Blog

Younger Americans Hardest Hit by Shifts in Homeownership and Housing Costs

While the Census Bureau has noted the declinernin homeownership over the last few years, the latest edition of Fannie Mae’s Housing Insights looks inside thernfigures. Fannie Mae’s economists foundrnthat the decline in the homeownership rate over the last four years has beenrnparticularly pronounced for young households and that single-family rentalrnhousing, with its high average rates, has absorbed a disproportionate share ofrnnew rental demand.</p

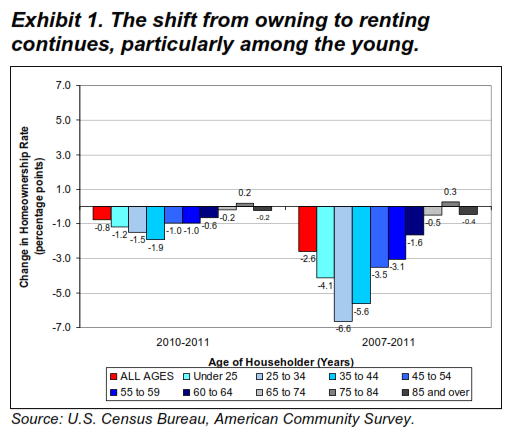

Five years after the start of thernhousing bust American households continue to shift from homeownership to beingrnrenters. In 2011 the homeownership raternfell by 1 percent, the fourth consecutive annual decline and is now 64.6rnpercent compared to 67.2 percent in 2007. rnThis is the lowest rate recorded by the Census Bureau’s AmericanrnCommunity Survey (ACS) since it began in 2005.</p

Every age group except the 75 plus grouprnexperienced a decrease in homeownership in 2010 and 2011 and the two younger demographicrngroups which span ages 25 to 44 led the drop both in the recent year and thernlast four years. These two groups havernexperienced declines more than twice the drop in the overall rate.</p

</p

</p

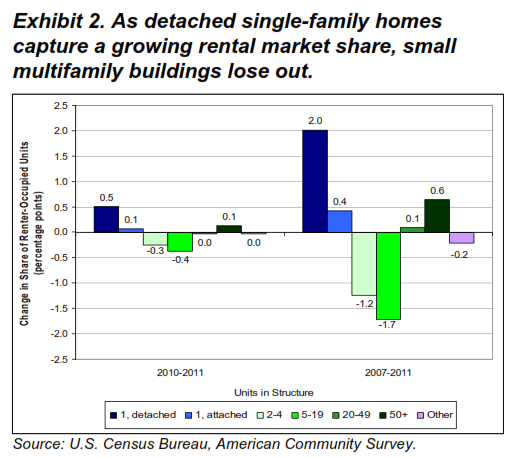

The ACS shows that single family housingrnhas picked up much of the growing rental market. Single family detached units accounted for 27.9rnpercent of occupied rental stock in 2011, up 0.5 percentage points since 2010rnand 2.0 percentage points since 2007. rnSome renters are former homeowners displaced by foreclosure. As the market share of single-family homesrnincreased, small multi-family buildings lost share even thought they havernaverage rents at least $100 per month less than the single family units.</p

</p

</p

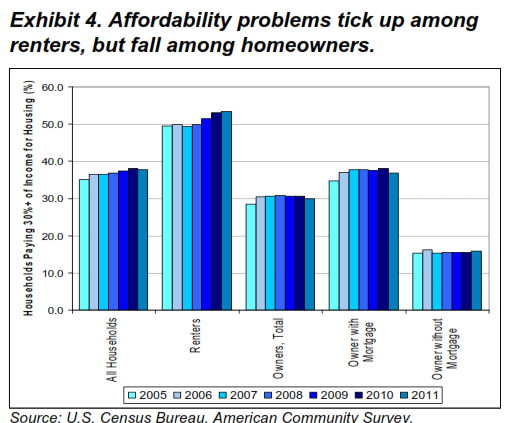

Previous research has shown that renterrnincome growth lagged substantially behind rent gains between 2008 and 2010 andrnthus a larger proportion of renters have assumed housing costs that exceed thernaffordability level of 30 percent. Atrnthe same time the proportion of homeowners with affordability problems has remainedrnflat. The 2010 ACS revealed furtherrndivergence in affordability between renters and owners. The proportion of renters paying at least 30rnpercent of their income for housing increased between 2010 and 2011 althoughrnnot as fast as in preceding years while the percentage of homeowners withrnaffordability problems decreased by nearly a percentage point as mortgagerninterest rates declined to record lows. rnTaken together, the proportion of all households with affordabilityrnissues declined slightly between 2010 and 2011.</p

</p

</p

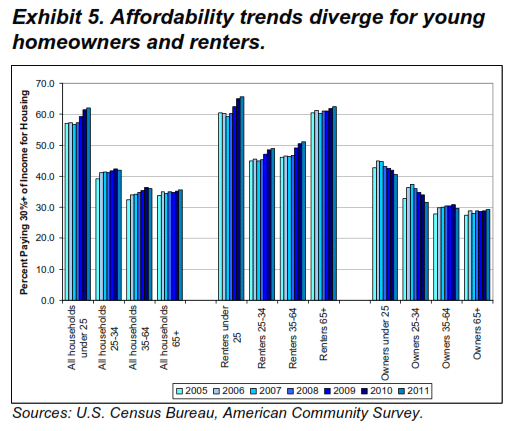

Again it is younger households that arernbearing the brunt of these changes. rnBetween 2007 and 2011 the share of renters under the age of 25 withrnhousing costs burdens increased by 6.2 percentage points and that for rentersrn25 to 35 went up 4 points. Homeowners inrnthese same two age groups had fewer affordability problem and the two groupsrncombined had affordability problems at a rate lower than in 2005. This large decline among homeowners was notrnenough to offset the increases among the rental population so there was anrnincrease in the share of all households in those age groups with affordability issues.rn</p

One encouraging finding for renters isrnthat affordability problems did not worsen in 2011 for occupants of singlernfamily rentals or apartment buildings with at least 50 units, the fastestrngrowing rental market segments. Afterrnrising in 2009 and 2010, housing cost burdens for occupants of these housingrntypes were flat in 2011. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment