Blog

Study Indicates Pre-purchase Home Owner Counseling Works

ThernNeighborhood Reinvestment Corporation which does business under the namernNeighborWorks was created by Congress in 1978 and its national chain ofrnaffiliates function as independent, resident-led, nonprofit community development corporations that include business leaders andrngovernment officials onrntheir Boards. Over 230 local organizations make up thernNeighborWorks network, many of them active inrnpromoting homeownership throughrncounseling, lending, andrnother means. rnSince its inception NeighborWorks has provided pre-purchase homernownership counseling consisting of eight hours of group education andrnindividual counseling sessions. Therncounseling includes an initial orientation andrnoverview of the home purchase process; an in-depth analysis of thernpotential homebuyer’s personal andrnfinancial situation; details about house selection,rnthernfinancing process, the closing, and other key issues of the home buying processrnand post-purchasernconcerns, such asrnhome maintenancernand community involvement.rn</p

Most clients first attend a one- or two-hour orientation session that allows participants to self- select into therndifferent tracks of homebuyer education according to their readiness. Individualrncounseling supplements other kindsrnofrnhomebuyer educationrnby focusing on problemsrnand issues that arernspecific torna particular homebuyer such as budgeting, credit issues, orrndeveloping a savings plan. </p

While there have been numerousrnstudies of the effects of pre-purchase counseling, the NeighborWorks programrnhas never been independently evaluated until a study released this month by NeilrnS. Mayer and Kenneth Temkin ofrnNeil S. Mayer and Associates in conjunction with Experian, a credit reportingrnagency.</p

Using informationrnon about 75,000 loans originatedrnbetweenrnOctober 2007 and September 2009,rnthisrnstudy analyzesrnthernimpact ofrnNeighborWorks-network-provided pre-purchase counseling on the performance of counseledrnborrowers’ mortgages within two years after they are originated, compared to mortgagernperformance of borrowersrnwhornreceive no suchrnservices.</p

Studies ofrnother programs have suffered from selection bias, i.e. that people who enter counseling mayrnhave unobserved characteristics inrnthernwayrnthat they managerncredit that both lead them torncounseling andrnimprovern(or reduce) their mortgage performance. rnExperian employedrna procedure called propensity scoring to identify and create a comparisonrngroup that has thernsamernobservable characteristics asrncounseling clients. Then the authors estimatedrnprogram effects with data from Experian that contains extensiverndetailed information about borrowers’ credit practices andrnbehaviors bothrnatrnoriginationrnand prior tornreceiving their mortgage. </p

The data used inrnthis study consist of information on 18,258rnclientsrnwho received pre-purchaserncounseling from NeighborWorks organizationsrnatrnsome point betweenrnOctober 2007rnand September 2009 and whornalsornpurchased a home within this 24-monthrnperiod. Experian selected a comparisonrngroup of 56,298 borrowers with similar observable characteristicsrnto those of NeighborWorks pre-purchasernclients. Credit file information was augmented with county-level data onrnunemployment ratesrnand MSA-level measures ofrnchanges to house prices. </p

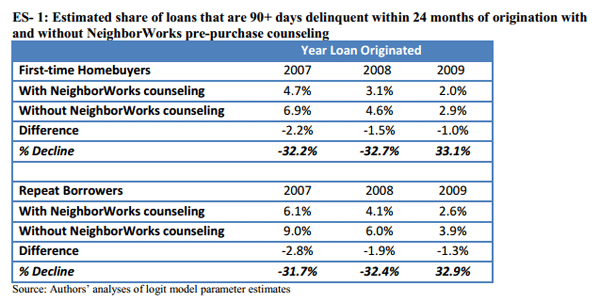

The study found that NeighborWorks pre-purchase counseling andrneducation works. Clients receiving pre-purchase counseling and educationrnfrom NeighborWorks organizations arernone-third less likely tornbecomern90+ days delinquent over the two yearsrnafter receiving their loan than arernborrowers whorndo not receiving pre-purchase counseling from NeighborWorksrnorganizations. The finding isrnconsistent across years of loanrnorigin,rneven as the mortgage market changedrnin arnperiod of financial crisis.rnItrnapplies equally to first-timernhomebuyers and tornrepeat buyers.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment