Blog

Unsustainable Home Prices in 14 Metro Areas -CoreLogic

CoreLogic has released figures showing that residential realrnestate in 14 of the 100 top real estate markets in the country were overvaluedrnin the second quarter of 2015, twice the number as in Quarter 1. By overvalued CoreLogic means these marketsrnhave increased well above their long-term sustainable prices as measured by eachrnarea’s real disposable per capita income.</p

The Austin-Round Rock metropolitan area has what is by far</bthe largest degree of excess valuation as measured by CoreLogic's Home PricernIndex – 42.3 percent above its sustainable level and 31.2 percent higher thanrnat its peak level prior to the 2007 downturn. rnPrices in Austin increased 10.4 percent in 2013 and 16.3 percent inrn2014.</p

Houston-The Woodlands-Sugarland was second on the CoreLogicrnlist with 25.4 percent overvaluation, and prices 22.7 percent above thernpre-2007 peak. Three of the fourrnremaining large Texas markets also made the list – Dallas-Plano-Irving atrnnumber eight, San Antonio-New Braunfels in ninth place, and FortrnWorth-Arlington in 12th place. </p

CoreLogic said the Texas markets are well above theirrnpre-2007 peaks partly due to strong job growth and partly due to the boom-bustrncycle that occurred in most of the country. rnThe oil and gas boom fueled job and population growth I the area betweenrn2006 and 2014 but oversupply has put downward pressure on energy prices whichrnmay intensify over the next few years and impact some of the high-flying Texasrnmarkets. </p

Charleston-North Charleston in in third place, overvalued byrn13.4 percent although less than 1 percent above its pre-crash peak. It is followed by Miami-Miami Beach-Kendall,rn20.6 percent above its sustainable level but still 25.3 percent below its peak,rnand Washington-Arlington-Alexandria DC-VA at 19.2 percent while remaining 11.5rnpercent off of pre-2007 prices.</p

Markets that have joined CoreLogic’s list since the firstrnquarter of 2015 are Knoxville in sixth place, overvalued by 14.4 percent, numberrnseven, Philadelphia at 14.2 percent; Nashville-Davidson-Murfreesboro-Franklin (tenthrnplace, 12.3 percent) and Cape Coral (number 11 at 11.1 percent overvaluation). Numbers nine and ten, SilverrnSpring-Frederick-Rockville, Maryland (10.1 percent) and Denver-Aurora-Lakewoodrn(10.0 percent) are also new to the list this quarter.</p

</p

</p

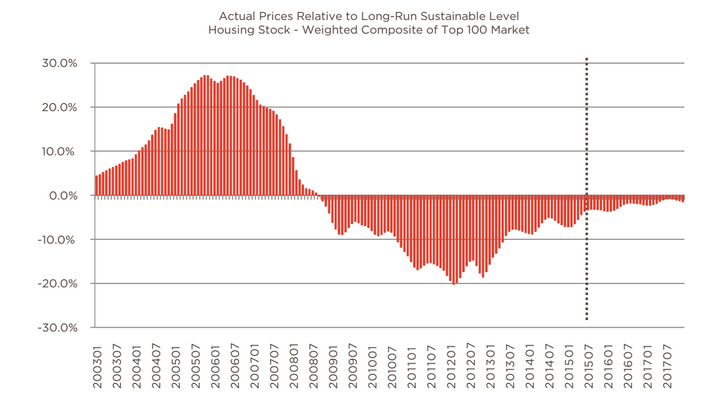

The figure above shows the gap between home prices and thernlong-run sustainable values for the weighted average of the 100 markets. From 2005 to 2007 home prices were more thanrn10 percent above sustainable levels then they fell quickly to more than 10rnpercent below that level from 2010 through 2013. Since then, as home prices continued to rise,rnthe gap narrowed to 3.6 percent below the sustainable level at the end of the secondrnquarter. The gap is expected to remainrnwithin the normal range, shrinking to 1.5 percent by the end of 2017.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment