Blog

Watchdog Calls for Tighter Leash on Fannie, Freddie Compensation

Therncompensation paid to executive officers of the two government sponsoredrnenterprises (GSEs) Freddie Mac and Fannie Mae has generated a lot of attentionrnboth from the media and from Congress. rnThe Federal Housing Finance Agency (FHFA) as conservator of the GSEs isrnresponsible for oversight of GSE compensation programs and it estimates that inrn2011 the two GSEs collectively paid 90 executives a total of $92 million, and 2,000 senior professionals a total of approximately $455 million. Since 2009, FHFA has directly overseen the GSE’s compensation of their two CEOs and approximately 90 other executivesrnbut has delegated to the GSEs the setting of compensation levels for all other employees. The Congressional Budget Office estimatesrnthat the GSEs pay their 11,900 employees about $2 billion annually.</p

FHFA and thernGSEs have stated that the current levels of compensationrnare necessary to recruit and retainrntalented executives and other employees. In 2011, Congress held oversight hearings on thernappropriateness of GSErnexecutive compensation, and legislative measures limiting it were introduced. In March 2011, FHFA-OIG issued a report that evaluatedrnFHFA’s oversight of the GSEs’ executive compensation programs, specificallyrnthat of their six most-senior executives. </p

TodayrnFHFA OIG released a second report, FHFA’s Oversight of the Enterprises’rnCompensation of their Executives and Senior Professionals, examining pay practices affecting approximately 2,100 employees, including nearly 90 executives and 2,000 seniorrnprofessionals. It updates thernearlier report with information on subsequent initiatives and provides comprehensive data onrnsenior professional compensation in 2010 and 2011.</p

Since OIG issued itsrninitial report, FHFA has taken several steps to strengthen its control and oversight of GSE executiverncompensation. In March 2012,<bFHFArnrevised their compensation packages, which will resultrnin significant reductions in the compensation of their CEOs and much smaller reductions in therncompensation of other executives. Further, FHFA has issued a written policy governing executive compensation and conducted examinations to assess GSE procedures.</p

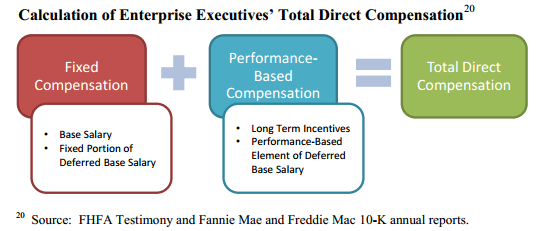

Afterrnassuming the conservatorship in late 2008 FHFA, in coordinationrnwith Treasury, developed compensation packages for thernGSEs’ executives to alignrnexecutiverndecision-making with the long-term financial prospects of thernGSEs, minimize costs to taxpayersrnand ensure that they could recruit andrnretain talented executives and professionals. rnThe key elements of the executive compensation packages were:</p<ul class="unIndentedList"

</p

</p

Fannie Mae’s and Freddie Mac’s former CEOs receivedrna total of $10.7 million in cashrncompensation or “take home pay” pursuant to the package. The median cash compensation at thernExecutive Vice President (EVP) level declined by 8.8 percent to $1.7 million inrn2011 and the median level for senior vice presidents (SVP declined fromrn$763,000 to $724,000 from 2010 to 2011. rnThis decline was likely due to a variety of factors including a 2010 payrnfreeze FHFA implemented which limited pay increases to promotions and tornturnover at high levels. </p

In 2012, both GSEs hired new CEOs under executiverncompensation packages approved by FHFA in March of thatrnyear. The packages eliminated LTI and reduced executives’ annual compensation, other than that of the CEOs, by 10%. Although FHFA initially targeted CEO total direct compensation at $500,000, Freddie Mac’s new CEO will earn $600,000. Thisrnrepresents a reduction of cash compensation of 88%rnfromrnthe $5.1 millionrnthat the former CEO received in 2011. An FHFA official explained thatrnthe figure incorporated all factors necessary to attract the candidate, including his commutingrnand living expenses.rn</p

Fannie Mae’s new CEO was already employed as Chief Administrated Officer, General Counselrnand Corporate Secretary andrnFHFArnagreed that hernwould be compensated in accordance with the terms of his previousrnposition however his totalrndirect compensation will be reduced to $600,000 starting on January 1, 2013, which is 89%rnlower than the $5.6 millionrnthat Fannie Mae’s former CEO received in 2011.</p

FHFArnand GSE officials have expressed concern that thesernreductions in compensation could make it more difficult for the Enterprises to recruit and retainrnexecutives and other employees, especially if the pay freeze put inrnplace in 2010 remains in effect indefinitely.rn</p

FHFA has taken several other steps to strengthen its oversight of executiverncompensation including implementingrnrecommendations in OIG’s March 2011 report;rndeveloping written guidelines governing its oversight and reviews of executive compensation and completingrnexaminationsrnto assessrnthe GSEs’ processes forrnsetting individual executiverncompensation levels. rnFHFA has also establishedrnprocedures to routinelyrnreview GSE requests to promoterntheir executives.</p

As compared to its oversight of executiverncompensation, FHFA’s oversight of the GSEs’rncompensation of approximately 11,900 non-executive employees, including about 2,000 senior professionals, has been limited, In addition to imposing the comprehensive payrnfreeze, FHFA commented on proposed changes to Freddie Mac’s compensation structure for non- executives in 2012, and approved several employee retentionrnpayments. It hasrnnot reviewed, examined, or tested compensation programs as cost mitigating actions nor has it assessed thernGSEs’ use of promotions and job changes to determine if they arerndesigned to circumvent the pay freeze.</p

FHFA’s relatively limited oversight of non-executive compensation is consistent with its view that delegating such day-to-day business decisions to thernGSEs is the mostrneffective means of managing the conservatorshipsrnand OIG recognizes this. Nevertheless OIG also believes that FHFArnshould be reasonablyrnsure that compensation controlsrneffectively preserve and conserve GSE assets and limitrntaxpayer-related costs. Moreover, it may be appropriate to enhance oversight of senior professionals since as a group ofrnfewer than 2,000 individuals they collectively received $455 million in cashrncompensation in 2011.</p

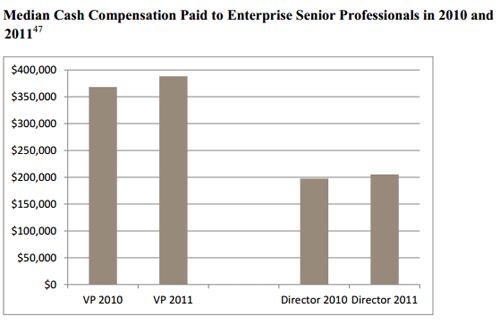

Thesernsenior professionals serve throughout their organizations. VPs typically implement strategies set by divisionrnheads; guide the resolution of complex business decisions; andrnfocusrnapproximately 70% of their time on either customer or regulatory relations.rnTypically, VPsrnhave 10 or more years of relevant experience. Directors generally report to VPs or SVPs and are responsible for one or more departmental areas within a division, implementing strategies set by divisionrnheads and havingrnday-to-day responsibility for the work product produced by their departments.rnThey typically have eight or more years of experience.</p

Senior professional compensation packagesrnare similar to those of executives including annual base pay and “other compensation,” but base pay accounts for a larger sharernthan in the case of executives because senior professionals are less directlyrnaccountable for the GSEs’ overallrnperformance.rn </p

EachrnGSE’s approachrnsetting senior professional compensation levels isrngenerally similar in that both use market data in the process and both employ consultingrnfirms that conduct confidential compensation surveys within a range of industries including financial servicesrnand both seek to establish target aggregate compensation at thernidentified median market level. rnThey differ in the details of establishing target levels. In 2011 thernmedian value of the VPs’ totalrncash compensation paid was $388,000 and the median for Directors was $205,300.</p

</p

</p

Beyondrnthe ongoing pay freeze, FHFA’s oversight has been limited and it has not reviewed or examinedrnnon-executive compensation costsrnto determine if they are reasonable and justified. OIGrnfound several general issues andrnrisks associated with Senior ProfessionalrnCompensationrnStructures merit review. </p<ul class="unIndentedList"

OIG tested GSE compensation offers made tornpotential hires in 2011 at a particular seniorrnprofessional rank.rnOIG found that offers were notrnconsistent between the two GSEs and that variation was sufficient to warrant further scrutiny by FHFA. Without testing and verification on a larger scale, FHFA lacks assurance that GSE compensation can be supported.</p

FHFA has established a process to review GSE implementation of the 2010rnmandated pay freeze with respect to theirrnexecutives,rnrequiring the GSEs to submit proposed executive promotionsrnfor review and approval. However FHFA has not yet conducted any similar reviews or examinations with respect to senior professionals and otherrnemployees although officials saidrntheyrnare planning to do so. OIG observes that the median cash compensation paid to senior professionals increased as much as 5% in 2011, despite the imposition of thernpayrnfreeze. It is possible that LTI payments accountrnfor much of this increase, but promotions and changes in responsibility also may have played a role. However,rnlacking reviews or examinations, FHFA is not in a position to determine whetherrnthe GSEs are consistently enforcing the pay freeze or using promotions and/or changes in responsibility to offset it. </p

OIGrnconcluded that over the past year, FHFA has increased itsrncontrol and oversight of the GSEs’ executive compensation of $92 million annually. Although this focus isrnappropriate, executiverncompensation is a comparatively small portion of overall expenditures in this area. Accordingly, OIG believes that FHFA has a responsibility to enhancernits current non-executive compensation oversight through reviews or examinations. </p

The plan should set priorities, ensure that available staffing resources are commensurate with them, and establish an appropriate timeframe for its implementation. The Agency should consider including the following items as priorities:</p<ul class="unIndentedList"

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment