Blog

Vacancies up, Rents Moderate, but 2015 still Looks Solid for Multifamily

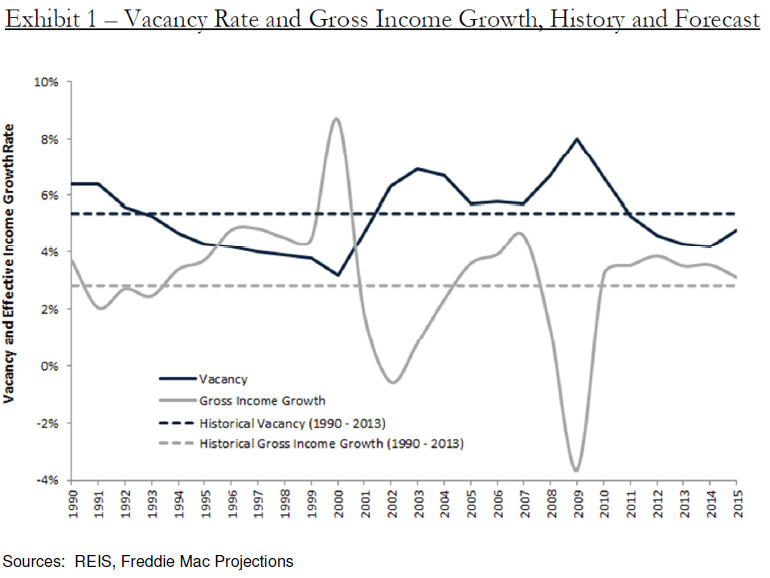

Thernmultifamily market outperformed many predictions in 2014; vacancy levels,rndespite a flood of new properties, declined by 10 basis points from 2013 to arn13-year low of 4.2 percent. Revenue per unit rose, continuing the pattern thatrnhas led to a 20 percent increase over the last five years. </p

FreddiernMac’s economists are predicting that, while easing a bit from 2014, this year willrnbe another strong one for the sector. rnIts 2015 Multifamily Outlook</iprojects that demand, driven by the millennial generation, will remain strongrnbut construction of units in buildings with five or more will continue to trendrnupward so vacancies will rise. </p

Supply,rnthey say, could actually outpace demand this year and the vacancy rate willrnprobably rise by 60 basis points to 4.8 percent by year-end. This however is still below the historicrnaverage of 5.4 percent. This negative isrntempered by an unknown; how much pend-up demand will be unleashed as householdsrnform that would have been formed earlier were it not for the recession. </p

Addingrnto the favorable outlook is the overall economy which is expected to grow 3rnpercent this year and an unemployment rate that is closing in on the FederalrnReserve’s definition of full employment. rnThe later should translate into rising wages which in turn shouldrnencourage more household formation and increasing demand for rentals. </p

Otherrnfactors that could drive the multifamily market in one direction of the otherrnis how the price of oil will impact employment in energy-dependent economiesrnand the trajectory of interest rates. </p

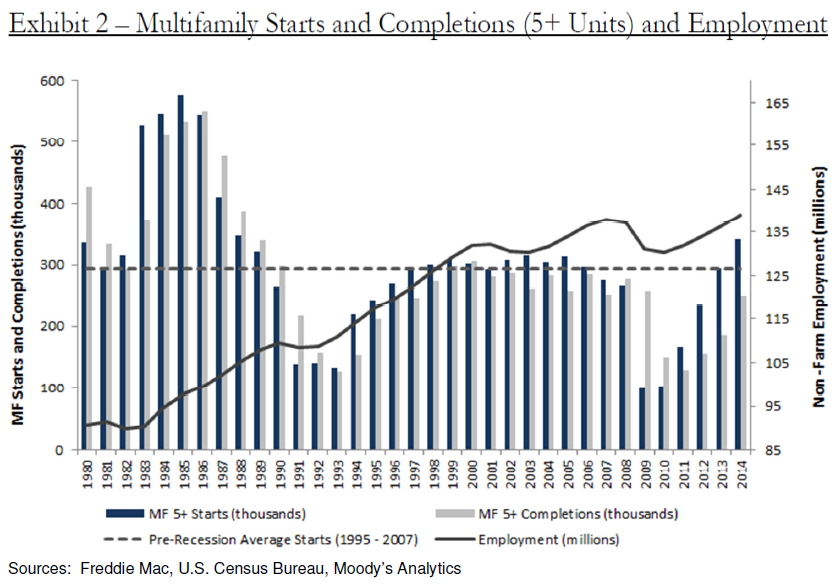

Completionsrnof multi-family units are expected to surpass their long-run average this yearrnand remain above average for several more years while at the same time demand,rndue to favorable demographic trends and expansion of the labor market, willrnremain strong and result in continued rent growth this year driven by therncoming of age of peak number of millennials which should continue through 2023.rn</p

Therernis considerable lag between starts and completions of multi-familyrnhousing. In 2014 completions increased byrnabout 67,000 units or 36 percent year-over-year to a total of 251,000rnunits. This was 18,000 below thernlong-run average from 1995-2007. Thernpace of construction is expected to slow but permits are still increasing sornstarts and completions will continue to increase for several more years.</p

</p

</p

Vacancyrnrates will not only rise nationally but in most Metropolitan Statistical Areas (MSAs)rnas well as new construction comes on line and rents are expected to respond</baccordingly. While growth will moderaternfrom 2014, rents will still rise by 3.1 percent. They will, however grow more slowly in manyrnareas and become flat or even decline in some markets. </p

</p

</p

The report says Freddie Mac estimatedrnlast year that the supply of new multi-family units needs to be around 440,000rnannual to meet demand including that from households that delayed formationrnduring the recession. While completionsrnwill rise above the historic average of 270,000 this will not meet long-term demand. “While the timing of the realization of pent-uprndemand is hard to predict, they expect that the wave of current supply will notrndisrupt the market and will be absorbed within the mid-term.”</p

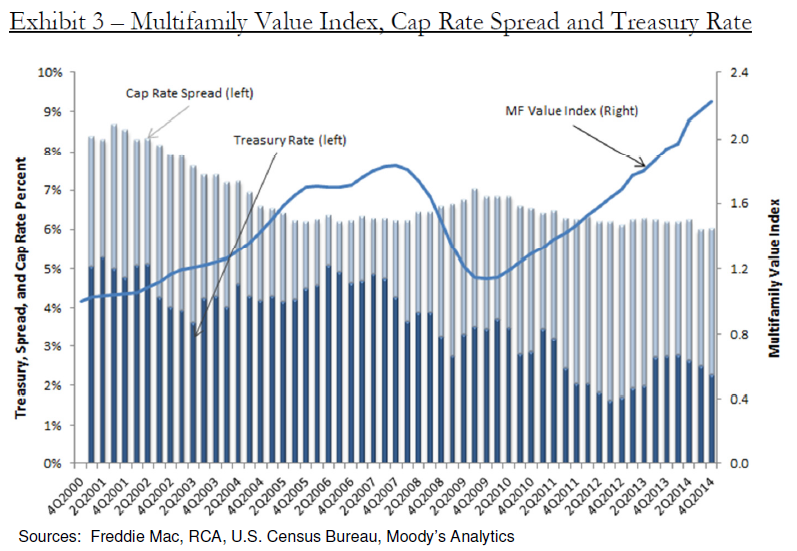

Consistentrnwith the revenue growth noted above, property prices also advanced robustly inrn2015, rising about 15 percent and this appreciation is expected torncontinue. Cap rates decreased by 16 basis points duringrnthe year, ending at 6 percent and Freddie Mac anticipates that cap rates willrnstay below that rate for the year. </p

</p

</p

Multi-family<borigination volume ended the year about $185 billion, $13 billion more than inrn2014 due to a strong second half of the year. rnThat finish can be attributed to declining interest rates, increasingrnconstruction completions, and increasing property prices. Freddie Mac expects that investors will takernadvantage of low rates by refinancing debt or funding new completions andrnexpects another substantial year for multifamily originations. It also expects that the sharp increase inrncommercial mortgage-backed security conduits, while still only a small share,rnwill continue.</p

Another unknown is energy prices. A continued decline could affect the economyrnin contradictory ways; lower prices are likely to lead to more economic growthrnbut energy dependent areas could be hurt by layoffs and cuts in capital spending. The biggest concern is in Texas, especiallyrnHouston but the area is more diversified than during the last energy crisis sornit is unlikely it will fall into a recession. </p

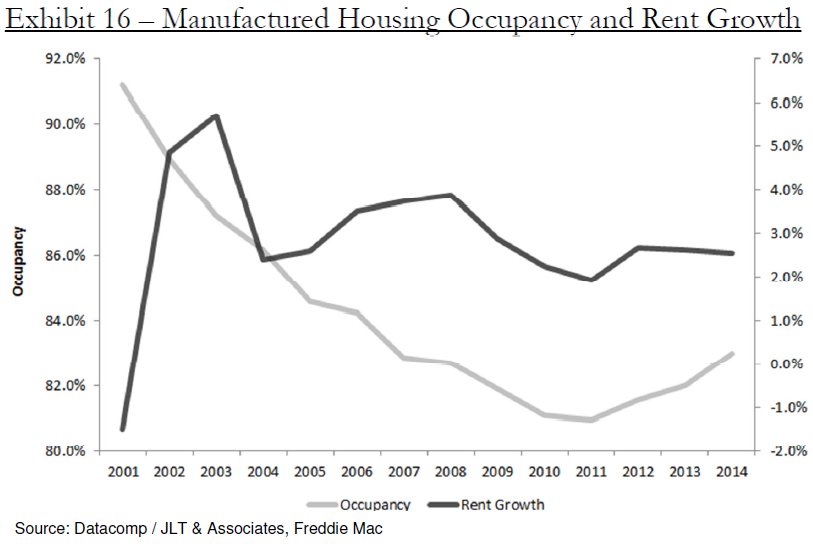

The report contained a specialrnsection analyzing manufactured housing which has seen growing popularity inrnresponse to the growing unaffordability of traditional housing. Average rent for manufactured housing in was $450,rnwhich was 42 percent lowerrnthan the median for arntraditional multifamily unit.</p

Nationwide 6.7 millionrnhouseholds reside in this housing or 5.8 percent of total households. About one-third of these are renters. More than half of manufactured units arernlocated in six states in the Southeast Region and California and Texas and isrnmore prevalent in smaller cities and municipalities. After falling during the recession, occupancyrnin this housing is trending up while rent growth remains below pre-recessionrnlevels.</p

</p

</p

Freddie Mac says it expects thernsupply of manufactured housing that will be delivered this year to surpassrnpre-recession levels; market dispersion will become more pronounced, and thernhousing is expected to be a vehicle to help bridge the housing affordabilityrngap.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment