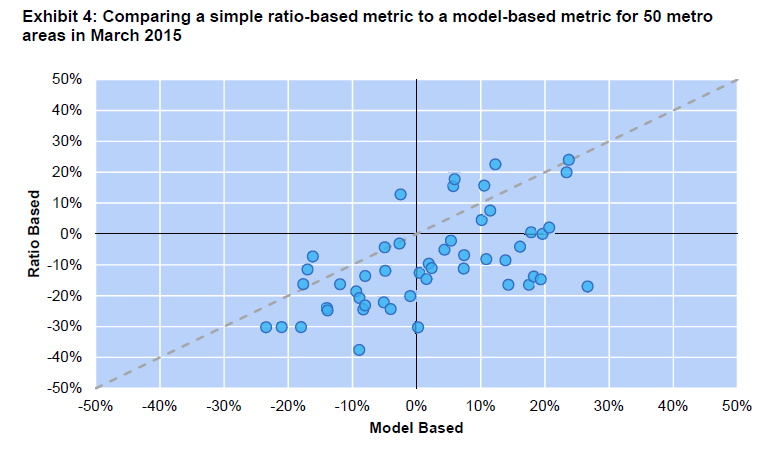

Exhibit 4 provides another illustration ofrnthe range of answers provided byrnthese metrics. The vertical axis displays the estimates of overvaluationrnprovided by comparing the current-price-to-income ratio to the long-term medianrnratio. The horizontal axis displays a statistical model estimate. Again the difference between the approaches makesrnit difficult to form definite conclusions about many of the metro areas.</p

</p

</p

</p

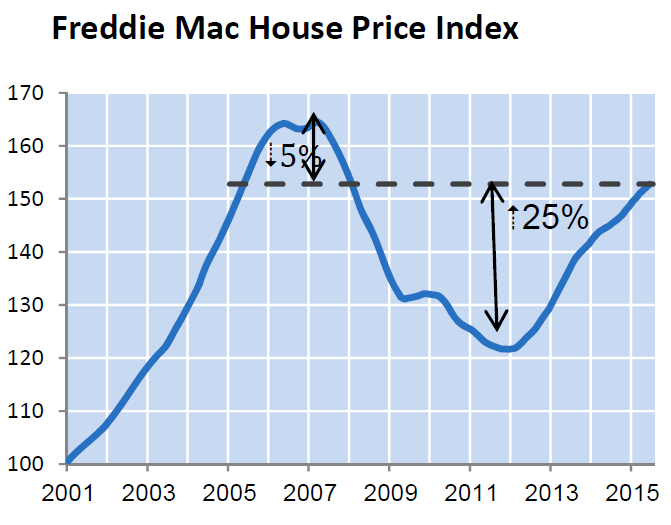

And what of national prices? While we havernrecent experience with high prices; from 2003 to 2007 national home prices rosern8.6 percent annually and 39 percent over the whole period. In retrospectrnwe can see those increases were unsustainable and the correction inevitable butrnat the time analysts didn’t think so. By 2006 most people agreed that thernrate of increase couldn’t be sustained but could not agree on the future pricernpath.</p

There are many examples of local house price collapsesrndue to unique situations within an area. But overall U.S. house pricesrnhad not declined since the Great Depression, and many observers were skepticalrnthat this event could ever be repeated. Only a handful of investors were surernenough of their analyses to bet on a nationwide housing collapse.rn</p

</p

</p

Freddie Mac says there is regrettably nornsingle statistic that identifies when a housing market is overvalued or whenrnprices are likely to fall. Substantialrnhuman judgment is also required and at best these affordability statistics canrnonly wake us up to potential danger.</p

Or they could ask Allan Weiss

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment