Blog

Treasury Reports Big Jump in Permanent Loan Modifications

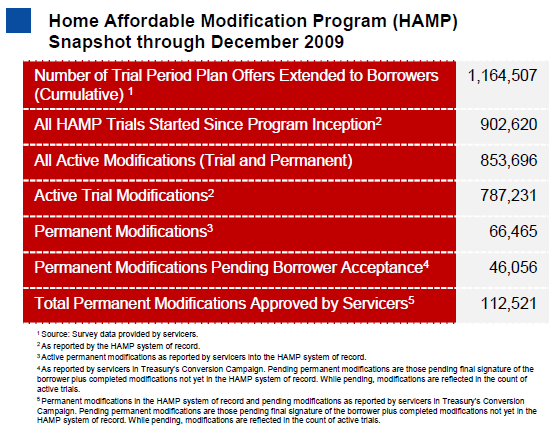

ThernTreasury Department reported Friday that 66,500 of the 902,620rnhomeowners who had started the trial modification period for its HomernAffordable Mortgage Program (HAMP) had completed the three month trial and enteredrninto a permanent modification by the end of December. Another 46,000 have satisfactorily completedrnthe trial and have been given final documents but have not yet signed andrnreturned them.

Although only a 7.4% conversion rate, this is more than double thern32,400 signed permanent modifications reported at the end of November.

The below chart from the REPORT provides a snapshot of HAMP progress since inception.

Thernprimary goal of the HAMP program is to reduce the monthly payment of thernborrower to no more than 31 percent of monthly income. This has beenrnaccomplished for all participants in both the trial and permanent program with arnmedian reduction in monthly payment of $516. rnThe median front-end debt-to-income ratio at the start of the programrnwas 45 percent and the back-end ratio was 72.2 percent. The median of the latter ratio has been reducedrnthrough modifications to 55.1 percent.

ThernTreasury Department's Servicer Performance Report showed that trial plans hadrnbeen offered to 1,164,507 borrowers since the program began in mid springrncompared to 1,032,800 reported in November. About 101,000 homeowners enteredrnthe program in December, bringing the cumulative total to 902,620. More than 787,000 are still in some phase of therntrial.

Inrnaddition to the interest rate reduction, 43.2 percent of participants havernreceived an extension in the term of their loan and 26.6 percent were grantedrnsome form of principal forbearance in order to reach the 31 percent ratio.

The 100rnpercent increase in the number of loans moving to permanent status has comernafter much criticism of the program for its poor conversion rate. The servicers who are responsible forrnimplementing the HAMP program have complained that borrowers are not completingrnthe required documentation while borrowers and consumer groups have blamed thernservicers for managing the program poorly, failing to respond to borrowersrnquestions and losing the documents. ThernTreasury Department announced last month that it was attempted to streamlinernthe process for borrowers and was stepping up its supervision of servicers andrnwould even be withholding incentive payments until conversions are complete.rnOfficials reported today that they have placed staff members on site to assistrnservicers and had implemented a temporary review that will extend to Jan 31 tornassure that borrowers are being fairly evaluated for the program.

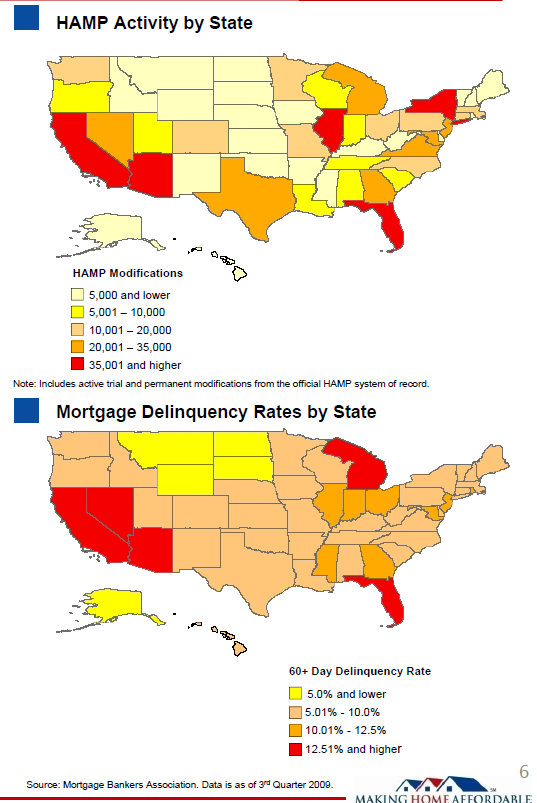

In spiternof the doubling of conversions last month, the actual numbers of conversionsrnremain small compared to the numbers who have entered the program not tornmention the numbers who may be eligible to do so. In California, a state with among the highestrndelinquency rate, 13,353 permanent modifications have been signed out ofrn172,288 borrowers who have entered the program. rnIn Florida the number is 8,405 out of 105,108, in Arizona, 4137 ofrn43,126. We could find no state in whichrnthe conversion rate was over 10 percent.

Here is a summary of HAMP Activity by State:

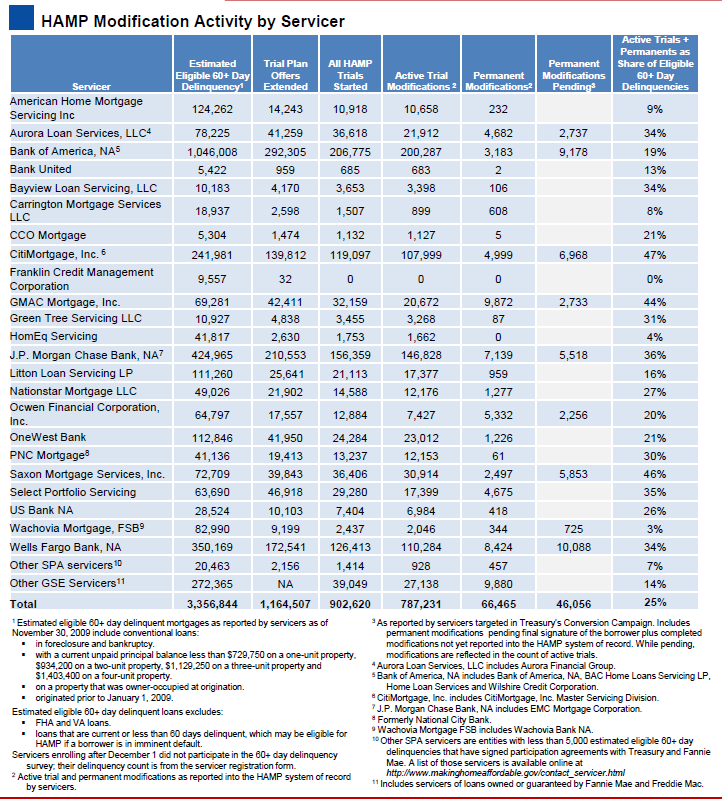

Servicerrnperformance appears to be quite erratic, both in enrolling borrowers in thernprogram and in converting modifications to permanent status. Citi Mortgage hasrnthe best record with 47 percent of the 60+ day delinquencies in its portfoliornenrolled. However, out of 119,097 trialsrnstarted, only 5,000 are now permanent and 7,000 permanent modifications arernpending. GMAC and Saxon have bothrnenrolled over 40 percent of their delinquent borrowers in the program and arernboth over 20 percent in completed or pending conversions. More than half of the servicers covered byrnthe report, however, have enrolled less than 20 percent of their borrowers inrntrials and one servicer has enrolled none of its 10,000 delinquent borrowers inrnthe program.

Here is an overview of servicer participation from the release:

Participantsrnin HAMP have most commonly reported that they fell behind on their mortgagernpayments because of a curtailment of income. rn52 percent of borrowers cited this as their hardship reason. Excessive debts were the reason given by 11.2rnpercent and unemployment to 5.6 percent. rnIllness of the borrower accounted for 2.7 percent of the reasonsrnreported in hardship statements.

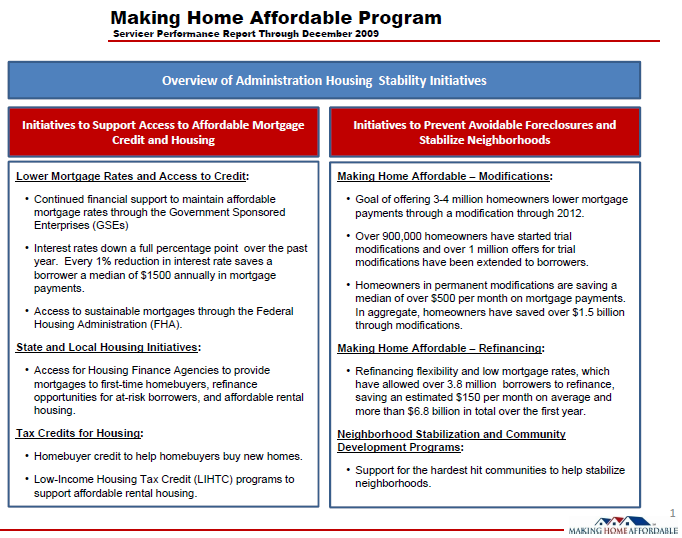

HAMP wasrndesigned to help three to four million homeowners avoid foreclosure. Itrnrequires that the monthly payment of enrollees be reduced to no more than 31rnpercent of monthly income and that borrowers keep payments on the modifiedrnloans current for a three month period before the changes are made permanent.

Here is an overview of the Adminstration's Housing Stability Initiatives:

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment